Back

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 12m

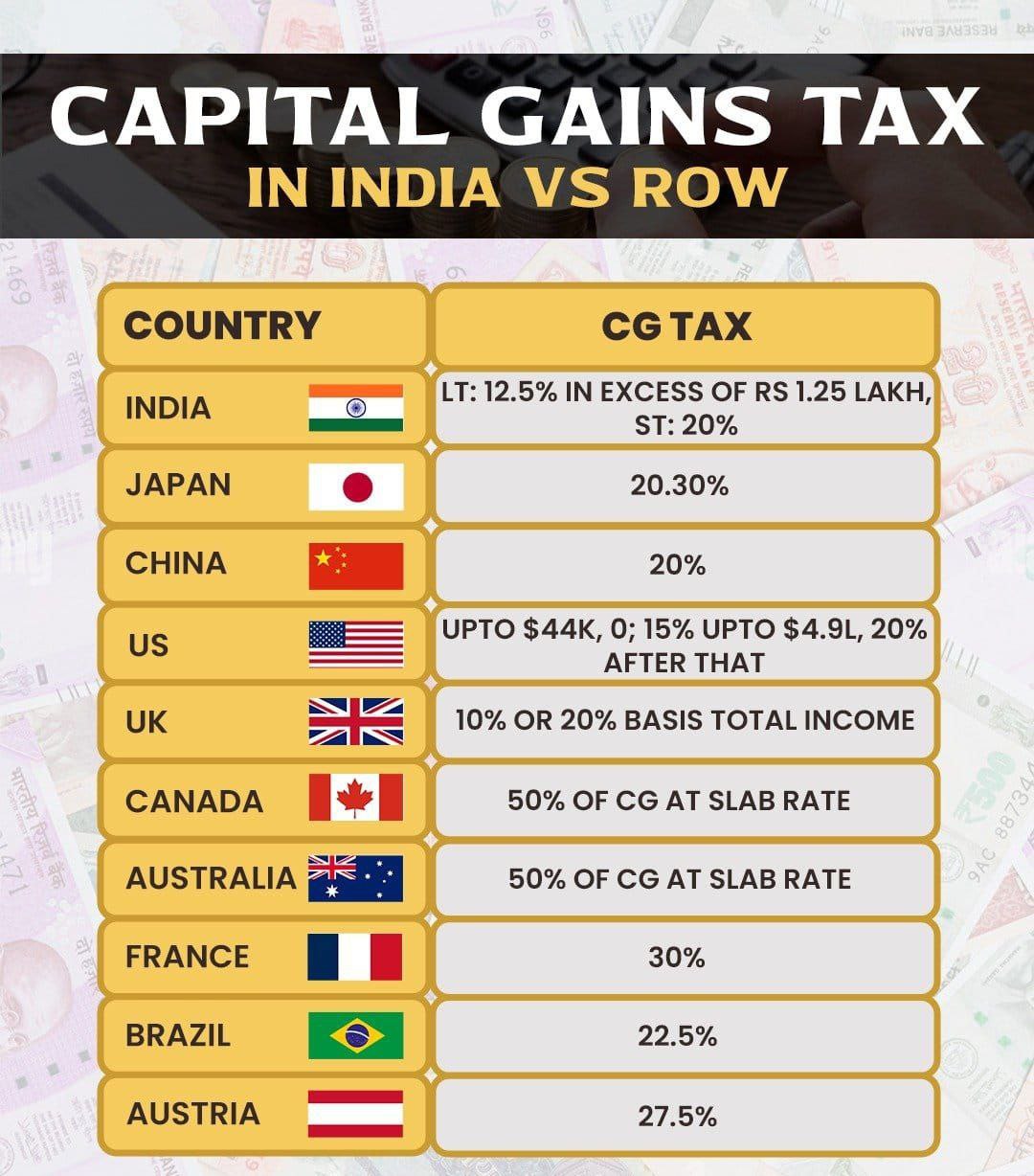

When comparing capital gains tax across different countries, India's main competitors are China and Brazil. Interestingly, both China and Brazil impose higher capital gains taxes than India. However, it's important to note that India also levies a Se

See More

1 Reply

4

15

Aman Verma

BIT'Mesra Undergrad|... • 1y

Who are actually middle class of India ? I am really confused to get the ideal answer of it. Because in village there is only a class that is caste... Most of the rich (as per village standard having acres of land, home, Cars, and non tax incom

See More51 Replies

8

27

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)