Back

Varun Bhambhani

•

Devza • 1y

My personal opinion towards such hypothetical bs rules are that they no longer justify the current economic/financial situation of a person. The inflation and the cost of sustainability was very less when these so called theories were listed out but now they are completely the opposite

Replies (1)

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

"RBI Expected to Cut Repo Rate by 25 Basis Points to 6.25% in December Amid Concerns Over Volatile Food Prices" "RBI Likely to Cut Key Policy Rate by 25 Basis Points to 6.25% in December as Inflation Expected to Ease, Aiming to Boost Economic Growth

See MoreAtharva Deshmukh

Daily Learnings... • 1y

PESTLE Framework:- The framework analyzes external factors influencing a business. 1] Political:- Government policies, regulations, stability, tax policies, trade traffic 2] Economic:- Economic growth, inflation, exchange rates, interest rates 3]

See MoreSairaj Kadam

Student & Financial ... • 1y

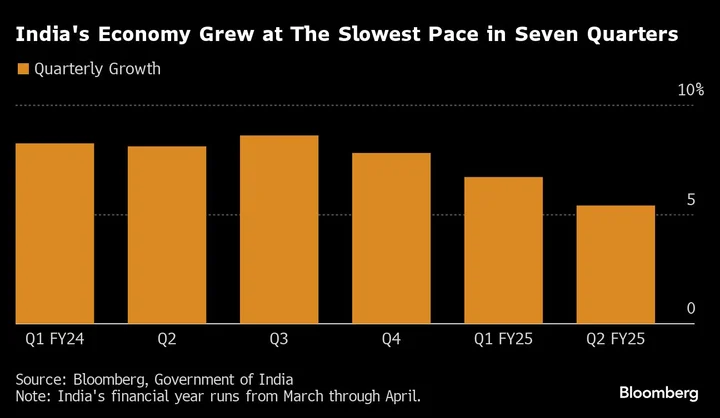

India's Two-Year Low: The Middle Class Squeeze Amid Economic Turmoil India's urban consumption has hit a two-year low in 2024, driven by persistent inflation and stagnant wages. Middle-class households, already struggling with rising costs, are cu

See More

Sairaj Kadam

Student & Financial ... • 1y

Do you Know How Important inflation is? Let's test it. If you had to borrow $1,000 from a friend and they agreed not to charge interest, but inflation is 3% annually, are you actually paying them back the full value of what you borrowed after one

See Morefinancialnews

Founder And CEO Of F... • 1y

Wall Street Update: US Stock Indices Trade Mixed Amid Fresh PCE Inflation Data Wall Street Update: Dow Rises, S&P 500 and Nasdaq Slip Amid PCE Inflation Data **US Stocks Mixed as Investors Digest PCE Inflation Data** US stock indices were mixed on

See MoreDownload the medial app to read full posts, comements and news.