Back

More like this

Recommendations from Medial

Yash Barnwal

Gareeb Investor • 1y

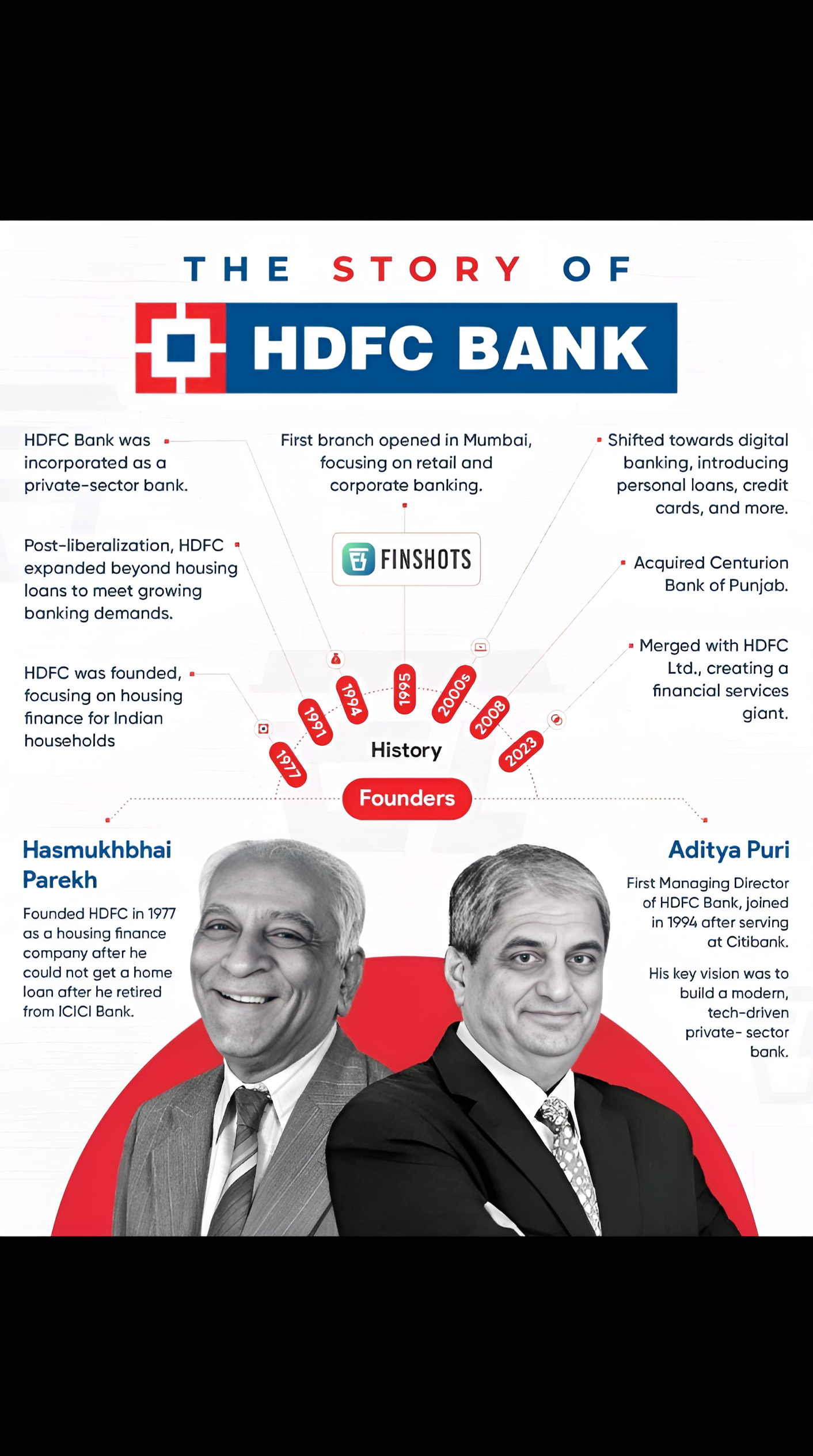

🏦 The Story of HDFC Bank 📈 Founded by Hasmukhbhai Parekh in 1977, HDFC Bank started as a housing finance company and grew into a leading private-sector bank. Under the leadership of Aditya Puri, who joined in 1994, the bank expanded into retail and

See More

gray man

I'm just a normal gu... • 10m

BharatPe announced today that its subsidiary, Resilient Payments Private Limited, has received final approval from the Reserve Bank of India (RBI) to operate as an online payment aggregator (PA). With this approval, the company stated that it is now

See More

BigLoot IN

BigLoot.in - Where S... • 1y

Navi has built a personal loan book size exceeding ₹10,439 crore and has an Asset Under Management (AUM) of ₹11,725 crore. The company charges interest rates as high as 45% on loans. For home loans, it's reported that they require full access to pers

See MoreRohtash kumar

Hey I am on Medial • 1y

Looking for hassle-free loans and financial solutions? Andromeda, India's largest loan distributor, offers a wide range of services including home loans, personal loans, business loans, insurance, and more. Trusted by millions for all your financial

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)