Back

Shreyas Ramdasi

Mechanical Engineer • 1y

Hey there! Today, we're delving into GST and its impact on businesses, which is crucial for understanding how illegal activities can affect this framework. Input GST is what businesses pay on raw materials, while output GST is charged to customers upon sale. The difference is paid to the government. For instance, in A's shirt business, he paid ₹10 as input GST on ₹100 of raw materials and collected ₹18 as output GST from selling shirts at ₹120. The ₹8 difference is what he owes the government. Understanding these dynamics helps us see how compliance or non-compliance can affect businesses and the economy

More like this

Recommendations from Medial

AASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

CA Jasmeet Singh

In God We Trust, The... • 11m

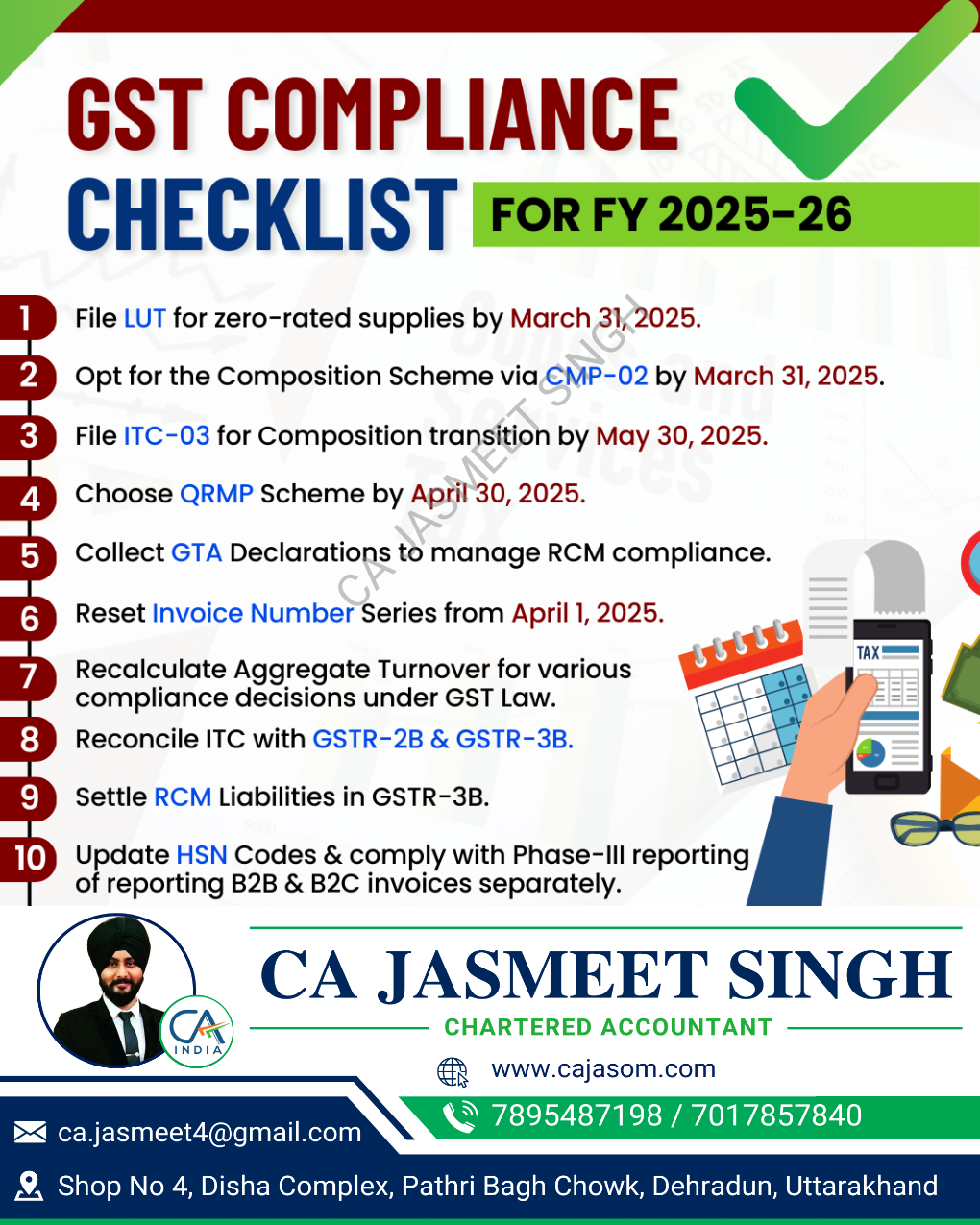

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

CA Kakul Gupta

Chartered Accountant... • 4m

GST Rate Change – Important Clarification The Govt. has clarified that new GST rates will apply on all deliveries made on/after 22nd September. 👉 Even if you have booked your order, issued invoice, or made advance payment pehle, the new rate will

See MoreSaurabh Mishra

Building a tech gian... • 7m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreCA Jasmeet Singh

In God We Trust, The... • 10m

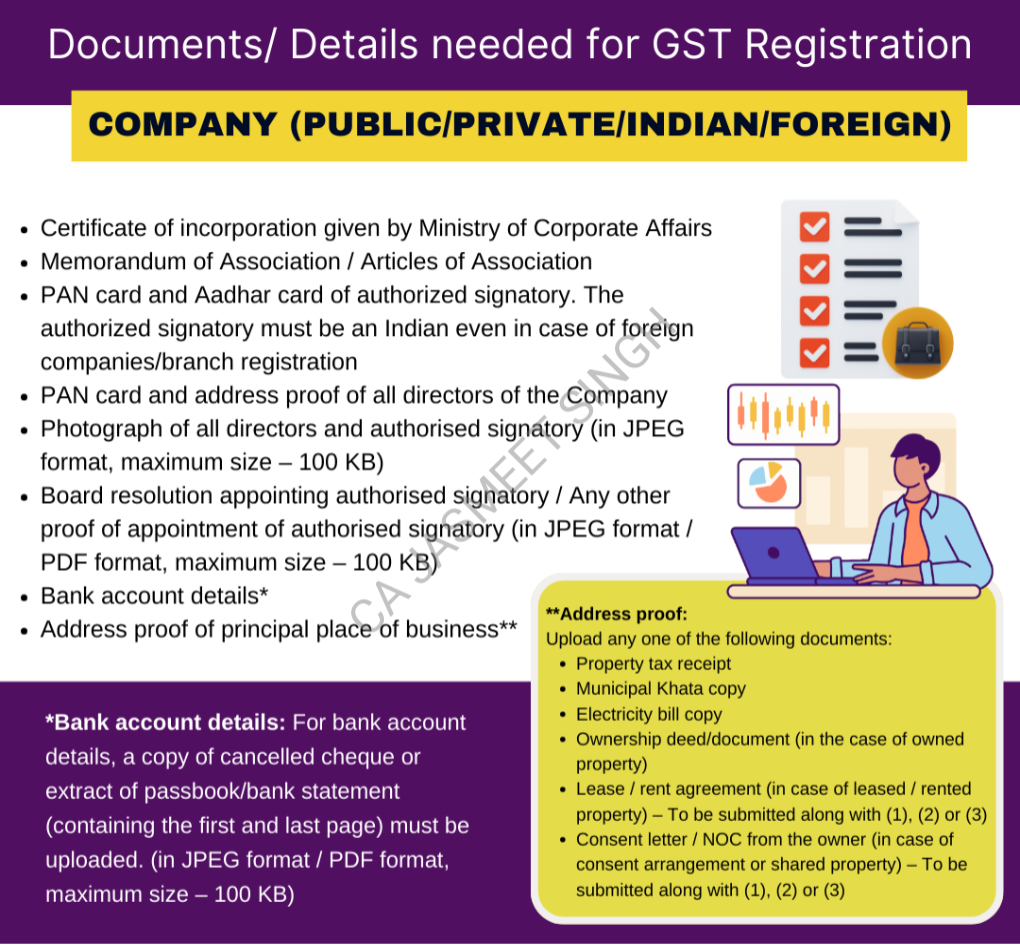

📢 GST Registration for Companies – Everything You Need to Know! 🚀 Starting a company? One of the first legal steps is getting GST registration! ✅ It not only gives your business a legal identity but also opens doors to seamless tax compliance, inp

See More

Download the medial app to read full posts, comements and news.