Back

Anonymous 3

Hey I am on Medial • 1y

Reduced corporate tax. Increased LTCG and STCG so that the middle class will remain middle class. Abolished angle tax Masterstroke from nirmalaji 🤡🥰

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

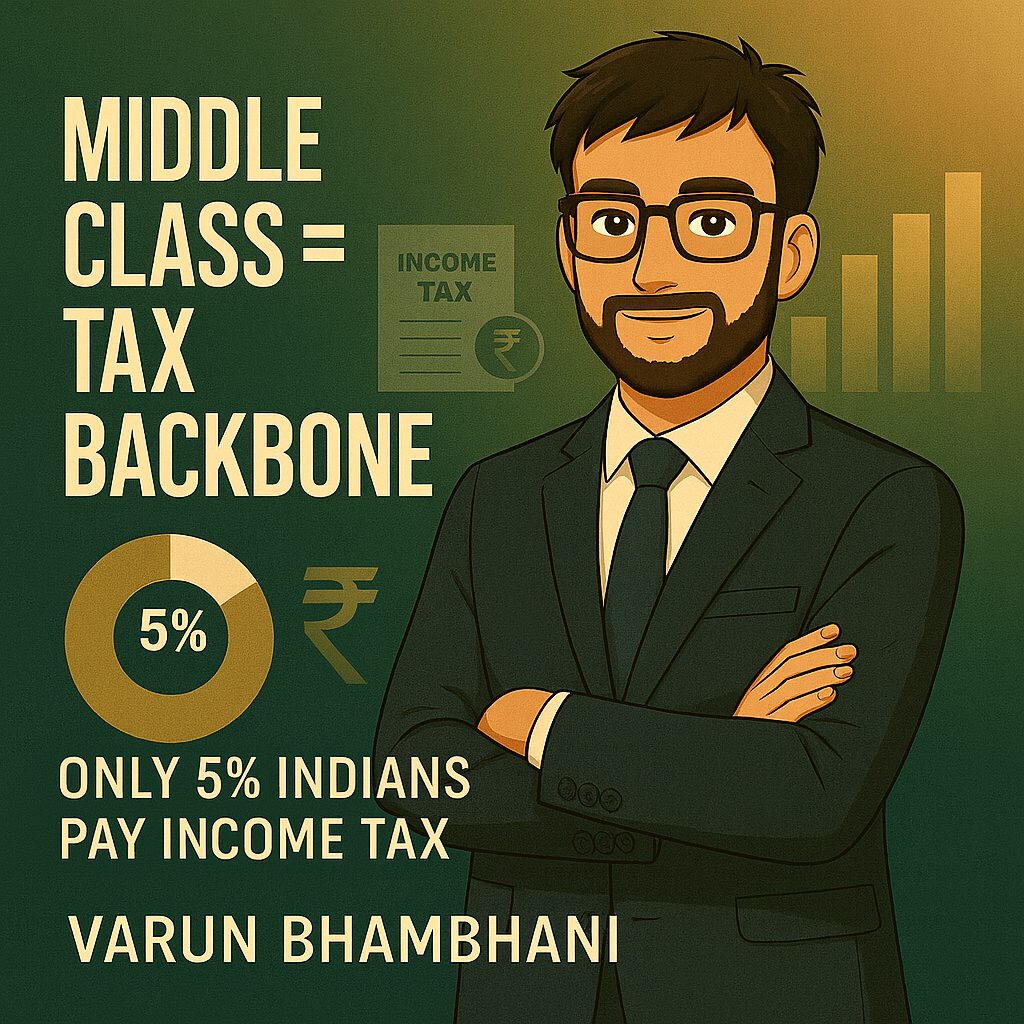

I think next civil war in India happens because of tax . We are facing this huge problem since 1947 and every government force only middle class people's for tax . According to reports only 3.5% people in India paying tax and other are just enjoying

See MoreMedial User

Hey I am on Medial • 11m

Change my mind: A middle-class person who cannot afford to buy a home in a metro city takes a loan and spends a lifetime paying EMIs, while the government incentivizes this through tax deductions. This is a pure strategy to enrich the real estate t

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

You still have to pay taxes if your income is below 12Lakhs.💀 Let’s talk about a crucial detail in the recent Indian Union Budget that many people are overlooking. If you’re already aware, great! But if not, this is essential to know—otherwise, you

See More

Niket Raj Dwivedi

•

Medial • 1y

Union Budget 2024-25: Key Highlights for Startups and MSMEs 🚀 Finance Minister Nirmala Sitharaman mentioned 'startup' just twice in her speech, but there's plenty for the startup ecosystem, manufacturing, and MSMEs in this budget! Here's the scoop:

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)