Back

Dhanush R

Student • 1y

Sorry for the late brother. I had some urgent work that's why iam messing very late See Boroltd is now step into overvalued For my analysis I first checked PE ratio is nearly 72 this is high so it says can earn high value . Then I get into the FCF(Free cash flow) mojor important factor it shows last 8 years they have a negative FCF it means they are loosing money but it is also sometimes give a wrong decision because some shares are worth even it have a negative FCF Lastly I gone for the DCF(Discounted cash flow) to calculate the intrinsic value of the company it results shows it is overvalued From my point of view I done only basic analysis so I tell if it comes to 420 or below it is okay

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

Okay, I was just checking the valuation of our Indian stock market and I noticed something interesting. Despite the heavy sell-off in October, FMCG, IT, and small-cap stocks are still overvalued. I understand why IT stocks are overvalued because the

See MoreJithin Tomy

student ! b.com ! pu... • 1y

I have gone through different communication apps which are more negative than much positive but medial is different.... it gives zero negative content Are you aware of any other application which is more informative and can be a milestone in my prof

See MorePRATHAM

Experimenting On lea... • 5m

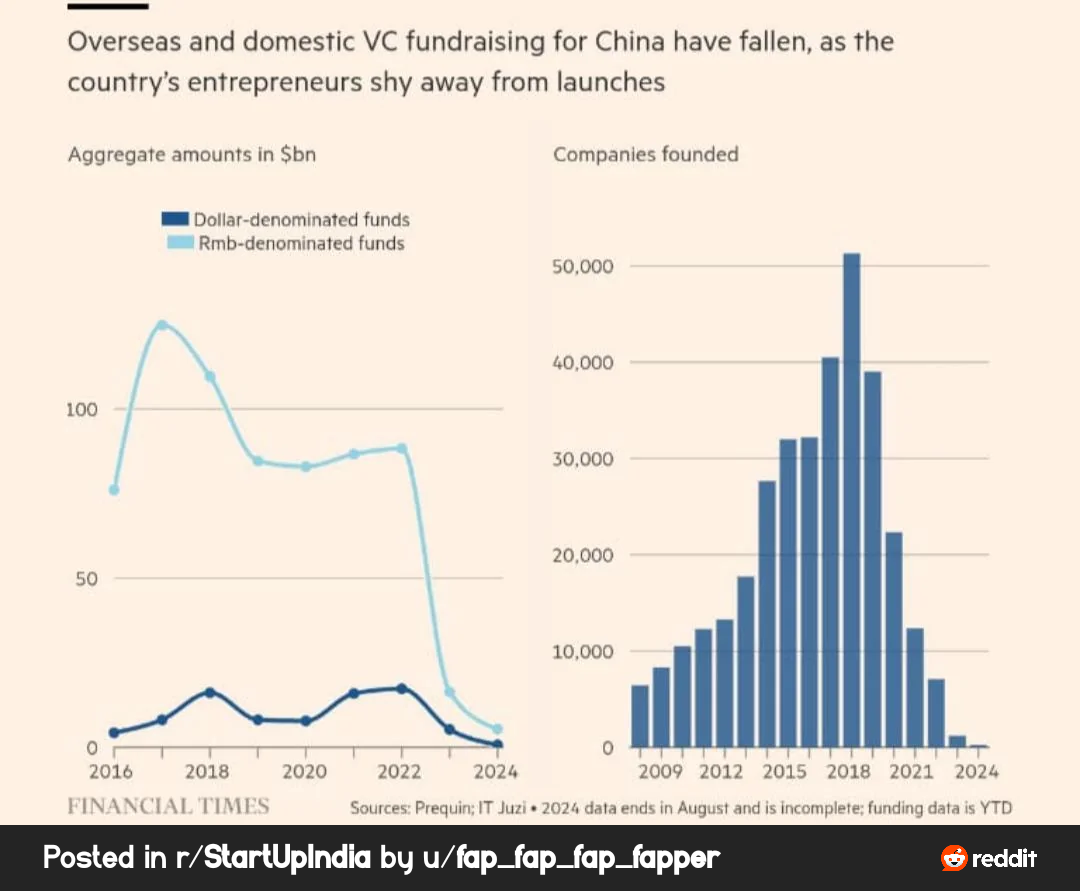

The U.S. market is overvalued, with a Buffett Indicator at 217% and P/E near 37–38, close to dot-com bubble levels (P/E - 44). Global markets ( India or China) may outperform the U.S. in the next 5–10 years. FIIs should flow some cash in India as we

See MoreVIJAY PANJWANI

Learning is a key to... • 2m

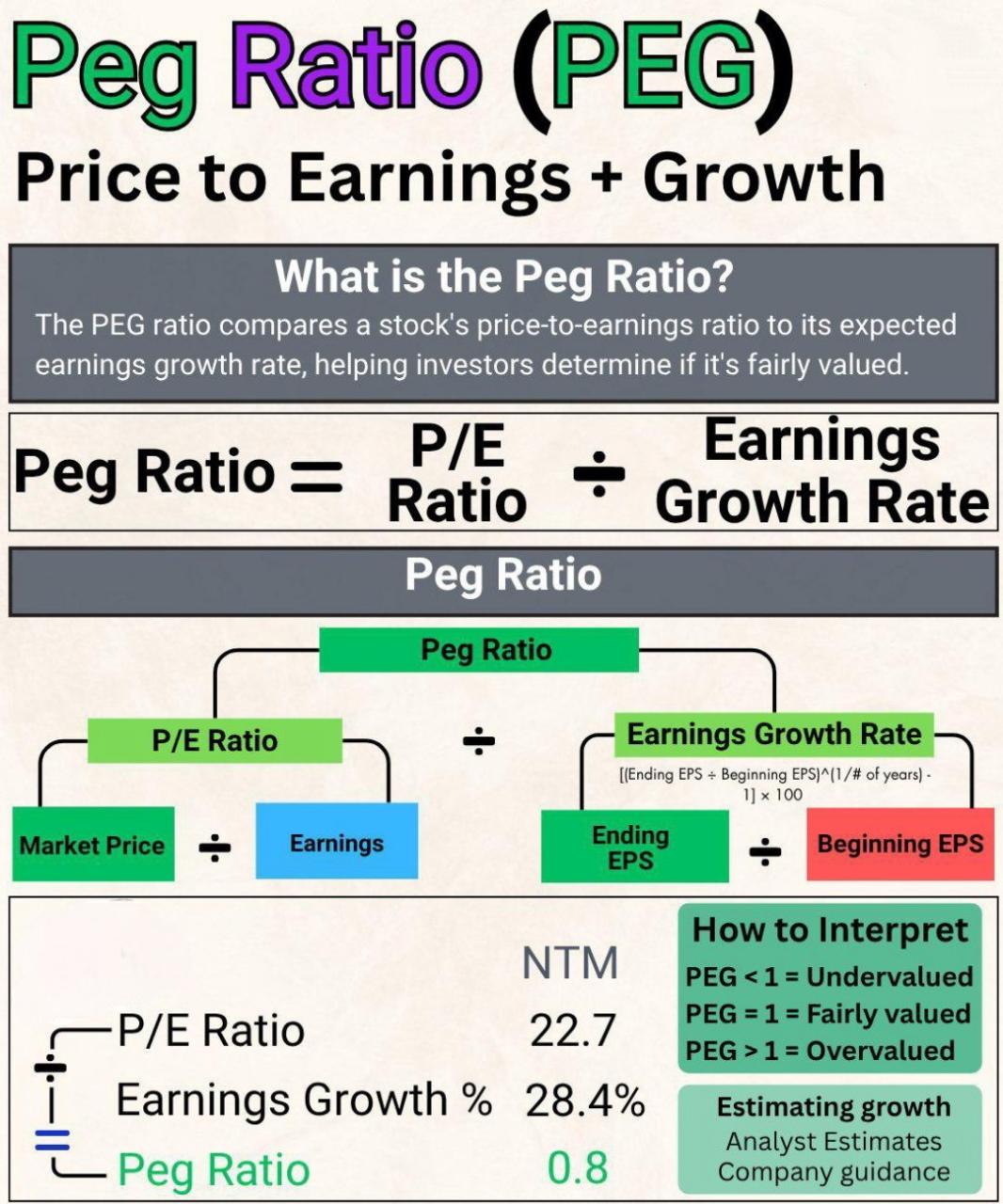

PEG Ratio Explained in 30 Seconds! Want to know if a stock is undervalued or overvalued? Use the PEG Ratio one of the smartest tools used by pro investors! 🧮 Formula: PEG = P/E Ratio ÷ Earnings Growth Rate ✅ PEG < 1 = Undervalued ⚖️ PEG = 1 = Fai

See More

Download the medial app to read full posts, comements and news.