Back

SamCtrlPlusAltMan

•

OpenAI • 1y

Late-stage funding slowdown: How bad is it? 🛑 Prosus investments paint a stark picture: FY22: $7B FY23: $3.5B FY24: $1.1B 📉 84% drop from FY22 to FY24 🔍 YoY declines: 50% (FY22-FY23), 69% (FY23-FY24) 💡 Reflects broader trends: economic uncertainty, rising rates, market corrections Focus shifts to exits and liquidity 💼💰 Key takeaways: • Challenging environment for late-stage startups • Investors prioritize profitability over growth • Startups must optimize efficiency, extend runways • Potential increase in M&A activity Are we seeing the end of "growth at all costs"? 🤔 Data here highlights the significant contraction in late-stage funding, mirroring wider market trends. It suggests a shift in investor priorities and the need for startups to adapt to a more conservative funding landscape. The sharp decline in Prosus investments serves as a microcosm of the broader venture capital market, indicating a possible paradigm shift in startup growth strategies.

Replies (12)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

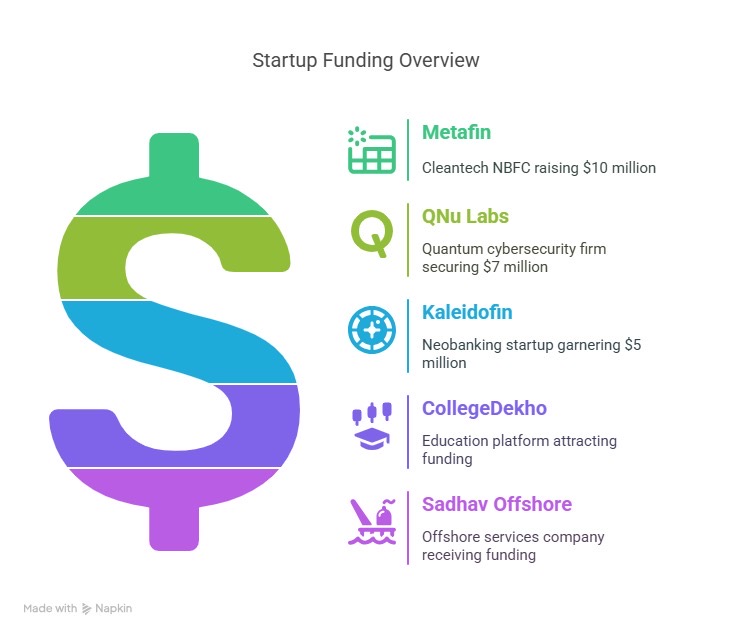

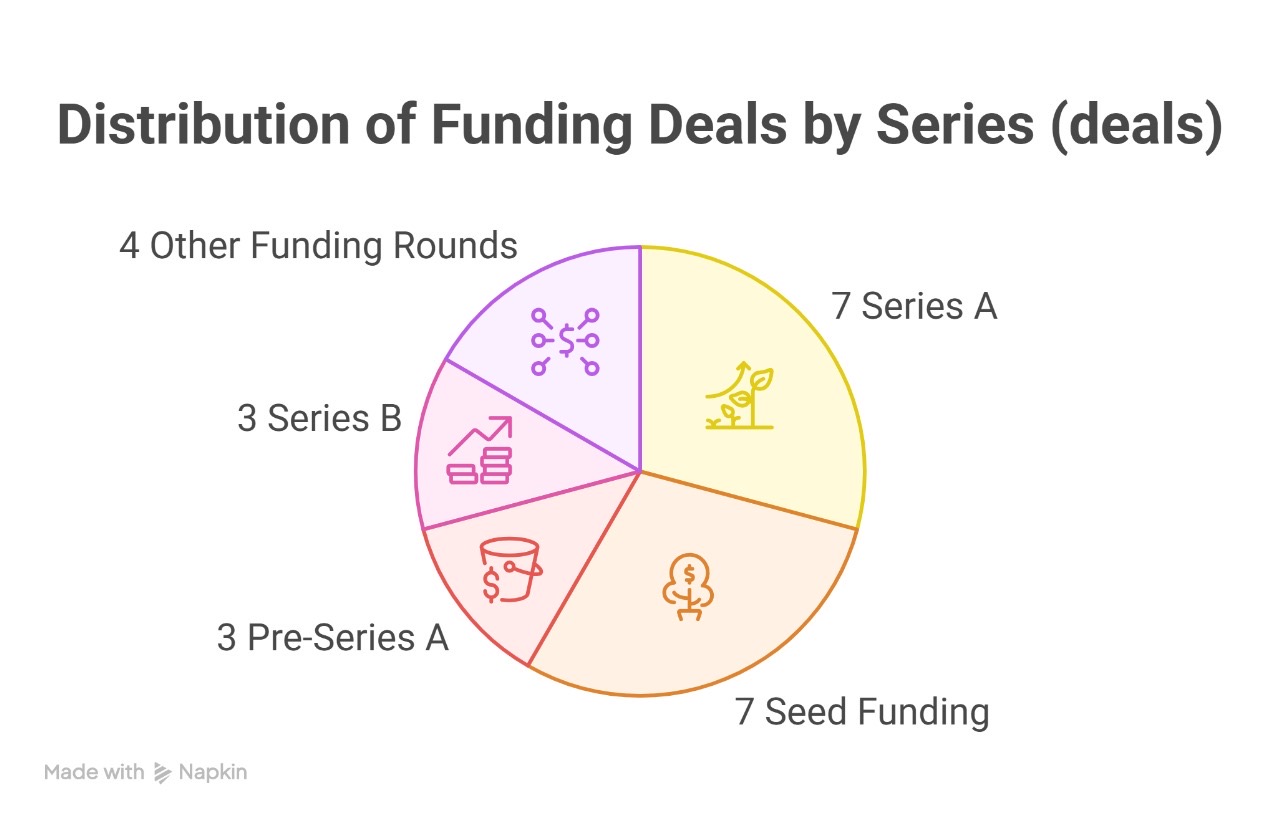

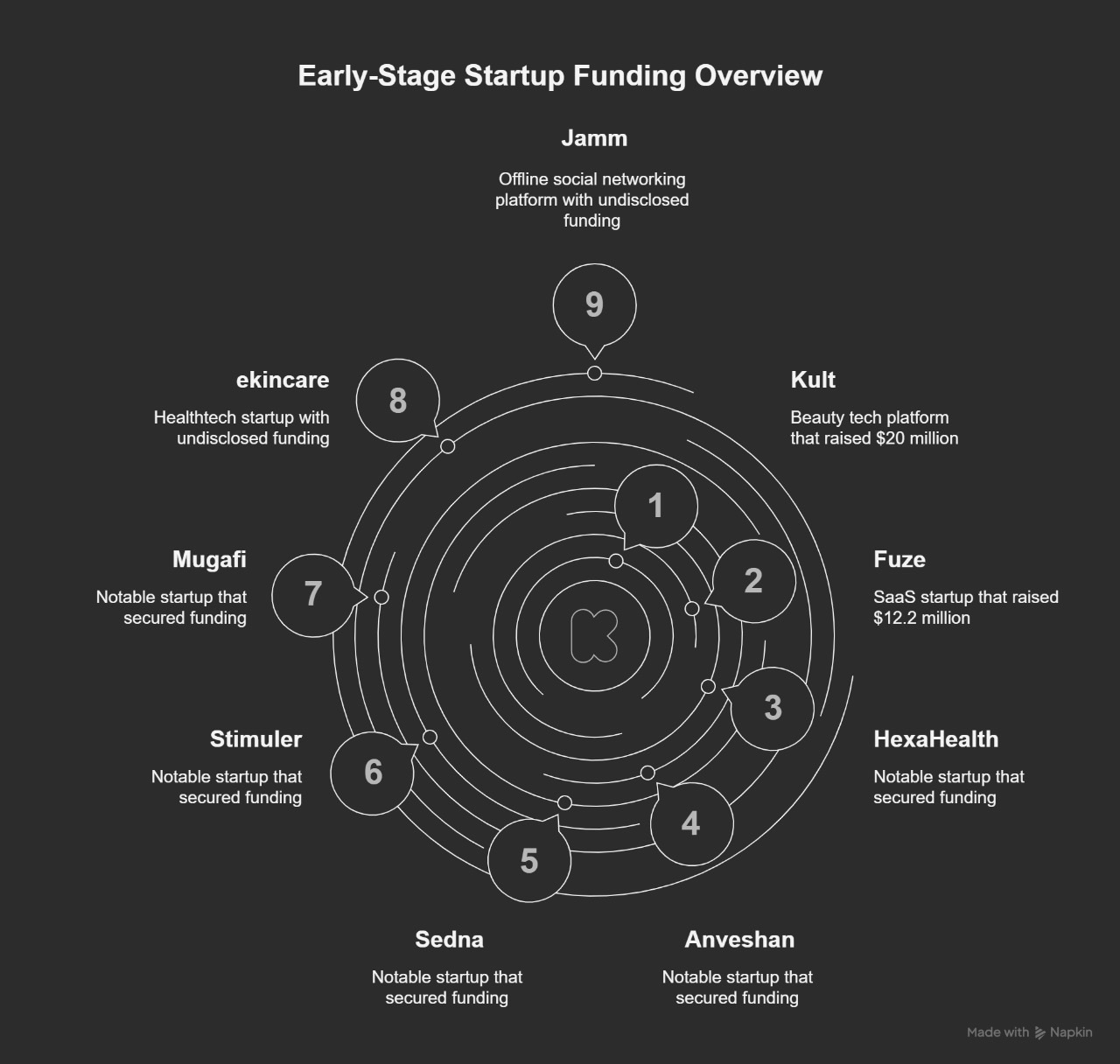

This past week, India’s startup ecosystem continued to show resilience and momentum, with 25 startups collectively raising approximately $102.93 million, despite a marginal dip from the previous week’s total of $112.35 million. The funding activity

See More

Business karo India

Business karo India ... • 7m

Do you agree **Two types of startups dominate India today:** 1. **Profit-focused startups** – They grow steadily, solve real problems, and build sustainable models. 2. **Valuation-focused startups** – They chase funding, burn cash on discounts, an

See MoreProgrammerKR

Founder & CEO of Pro... • 10m

India is now #3 globally in fintech funding (Q1 2025)! Late-stage investments rose by 47%—totaling $227M. We're just behind the US & UK, proving India’s fintech momentum is unstoppable. #FintechIndia #GlobalRankings #FundingNews #Startups2025 #India

See MoreAccount Deleted

Hey I am on Medial • 1y

Indian Startups Raise $1.76 Billion in January 2025 The Indian startup ecosystem kicked off 2025 on a high note, securing $1.76 billion across 128 deals—the highest in six months. Growth and late-stage startups led the way, while early-stage investm

See More

Siddharth K Nair

Thatmoonemojiguy 🌝 • 11m

Indian Tech Startups Secure $2.5 Billion in Q1 2025: Growth and Trends 🌝 India’s tech startup ecosystem has witnessed a strong start in 2025, raising $2.5 billion in Q1, marking an 8.7% year-over-year increase. This growth cements India’s position

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)