Back

More like this

Recommendations from Medial

Swayam Chatterjee

Boring person • 1y

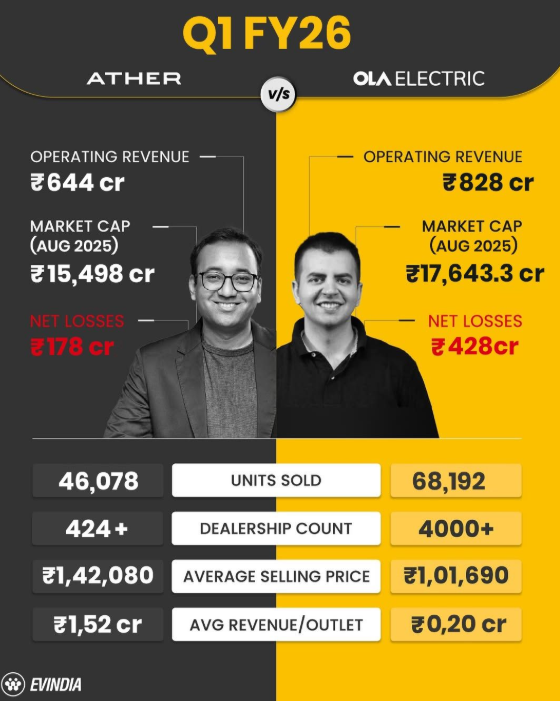

Why India's OG Electric Scooter Company is Failing? Founded in 2013 by Tarun and Swapnil, Ather initially aimed to build a battery company. However, they shifted their focus to creating electric vehicles due to existing EVs’ poor performance and de

See MoreRohan Saha

Founder - Burn Inves... • 10m

Many traders and investors often overlook fixed income instruments, but having a portion of the portfolio in debt is essential for stability. Buying bonds in India is very easy, yet people do not give much consideration to bonds or debt mutual funds.

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

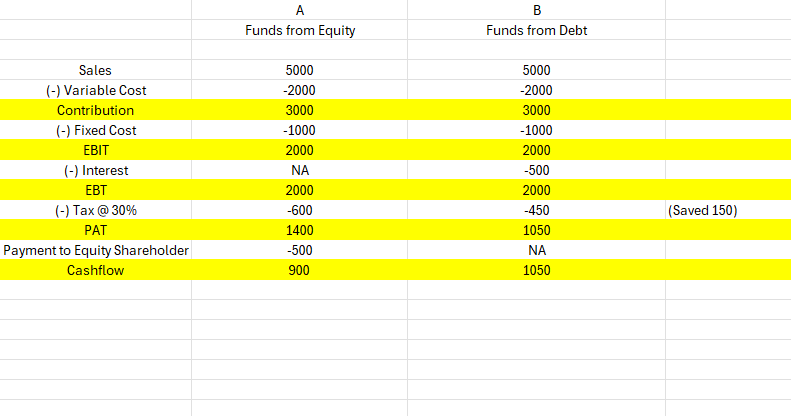

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)