Back

Havish Gupta

Figuring Out • 1y

Another benifit is that because of debt financing, Startups utilizes the funds more properly rather than just focusing on growth

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Omkart

A SMM posting useful... • 11m

what does Burn rate mean in startup ecosystem? It is the rate at which the startup is using its raised capital to fund its overheads before generating any positive cash flow/sales. what does Debt Financing mean? A company can raise funds by issue

See MoreSairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll

See MoreAccount Deleted

Hey I am on Medial • 1y

Let's decode one pattern : • Companies were backed by Softbank such as OYO, OLA Electric and FirstCry are continuously filing for IPO but some IPO's approved or some failed for IPO. • Startups backed by Softbank such as OLA Electric and OYO are ra

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

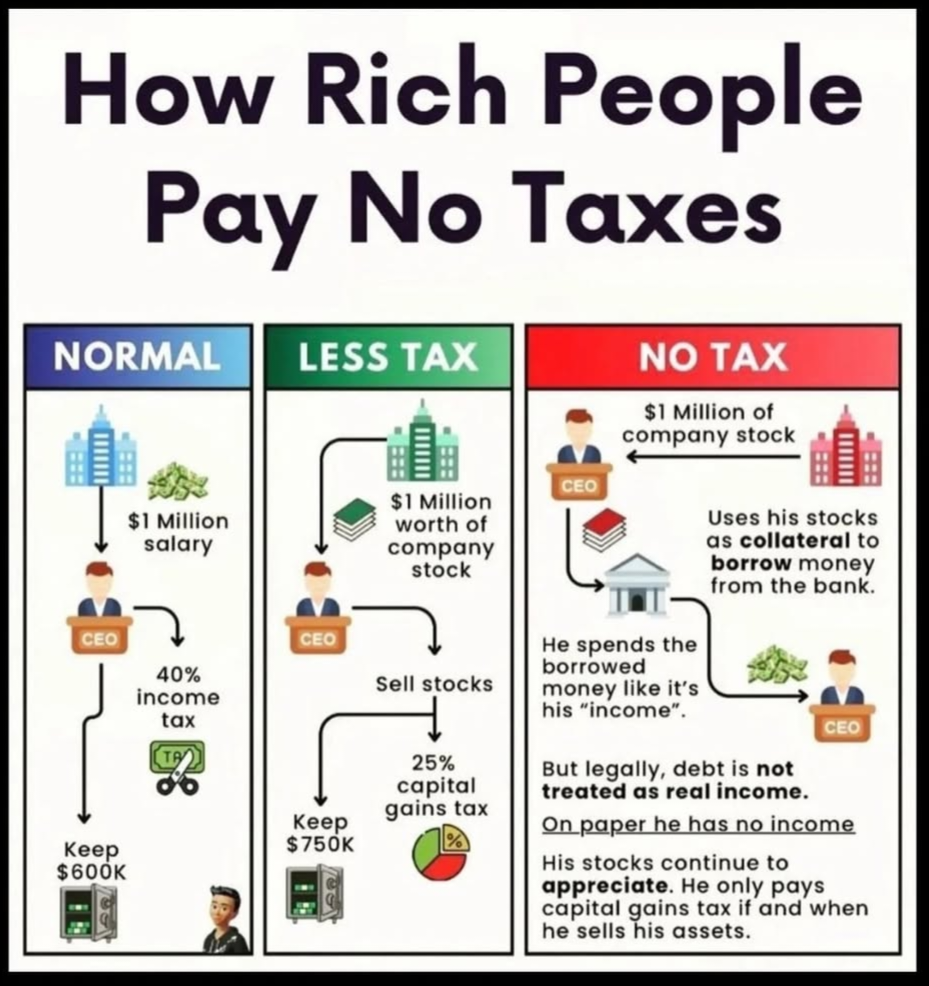

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)