Back

Anonymous 2

Hey I am on Medial • 1y

Ensure the sum insured is adequate to cover major medical expenses for yourself and your parents. Given their age, consider a higher sum insured, especially since healthcare costs rise with age. Evaluate if a family floater policy, which covers all members under a single sum insured, is more beneficial than individual policies. While family floaters are often more economical, high claims by one member can exhaust the entire cover.

More like this

Recommendations from Medial

Praveena J

Stay Hungry, Stay Fo... • 1y

Guys everybody knows that insurances ( health, life and retirement) covers will cover the money for the covers only, but nobody gives the fixed expenses of his family, which is emergency funds, which i think most of the people doesn't know about. May

See MoreNavneet Kumar

--Building a social ... • 1y

i have an startup idea💡 what's your thoughts on it Observation: Many young adults in India are uncertain about their career paths in their early 20s. Traditional advice from parents often revolves around common degrees (e.g., B.Tech, MBBS, B.Com)

See MoreJayant Mundhra

•

Dexter Capital Advisors • 1y

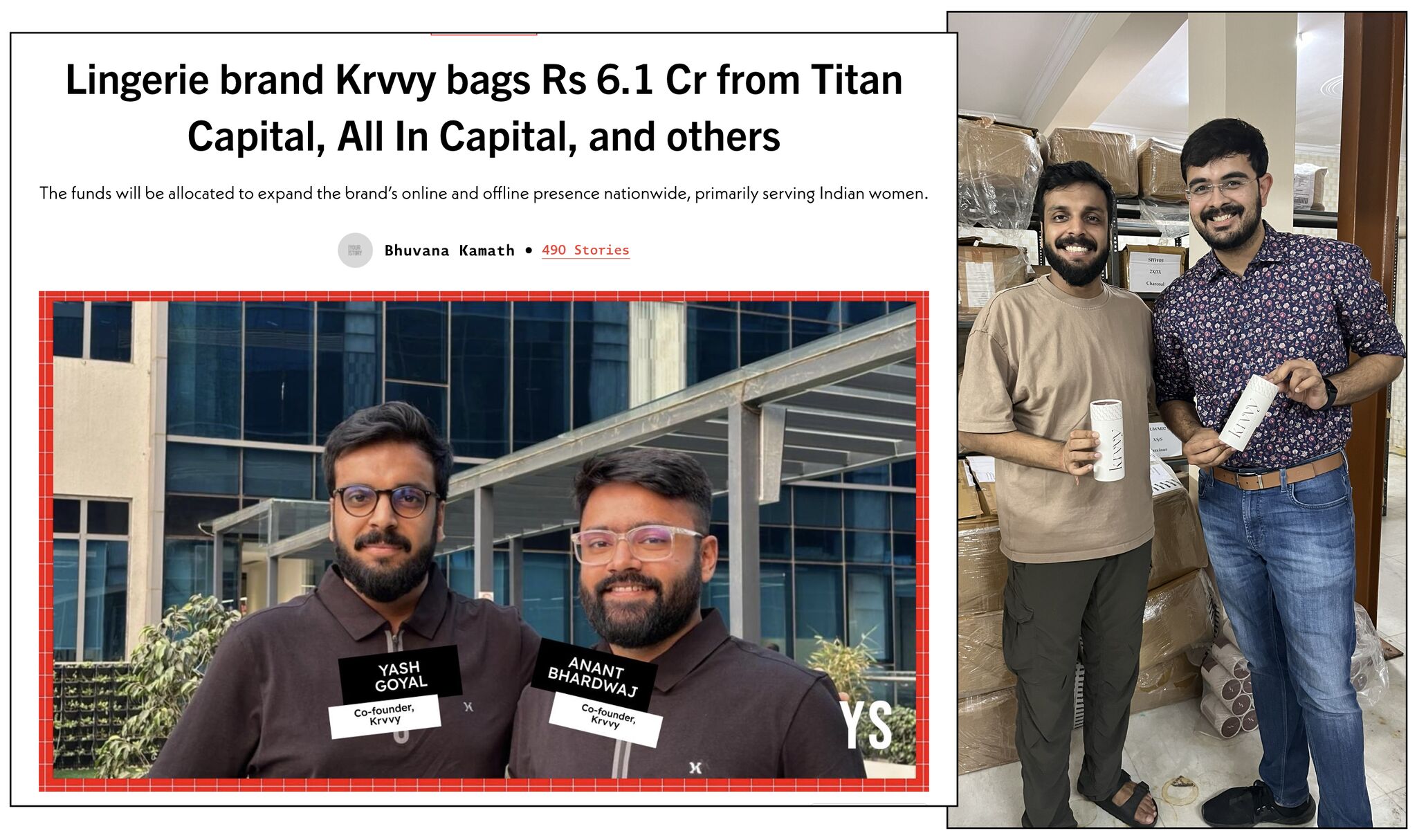

Krvvy was my first angel investment. This was back in April ’24 at pre-revenue stage 😅😅 And days ago, the lingerie company announced a fantastic Rs 6.1 crore fundraising from marquee names like Shark Kunal Bahl and Rohit Bansal of Titan Capital, A

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)