Back

Replies (1)

More like this

Recommendations from Medial

CA Jasmeet Singh

In God We Trust, The... • 11m

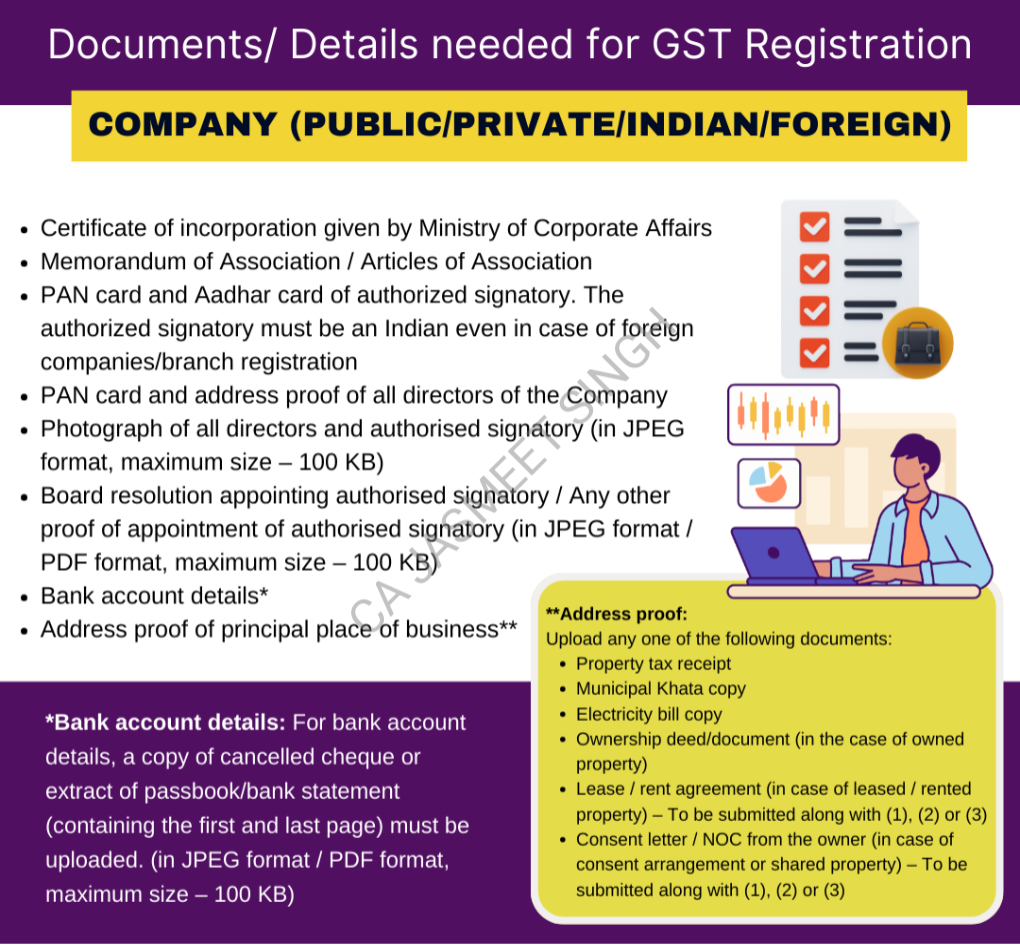

📢 GST Registration for Companies – Everything You Need to Know! 🚀 Starting a company? One of the first legal steps is getting GST registration! ✅ It not only gives your business a legal identity but also opens doors to seamless tax compliance, inp

See More

Ravi Kumar Mishra

Hum hai Aapke Busine... • 8m

ITR 23-24 24-25 25-26 Compution,Balancesheet with Ca Certified 1. GST Registration 2. GST return Filing 3. MSME Registration 4. Tds FILLING 5. Company, NGO & Partnership Reg. 6. Importer Exporter Code 7. ISO Non-Iaf/IAF Registration 8. Start up

See MoreSaurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

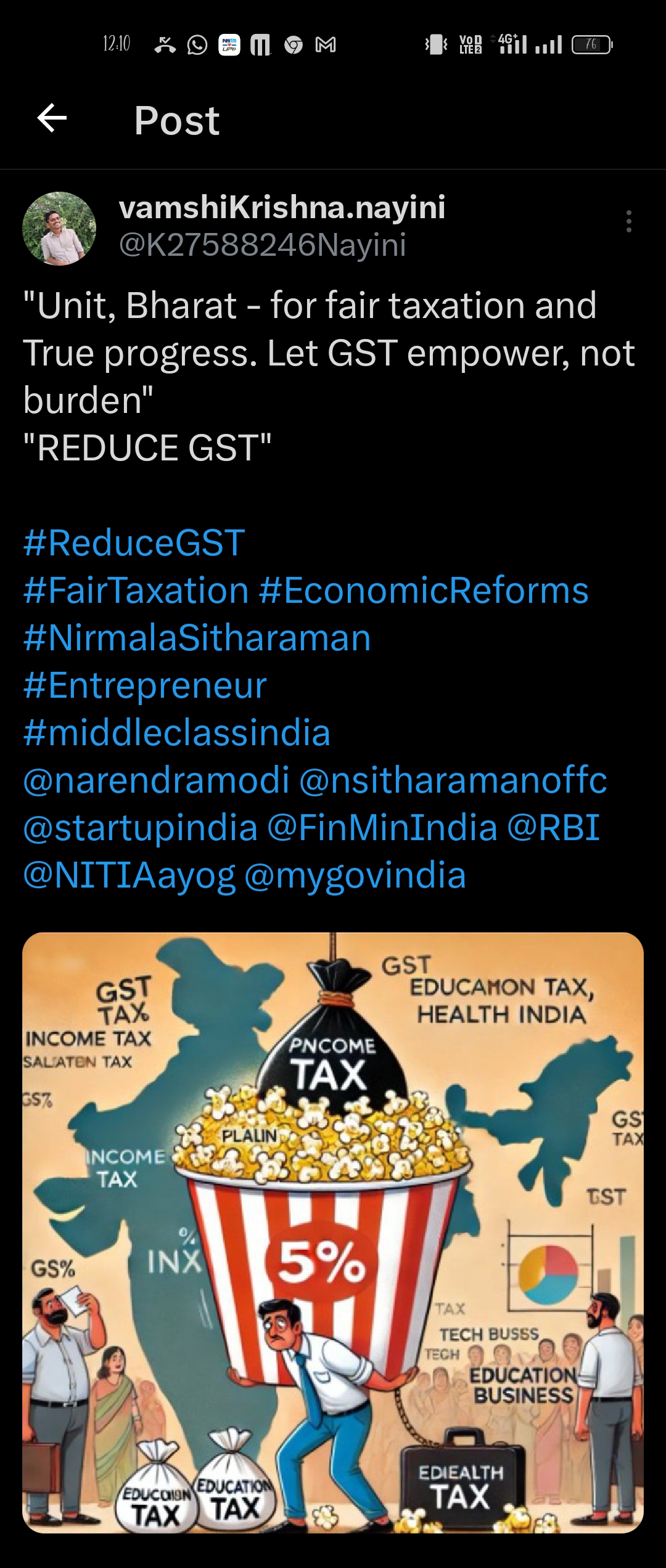

See MoreVamshi krishna Nayini

Hey I am on Medial • 1y

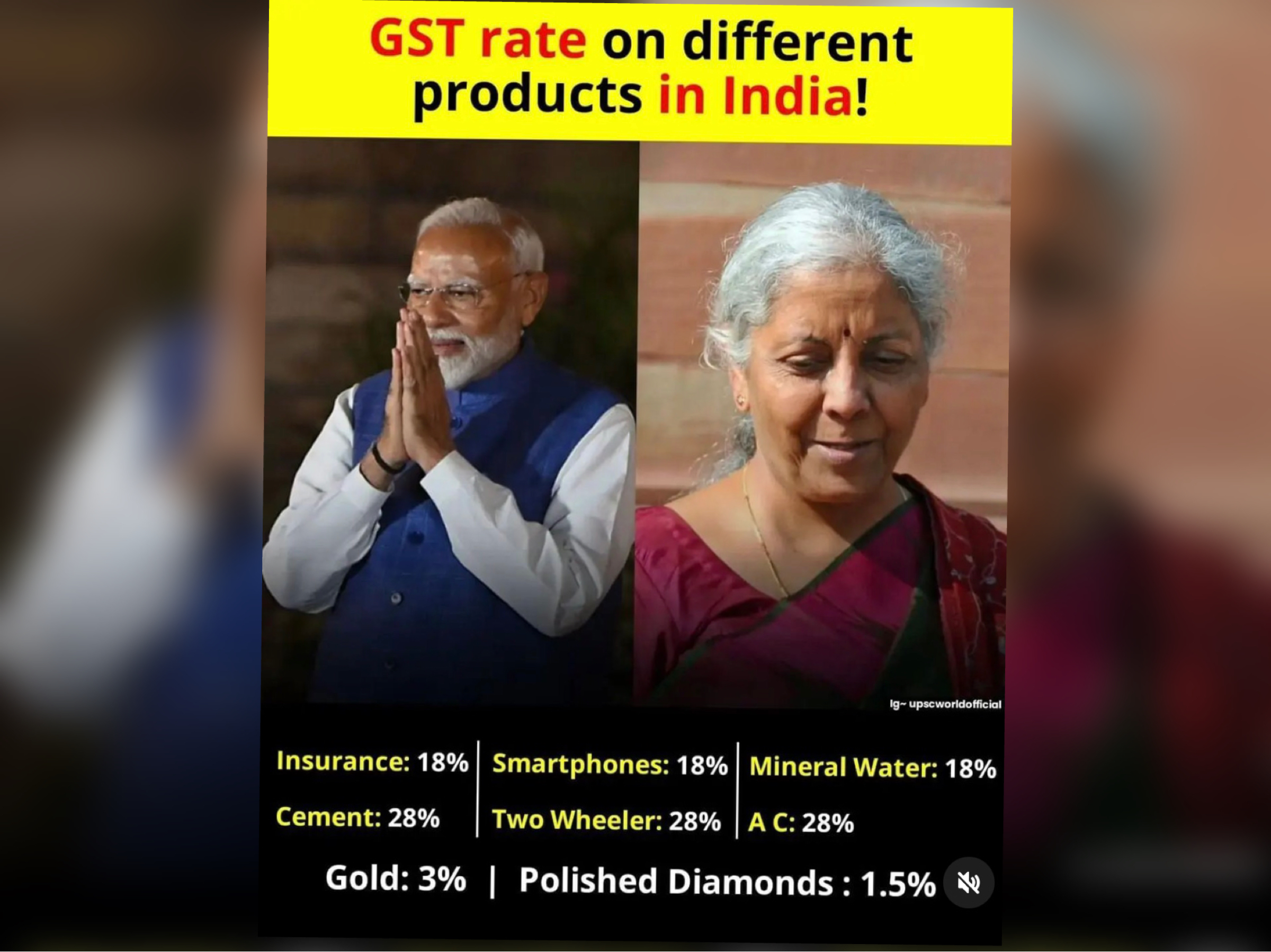

Plain popcorn: 5% GST. Salted popcorn: 12% GST. Caramel popcorn: 18% GST. This is the state of taxation in India! As a tech business owner, how can we thrive in an environment with such irrational policies? India is already ranked 1st worldwid

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)