Back

Replies (1)

More like this

Recommendations from Medial

Rajan Paswan

Building for idea gu... • 1y

As a founder, your startup is your baby. But what about when that Golden Exit opportunity appears? Drag-Along Rights in your Shareholder Agreement(SHA) are crucial for ensuring a smooth acquisition process. What are Drag-Along Rights? They empower

See MoreVedant SD

Finance Geek | Conte... • 1y

Day 62: From Idea to IPO: The Bengaluru Startup Lifecycle The journey from a spark of an idea to a successful IPO is a marathon, not a sprint. Here's a roadmap for your Bengaluru startup: * Ideation & Validation: Identify a problem worth solving a

See MoreThakur Ambuj Singh

Entrepreneur & Creat... • 11m

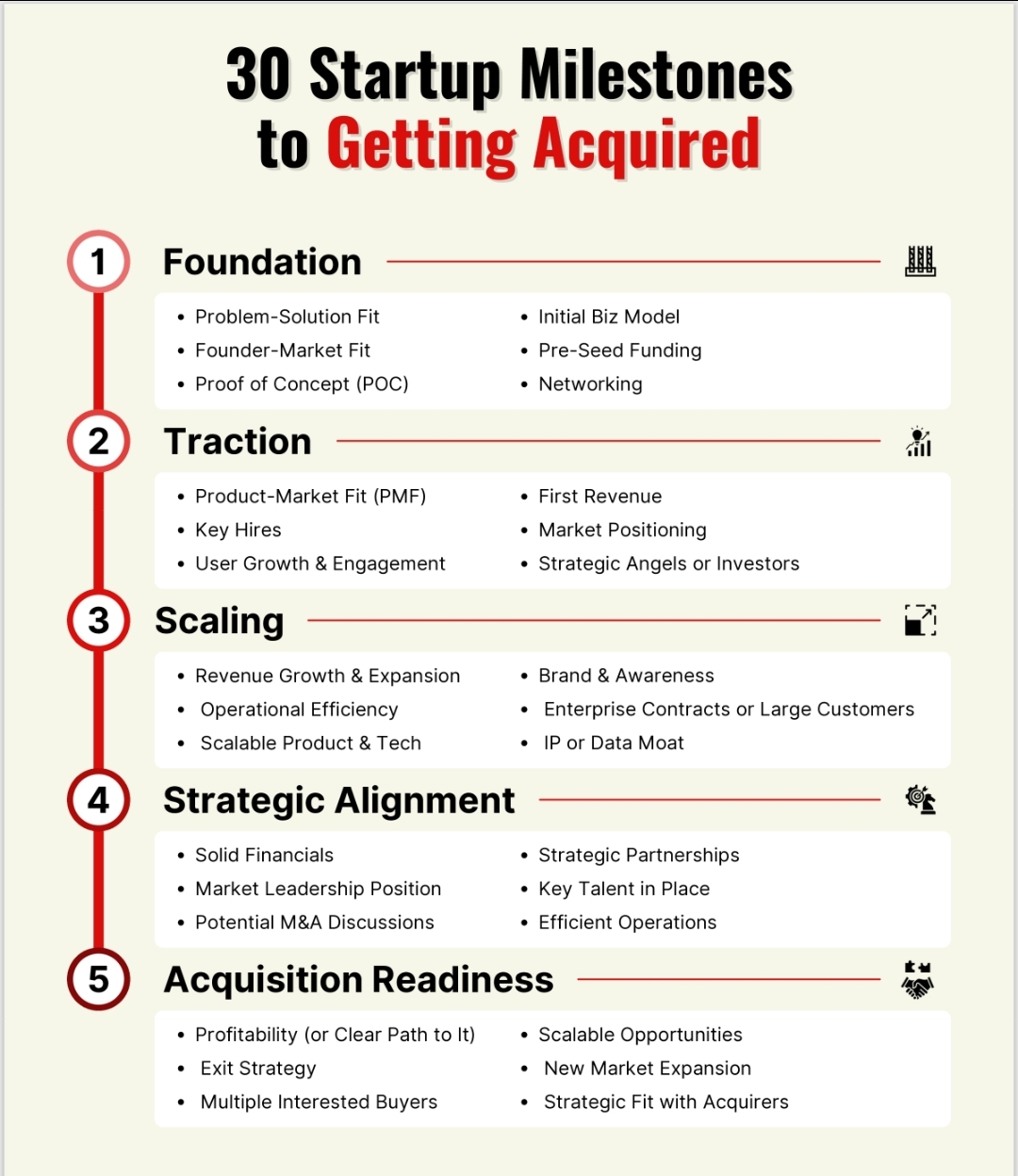

Starting from today, be ready to build a high value startup! 🚀 Here are the 30 Startup Milestones to Getting Acquired step by step from foundation to acquisition readiness. Master these stages and you'll be on the path to a successful exit! 💼💰🔥

Ashutosh Meena

Dear Creators : Lear... • 1y

School solver, hey if you are a Student and Teacher. So you make a lot of money 💰 from school solver to as a tutor and use Chat GPT and understand the process how do this follow the instructions 1. First of all you need a School Solver Tutor Acco

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)