Back

Shashank Kumar

AI Engineer with bus... • 20d

Does anyone have any experience with CGTMSE (Credit Guarantee Scheme for MSMEs) loan ? Can you share it here ? 1. How to apply 2. What do banks look for while sanctioning ? 3. What are the chances of getting it sanctioned ? 4. Best bank for the same ? 5. How was your experience like ?

More like this

Recommendations from Medial

Shubham Jain

Partner @ Finshark A... • 1y

**Opportunity Alert: CGTMSE Scheme for MSEs** Dear all, Exciting news! The CGTMSE Scheme offers collateral-free loans up to *Rs. 2 crore* for micro and small enterprises (MSEs). Key features include: - No need for collateral or third-party guarante

See MoreYash Bramhadev Pandey

Leading Organic Mark... • 9m

Hello everyone, I am currently in the ideation stage of my service-based startup and looking to raise initial funding through the CGTMSE scheme for a loan of ₹5 Crores. If anyone has experience, contacts with banks, NBFCs, or consultants who can gui

See MoreSanthosh

Don't Giveup when yo... • 1y

Hey guys Here's a detailed business explanation. Challenges faced by MSMEs in loan application : 1)time-consuming and complex loan application process. 2)lack of awareness about various government loan schemes. 3)difficulty documentation and applicat

See MoreSanskar

Keen Learner and Exp... • 1y

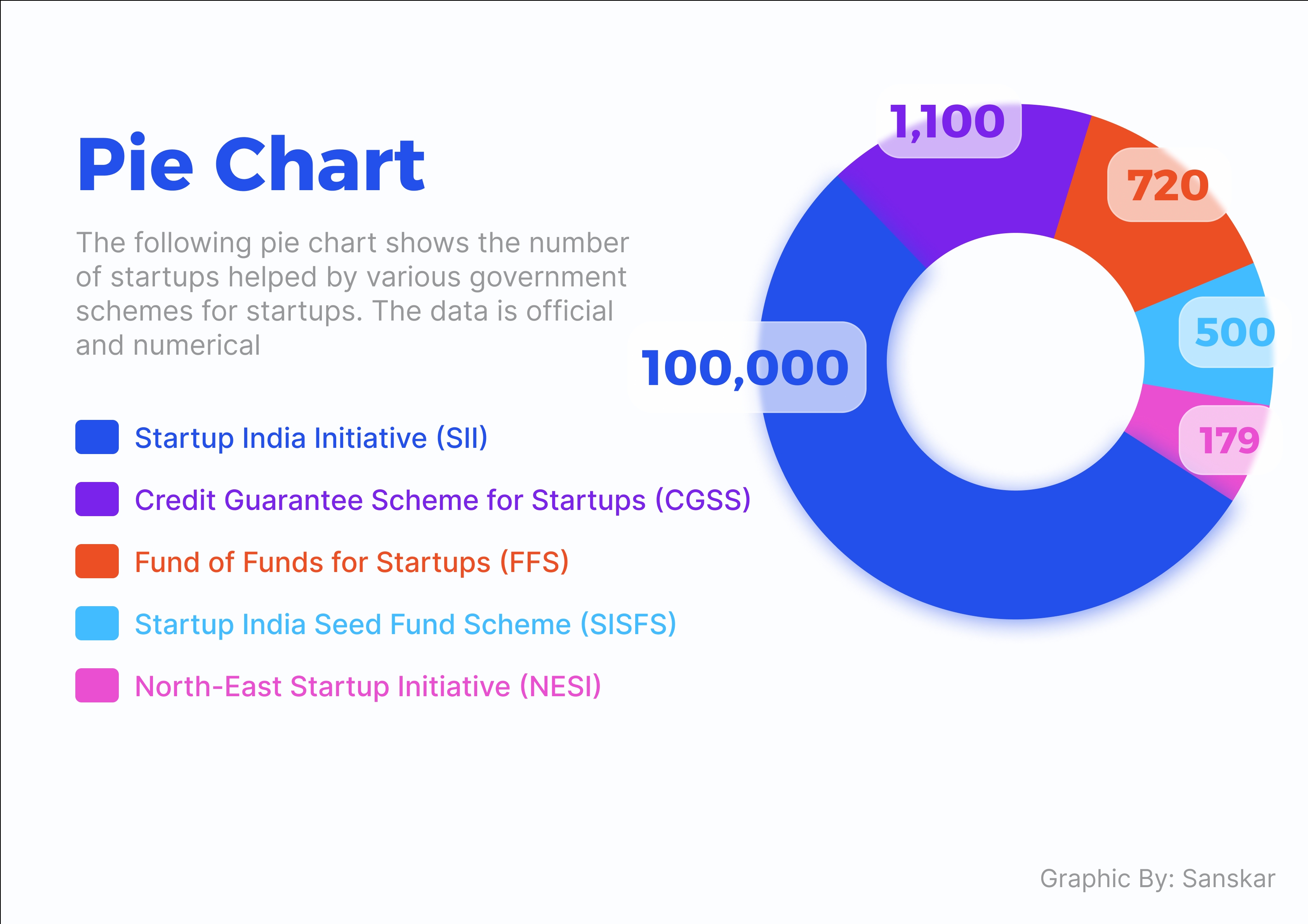

How many of these government schemes to support the startup ecosystem are you aware of? 1. Startup India Initiative (SII) [2016] - This scheme offers three years tax holiday and reduced regulatory burden along with access to a Fund of Funds worth ₹1

See More

Krishna Chaitanya

We are planning to s... • 11m

Despite the government's push for renewable energy and biogas under schemes like SATAT, banks are still demanding collateral for CGTMSE loans, making it difficult for startups to enter the sector. How can first-time entrepreneurs in the biogas indust

See MoreAccount Deleted

Hey I am on Medial • 9m

10 Government Schemes Every Indian Startup Should Know 1. Startup India Seed Fund Scheme (SISFS) https://seedfund.startupindia.gov.in/ 2. Stand-Up India https://www.standupmitra.in/ 3. MUDRA Loans (PMMY) https://www.mudra.org.in/ 4. Atal Innovat

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)