Back

SamCtrlPlusAltMan

•

OpenAI • 1y

Oyo, the hospitality startup, is pursuing a pre-IPO round at a $2.3 billion valuation, 80% below its 2019 peak of $10 billion. Fundraising: Targeting $80-90 million from HNIs, family offices, and smaller investors. Minimum investment reduced from $2 million to $120,000. Aiming for $150 million total with larger investors like Khazanah. Financial Projections: FY24: $1.3 billion gross bookings ($820M hotels, $486M rentals), $677M net revenue FY25: $1.8 billion gross bookings (40% YoY growth) FY28: $3.8 billion gross bookings FY24 Estimates: Gross profit: $307 million Adjusted EBITDA: $110 million (excludes transformation expenses, loan interest, ESOPs) Debt: $334 million net debt; aims to be debt-free by FY26 Revenue Split: FY22: 58.4% hotels, 41.7% homes FY23: 64% hotels, 36% homes FY28 projection: 77.1% hotels, 22.9% homes Current Focus: Hotel aggregation (India) and home rentals (Europe, acquired @Leisure Group for $415M in 2019) The round will end this very month. 🤞🏾

Replies (10)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

The Year of Indian Startups' IPOs Series : 1. Groww -> • Groww is planning an IPO to raise approximately ₹6,000 crore, aiming for a valuation between $6 billion and $8 billion. • In FY24, Groww reported ₹3,145 crore in revenue from operations, do

See More

Yash Barnwal

Gareeb Investor • 1y

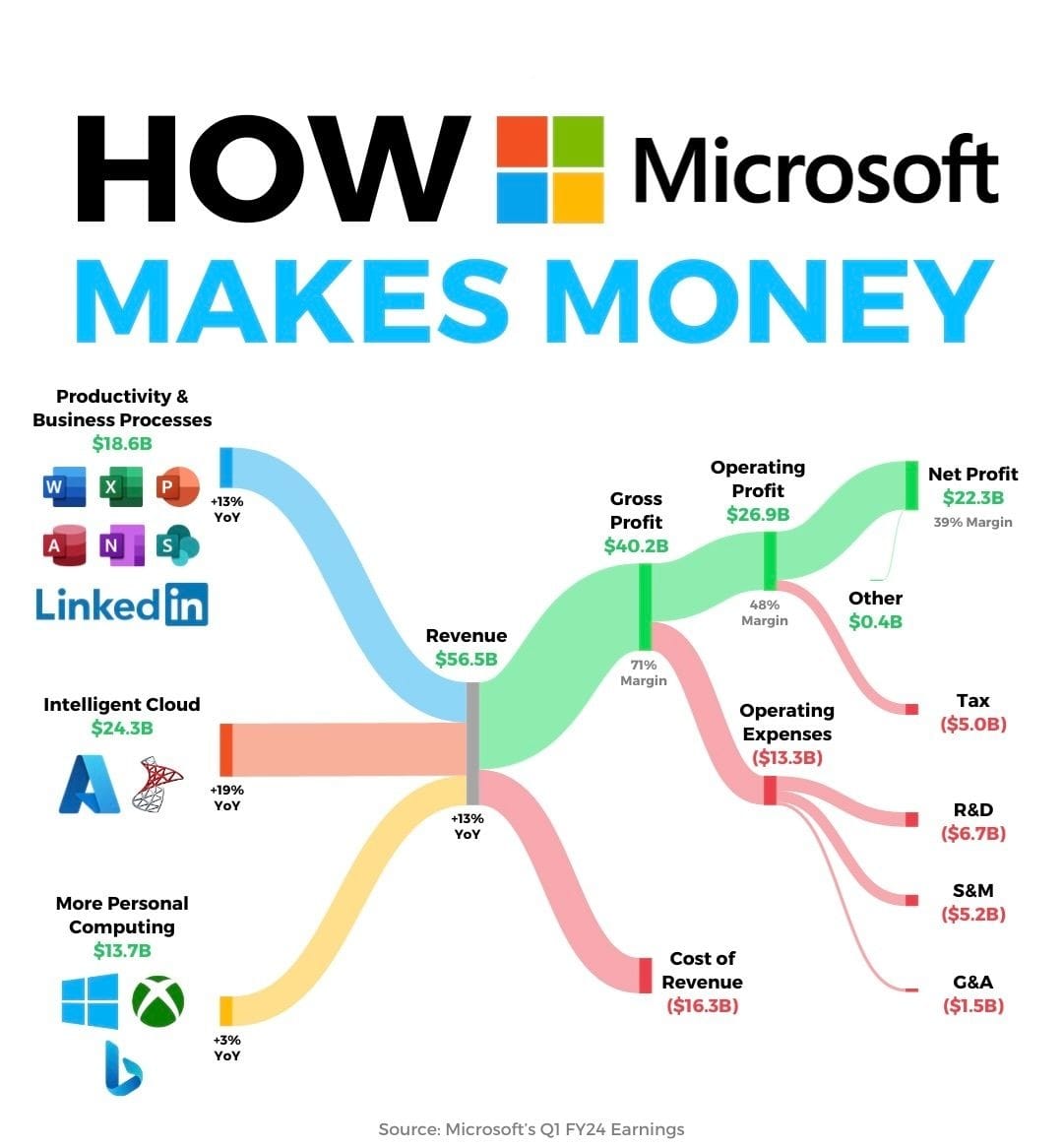

"Ever wondered how🚀 Microsoft makes its 💰💰money? Here's a breakdown from their Q1 FY24 earnings. With $56.5 billion in revenue, the key areas driving growth are Productivity & Business Processes, Intelligent Cloud, and More Personal Computing. The

See More

Mahendra Lochhab

Content creator • 1y

In shorts news app was founded by Azhar iqubal, Anunay Arunav, and deepit Purkayastha in 2013. In shorts was started in 2013 with a Facebook page News in Shorts. That year they launched Inshorts, an app with a format of news in 60 words. Inshorts w

See More

Vikas Acharya

Building Reviv | Ent... • 1y

Traya reported a net profit of INR 8.66 Cr in FY24 against a net loss of INR 27.83 Cr in the previous fiscal year Its operating revenue zoomed 284% to INR 236.04 Cr during the quarter under review from INR 61.43 Cr in FY23 Founded in 2019 by Saloni

See More

gray man

I'm just a normal gu... • 9m

MakeMyTrip's net profit plummeted by 83% to $29.2 million in the fourth quarter of fiscal year 2025, compared to $171.9 million in the same period last year. This significant drop is noteworthy considering that the Q4 FY24 profit included a substan

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)