Back

Bhavya jha

Just on the way of r... • 1y

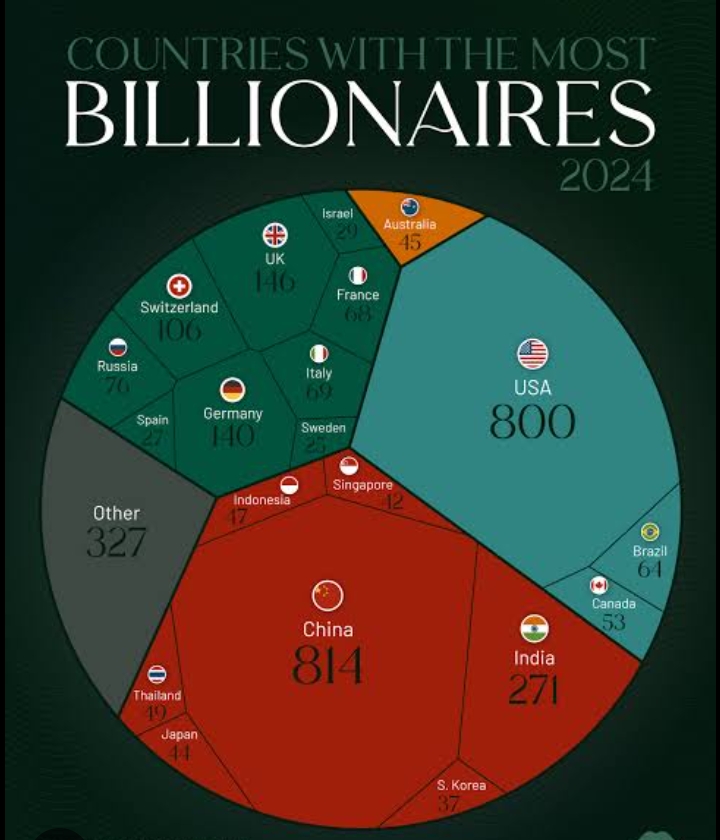

According to the Hurun Global Rich List 2024, China housed the highest number of billionaires worldwide in 2024. In detail, there were 814 billionaires living in China as of January that year. Now , all of u are wondering , how china come this far, or what are the reasons behind this ? Here r the reasons :- 1) economic reforms (late 1970s onwards) :- China began its economic reforms and opening up polices under the leadership of deng Xioping . These reforms aimed to shift from a centrally planned economy towards a more market oriented system. 2) globalization and foreign investment (1980s onwards) :- this led to attraction of foreign investment and fostering international trade. 3) technology advancements ( 1990s onwards) :- companies like Xiaomi , tencent emerged and flourished 4) government polices (2000s onwards) :- the Chinese government took a big step towards Innovation and entrepreneual growth . 5) Rapid urbanization (2000s onwards) 6) investment in tech (present).

Replies (25)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 10m

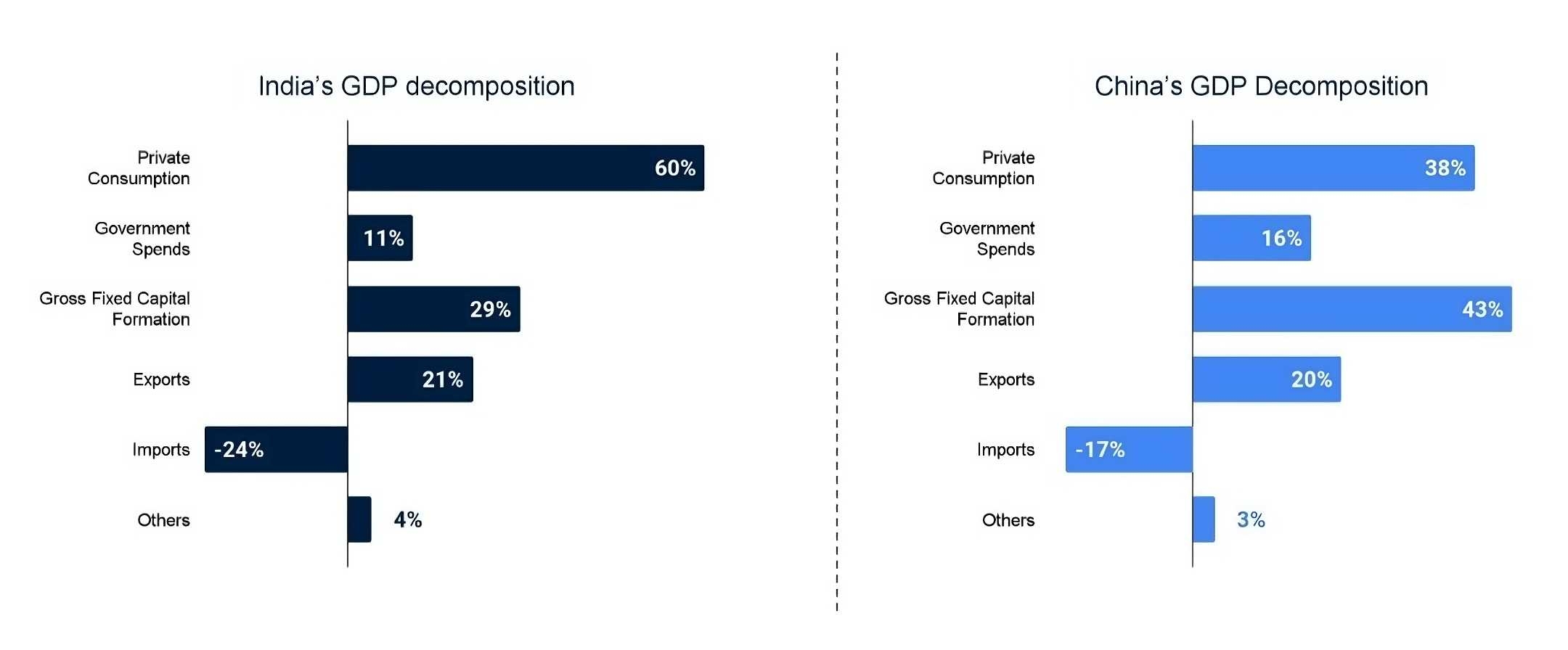

Last week, FIIs poured ₹8,500 crore into the Indian market. One of the main reasons could be the ongoing trade tensions between China and the US. Plus, Indian market valuations have become quite attractive lately, and the overall economic indicators

See Morefinancialnews

Founder And CEO Of F... • 1y

"Manmohan Singh’s Landmark 1991 Budget Speech: The Dawn of a New India" Manmohan Singh’s Historic 1991 Budget Speech: A Turning Point in India’s Economic Journey On July 24, 1991, then Finance Minister Dr. Manmohan Singh delivered a landmark budget

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)