Back

Varun Bhambhani

•

Medial • 1y

No, individuals with an annual income upto 3LPA are not required to pay any income tax under these new changes for the new regime

Replies (1)

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See Moretheresa jeevan

Your Curly Haird mal... • 1y

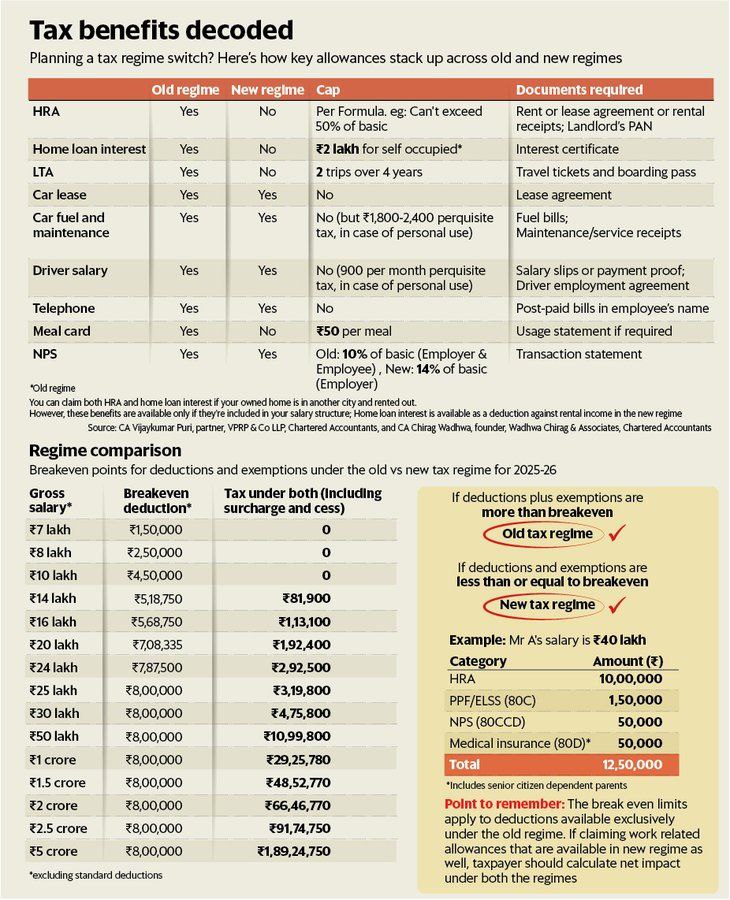

Deadpool’s Tax Tips—Let’s Make It Simple! 💸 Salary below ₹12.75L? Go with the new tax regime—less pain, less paperwork. Easy peasy. 🥳 💰 Salary above ₹12L? If your exemptions (HRA, 80C, 80D, home loan, etc.) are more than ₹5L, old tax regime coul

See More

B Yashwanth

Customer success ent... • 1y

Just invest 10 sec in below 👇 calculator to calculate your tax as per new regime 2025 Tax Calculator comparison as per budget 2025! https://tax.pythontrader.in/ Calculate ur tax as per new proposed slab rates .. just enter your income in this ..

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)