Back

Udyamee

Baki sab thik ? • 1y

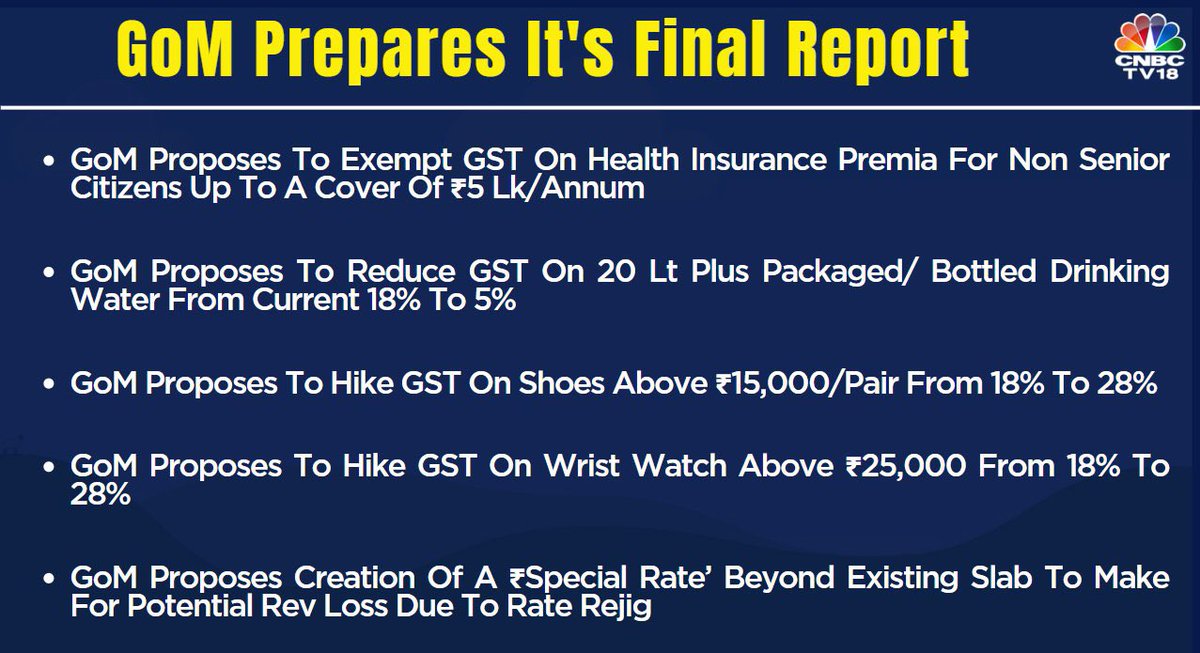

Sad life. This is why India has such a low number of people paying taxes; the government takes too much in the form of GST.😔

Replies (1)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

First, DHFL and now Jet Airways, both have one thing in common: retail investors knowingly invest their money in such companies that are bound to fail, and then they blame the government for losing their money. But investors don’t see their own mista

See Moregray man

I'm just a normal gu... • 10m

The Finance Ministry has dismissed reports suggesting that the government is considering imposing Goods and Services Tax (GST) on UPI transactions exceeding INR 2,000. In an official statement, the ministry clarified, “The claims that the government

See More

Ravi Handa

Early Retiree | Fina... • 1y

Before criticising the government, please have a look around you. You live in a very poor country. If you are buying shoes above 15k or watches above 25k - you are in a much better position than your fellow countrymen. You are not just the 1%,

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)