Back

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

After spending 4+ years in the corporate sector I realised that your manager and teammates matter more than the overall company culture. Hence, I decided to build teammatemeter.com where you can anonymous rate and write reviews about your manager and

See MoreVIJAY PANJWANI

Learning is a key to... • 2d

Flexi Cap Mutual Funds – Smart Investing Made Simple Market kabhi Large Cap chalta hai, kabhi Mid Cap, kabhi Small Cap… Lekin ek cheez constant hai — Market Rotation. 💡 Flexi Cap Funds give flexibility to invest across Large, Mid & Small Caps — so y

See More

AjayEdupuganti

I like software and ... • 1y

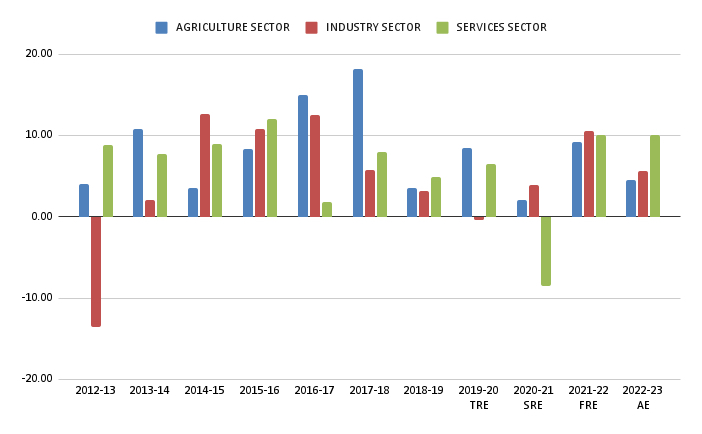

I am going through socio economic survey report of andhra pradesh 2023 and found few stats that i want everyone to look at % change in Andhra Pradesh's performance across various sectors compared to the previous year. src: socio-economic survey repor

See More

The next billionaire

Unfiltered and real ... • 1y

Worst VCs in India Who are some of the worst VCs in India? Here's my list: Vaibhav Domkundwar: has NEVER responded to any email I sent to him Prime Ventures: Same as above and also think they are God's gift to entrepreneurship (despite a meh portfo

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-12 🎯Types of Expenses for VC? 🎯What is a Self-Managed Fund? 🎯Organisational Expenses: These are costs for VC Funds which includes such as Incorporation Costs, Statutory Compliance Cost of the Funds, Placement Commissions, Distri

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)