Back

Replies (1)

More like this

Recommendations from Medial

Vedant SD

Finance Geek | Conte... • 1y

The Future of Fintech in India India's fintech sector has experienced rapid growth, driven by technological advancements, increasing smartphone penetration, and government initiatives. The country's large population and diverse demographics offer a s

See Morejaspreet Singh

Time equals to money... • 3m

Fintech Industry – Detailed Overview 1. Introduction to Fintech Fintech (Financial Technology) refers to innovative technologies that improve, automate, or transform financial services. It blends finance + technology to create faster, smarter, and

See More

Bhavya Sharma

Our Expert Due Dilig... • 1y

Hello everyone, I am Bhavya from Bhavya Sharma and Associates where we manage multiple startups and organisations for their startup finance, CS and legal services. We handle quite big startups and I am here to answer all your doubts around startups,

See More

Vikram Kumar

Founder at Stockware • 1y

Navi Finserv Ordered to Cease Loan Disbursement by RBI 🚨 In a recent development, Navi Finserv, the NBFC arm of Sachin Bansal’s Navi Technologies, has been ordered by the Reserve Bank of India to cease and desist from sanctioning and disbursing loa

See MoreA Krishna chaitanya

Student at cmr in Hy... • 7m

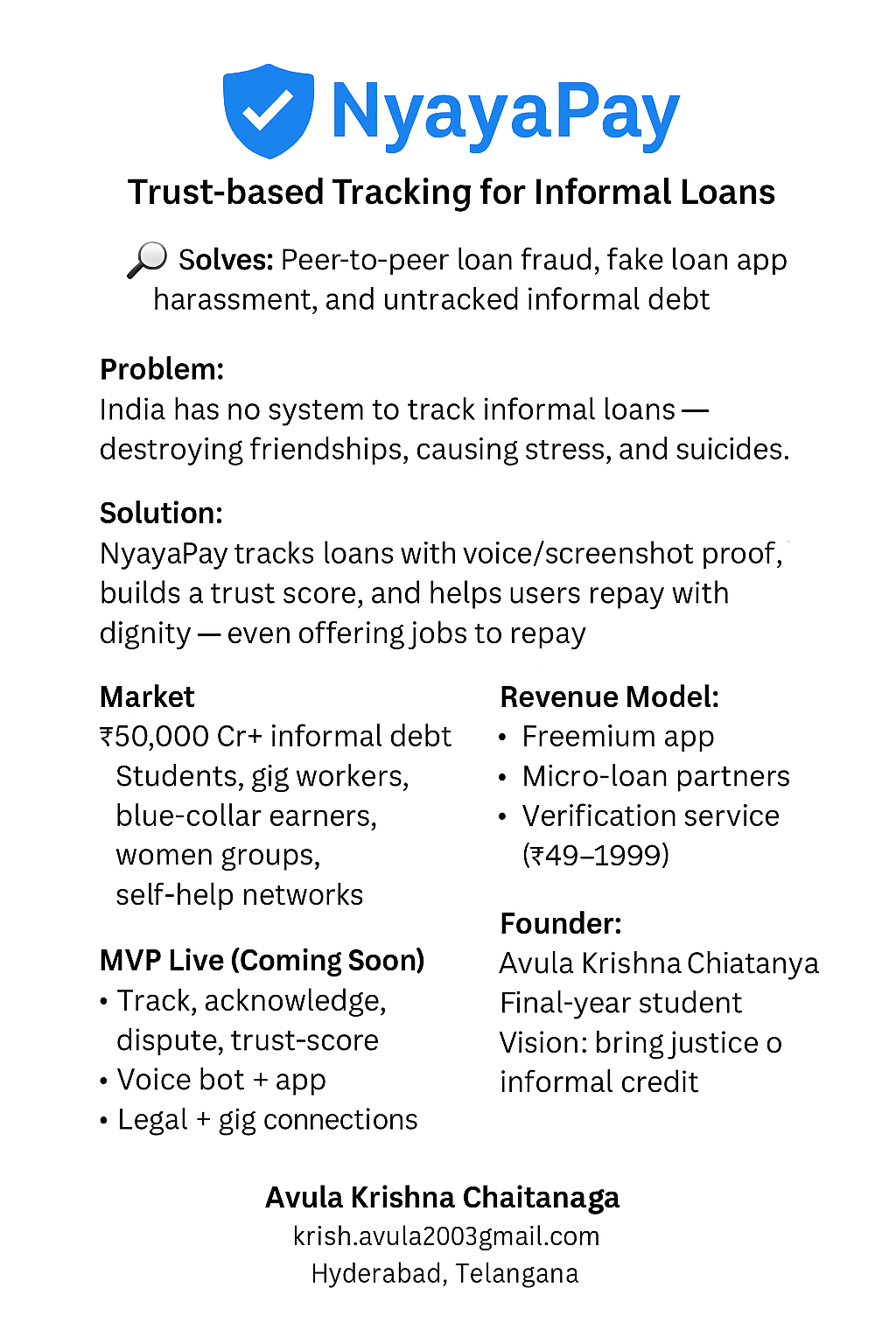

NyayaPay is a fintech idea that helps people track and manage informal loans given to friends, family, or via unregulated apps. In India, millions fall into debt traps with no proof or legal safety. NyayaPay lets users log loans, upload proof (voice

See More

Kabir Kataria

President - SyncMate... • 11m

Fintech: Transforming the Future of Finance The fintech industry is booming, revolutionizing how we manage money. From digital wallets and UPI payments to AI-driven lending and blockchain, fintech is making financial services faster, smarter, and mo

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)