Back

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 9m

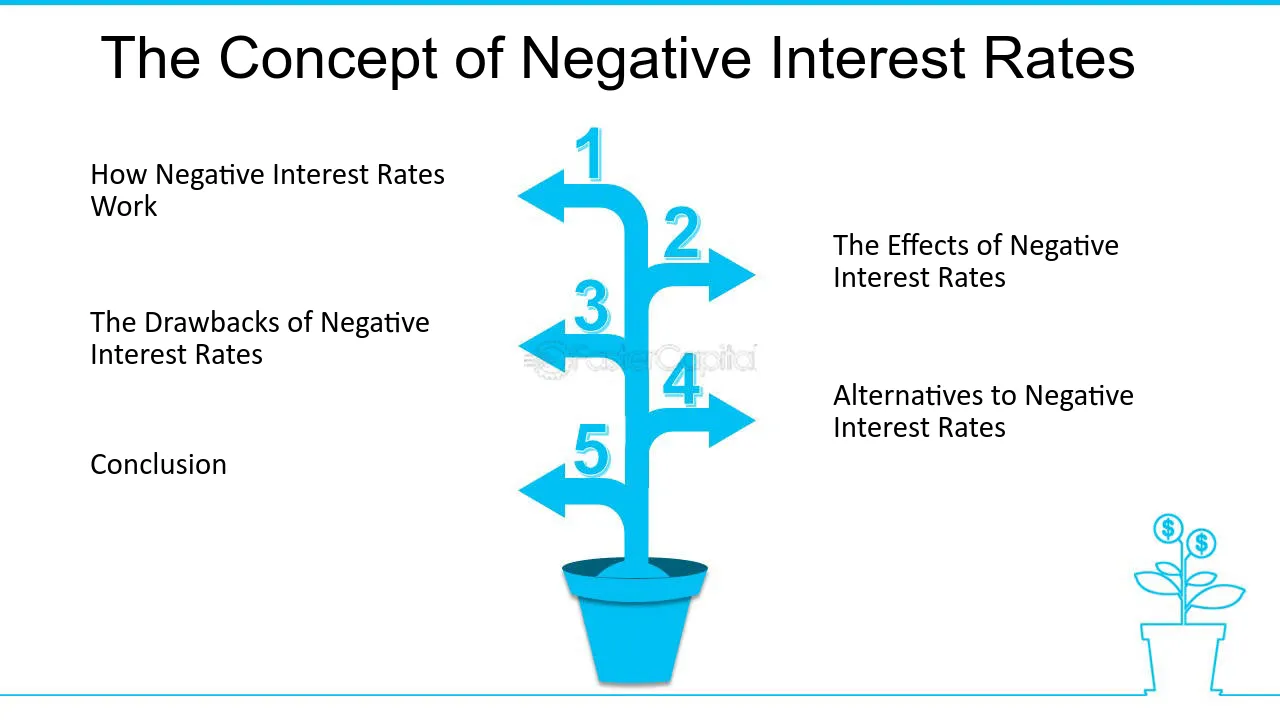

Exploring Negative Interest Rate Policy (NIRP) Have you ever wondered about central banks setting interest rates below zero? This is known as Negative Interest Rate Policy (NIRP). Here's a quick look at this unconventional monetary tool: ✍️ What is i

See More

Shashank Kumar

AI Engineer with bus... • 25d

Does anyone have any experience with CGTMSE (Credit Guarantee Scheme for MSMEs) loan ? Can you share it here ? 1. How to apply 2. What do banks look for while sanctioning ? 3. What are the chances of getting it sanctioned ? 4. Best bank for the sam

See MoreAccount Deleted

Hey I am on Medial • 9m

8 Startup-Friendly Banks in India 1. YES Bank Startup Banking https://www.yesbank.in/business-banking/startup-banking 2. HDFC Bank SmartUp https://www.hdfcbank.com/personal/pay/cards/startup-services/smartup 3. ICICI Bank InstaBiz for Startups htt

See More

Government Schemes Updates

We provide updates o... • 4m

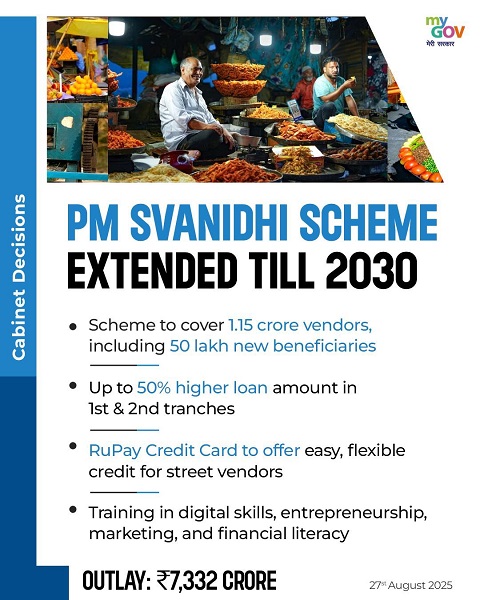

The Central Government’s PM SVANidhi Scheme continues to empower millions of India’s street vendors by providing easy access to short-term working capital loans up to ₹50,000. With added benefits like 7% interest subsidy, monthly cashback for digita

See More

Government Schemes Updates

We provide updates o... • 5m

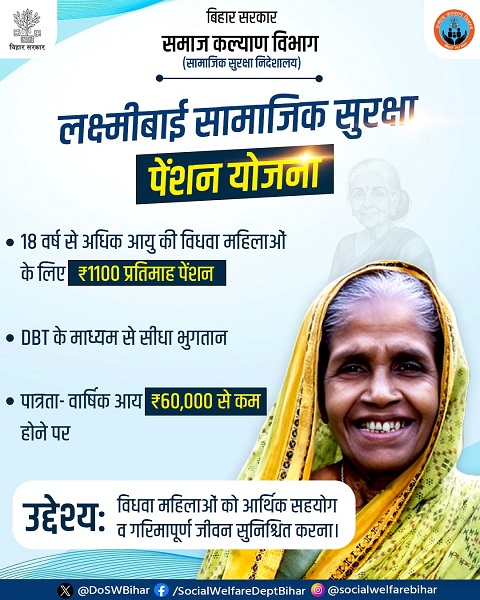

The Bihar Government has revised its Widow Pension Scheme – Laxmi Bai Samajik Suraksha Pension Yojana. Under this scheme, widowed women are now entitled to a ₹1,100/- monthly pension, directly transferred to their bank accounts. Eligibility: Widow,

See More

Government Schemes Updates

We provide updates o... • 3m

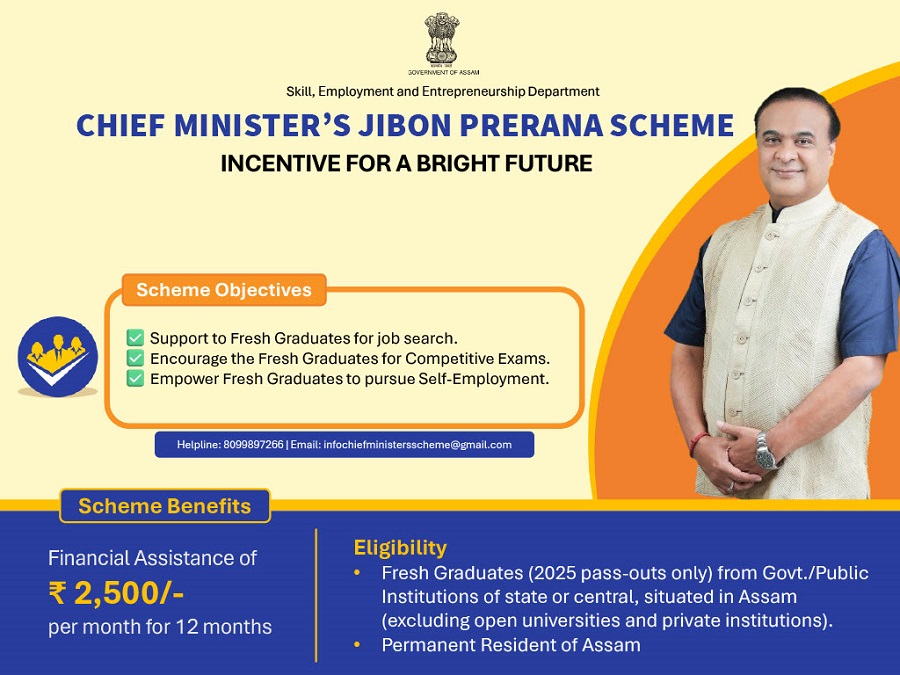

The Chief Minister Jibon Prerana Scheme launched by Assam CM Himanta Biswa Sarma is a milestone in educational welfare. The scheme aims to financially support graduates of 2025, enabling them to prepare for their professional journey without stress.

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)