Back

Navneet Chaudhary

•

ABC • 1y

No credit has has no impact on my spending habit. It's a very nice to have the free money which I've to pay later.

Replies (1)

More like this

Recommendations from Medial

AjayEdupuganti

I like software and ... • 1y

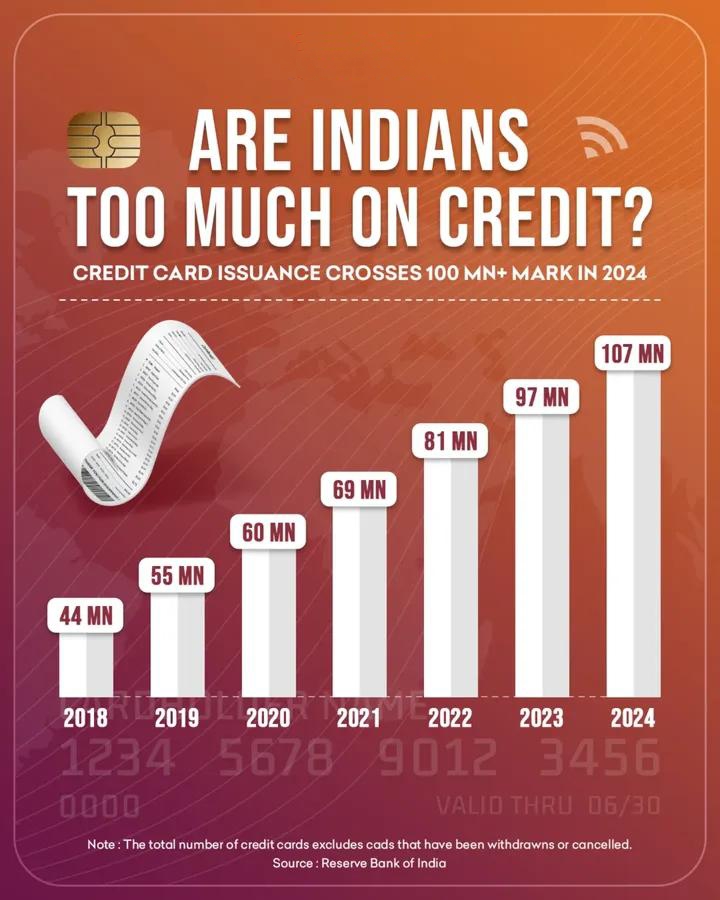

Do you use a RuPay credit card with UPI? How often does your credit card bill exceed your expectations? Are you spending more because of your credit card? I just want to understand whether this could become another potential debt trap for Indians

See MoreAbdul Alim

Building Lovable for... • 3m

The Crazzy Grind - Day 18: The Scariest Button I've Ever Added. For the past few weeks, Crazzy has been a completely free, open-source project. But it's always been my dream to turn it into a sustainable, long-term business. Today, I've taken the fir

See More

Anonymous

Hey I am on Medial • 9m

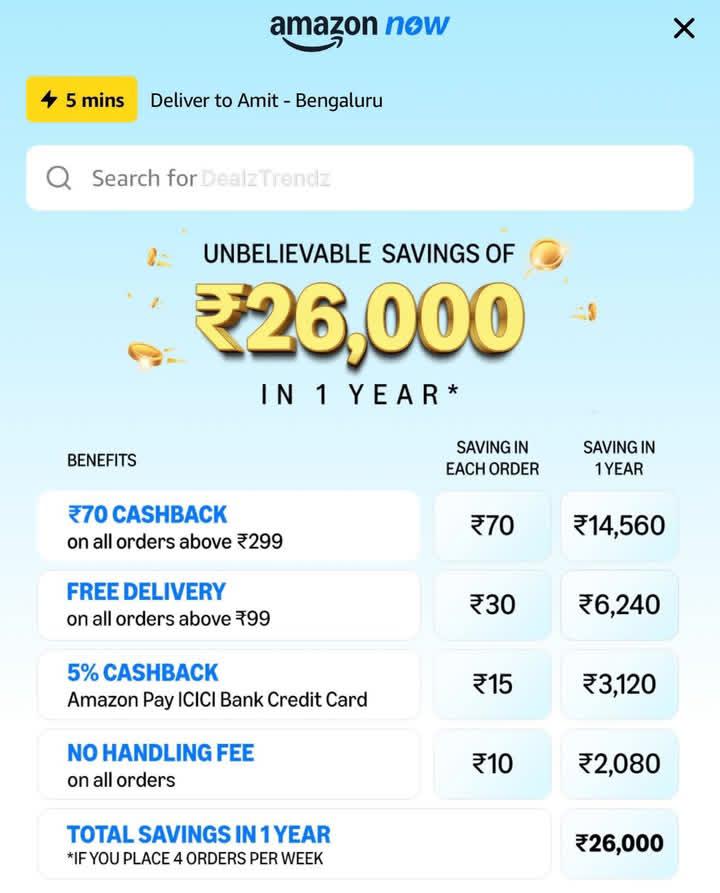

Amazon has launched “Amazon Now”, a 10-minute delivery service in select pincodes of Bengaluru! • Get ₹70 instant cashback in your Amazon Pay Wallet on orders above ₹300. • Pay with Amazon Pay ICICI Credit Card to enjoy an additional 5% cashback, m

See More

Account Deleted

Hey I am on Medial • 1y

Today's Topic : Buy Now Pay Later Services Do You think BNPL Service will big ? E.g : Simpl,Lazypay etc. •Buy Now, Pay Later (BNPL) services are popular for splitting purchases into smaller, interest-free installments. •BNPL services are targeting

See More

Gangesh Rameshkumar

Figure it out • 8m

Today's term of the day: Credit Credit is a kind of loan handed out by financial institutions to businesses and individuals. You can think of it as the ability you have to borrow resources from a lender to pay at a later date, with interest for usin

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)