Back

Anonymous 1

Hey I am on Medial • 1y

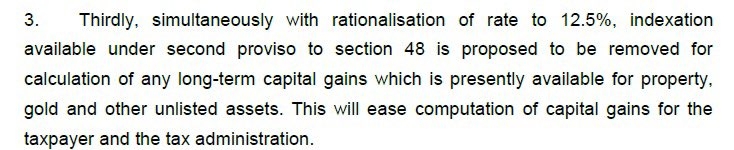

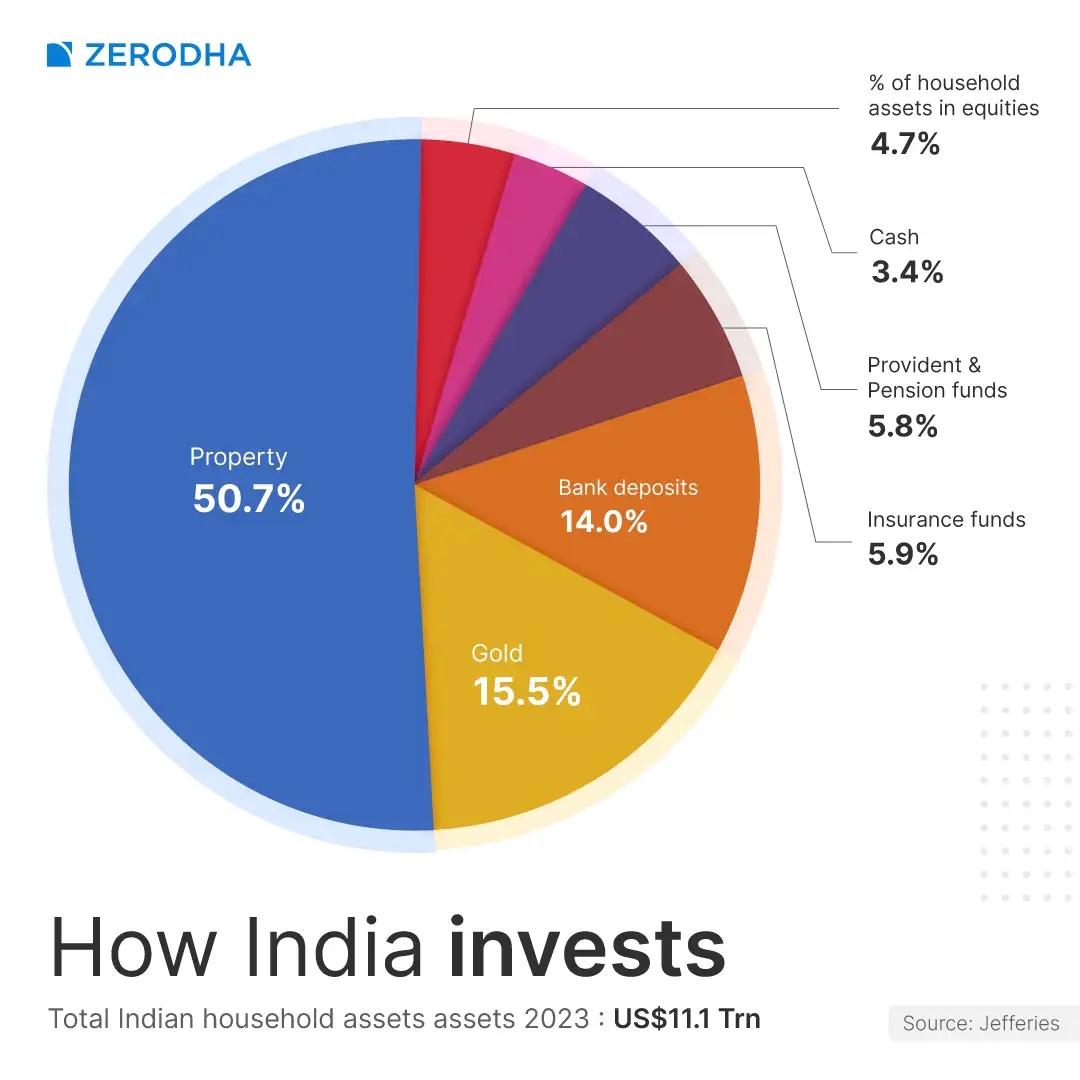

The removal of indexation benefit for long-term capital gains on property, gold, and unlisted assets is a significant blow to investors. While it might simplify calculations, it essentially increases the tax burden on these investments. The government seems to be prioritizing administrative ease over taxpayer benefits. This could discourage long-term investments in these asset classes.

Replies (1)

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 1y

Day 9 About Basic Finance and Accounting Concepts Here's Some New Concepts 2. Non-Current (Long-Term) Liabilities Non-current liabilities are long-term debts that are due beyond one year. These are generally used to fund large purchases or investme

See More

planify

pre-IPO shares, ESOP... • 1m

Unlisted shares of SBI Mutual Fund represent ownership in the AMC before it becomes publicly traded. These shares are exchanged privately, often among long-term investors and institutions. visit here:- https://www.planify.in/research-report/sbi-mutua

See MoreVIJAY PANJWANI

Learning is a key to... • 27d

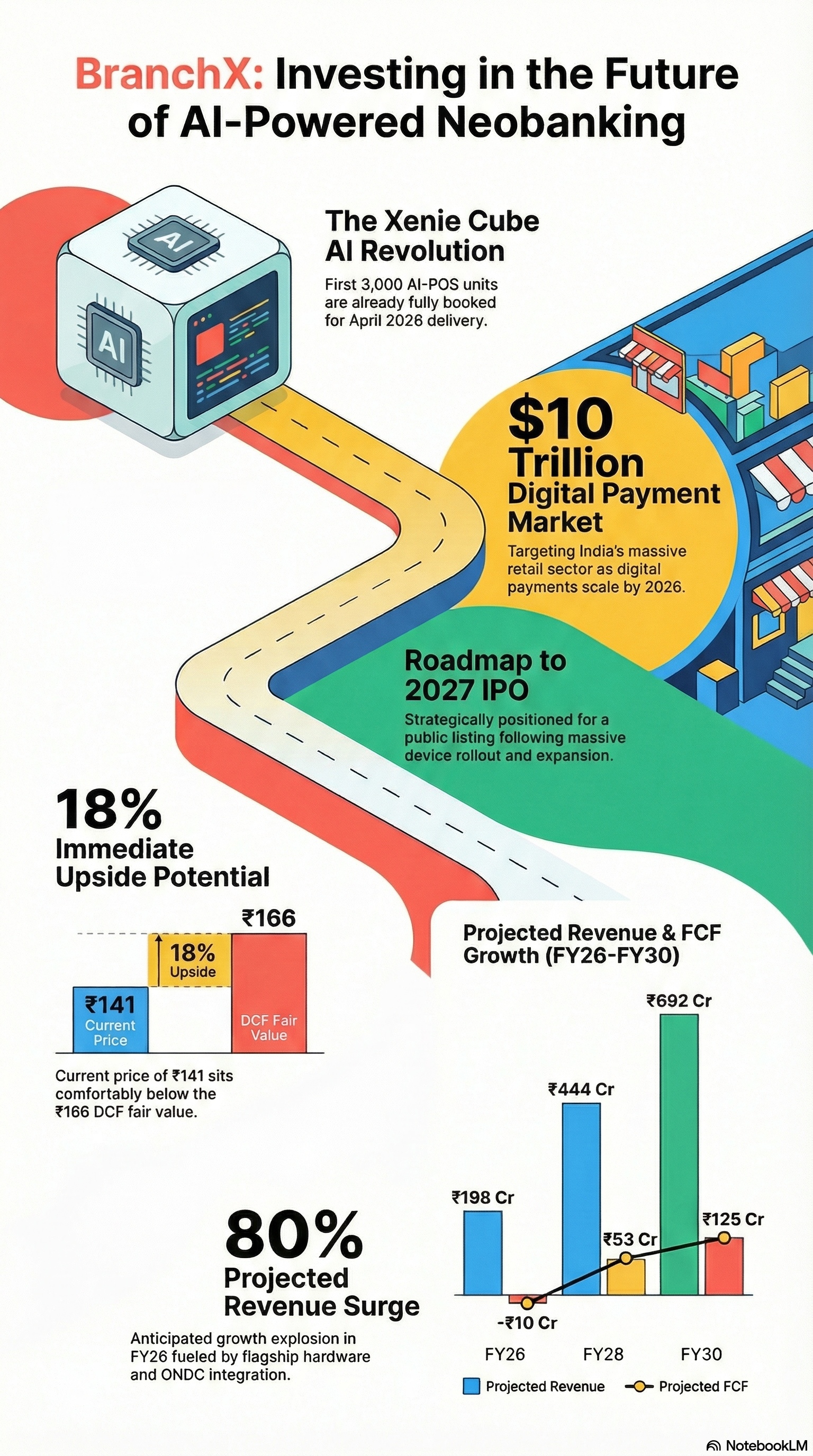

BranchX India Limited (Unlisted) An AI-powered fintech neobank focused on India’s retail & kirana ecosystem 🇮🇳 🔹 Flagship Product: Xenie Cube (AI POS) 🔹 Strong revenue growth & ONDC-led credit expansion 🔹 DCF Fair Value: ₹166/share 🔹 Current A

See More

Kunal Ghosh

Hey I am on Medial • 1y

I work as a finance advisor in Kolkata, West Bengal, making investments. Need some good finance for real estate car and other finance I have over eight years of experience in the loan sector I need some good investors for short term and long term i

See More

Sarthak Gupta

Creating DeepTantra,... • 1y

India's Youth: A Call to Responsibility and Growth 🇮🇳✨ India's youth have the potential to drive the nation's future, but current lifestyle choices are concerning. Let's address these trends and encourage more responsible behaviors. The Consumeris

See MoreNeelakanth Chavan

Analytics and Data s... • 1y

What are the taxation rules in india on investments in stocks. As per my knowledge, gains on stocks more than 1 lakh are taxed at 10% for long term gains(>1year) & 15% for short term gains(<1year). How can someone escape from this. One method that

See MoreChintu Adwani

Helping Start Ups an... • 8m

In the unlisted world, transparency often ends after the funding round. We want to change that — by helping startups communicate better and investors stay informed. From structured updates to founder support, we’re on a mission to build long-term t

See MoreSuman solopreneur

Exploring peace of m... • 1y

Behavioral Finance examines how emotions and biases affect financial decisions, leading to irrational behavior. Unlike traditional finance, it acknowledges that people often make decisions influenced by psychology. Key points include: 1. Loss Avers

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)