Back

Anonymous 3

Hey I am on Medial • 1y

Keep in mind, valuations are a mix of art and science. Market perception, investor sentiment, and strategic goals all play a part. Sometimes, a lower valuation now can pave the way for future opportunities.

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

As we know Invesco revalued the Swiggy and Pinelabs valuation and As of now PineLabs $3.5 Billion and Swiggy at 12.1 Billion . But due to this cut in valuation, these firms can face these challenges in the future and both firms are backed by Peak XV

See More

TheLuhas

Never take anyone as... • 1y

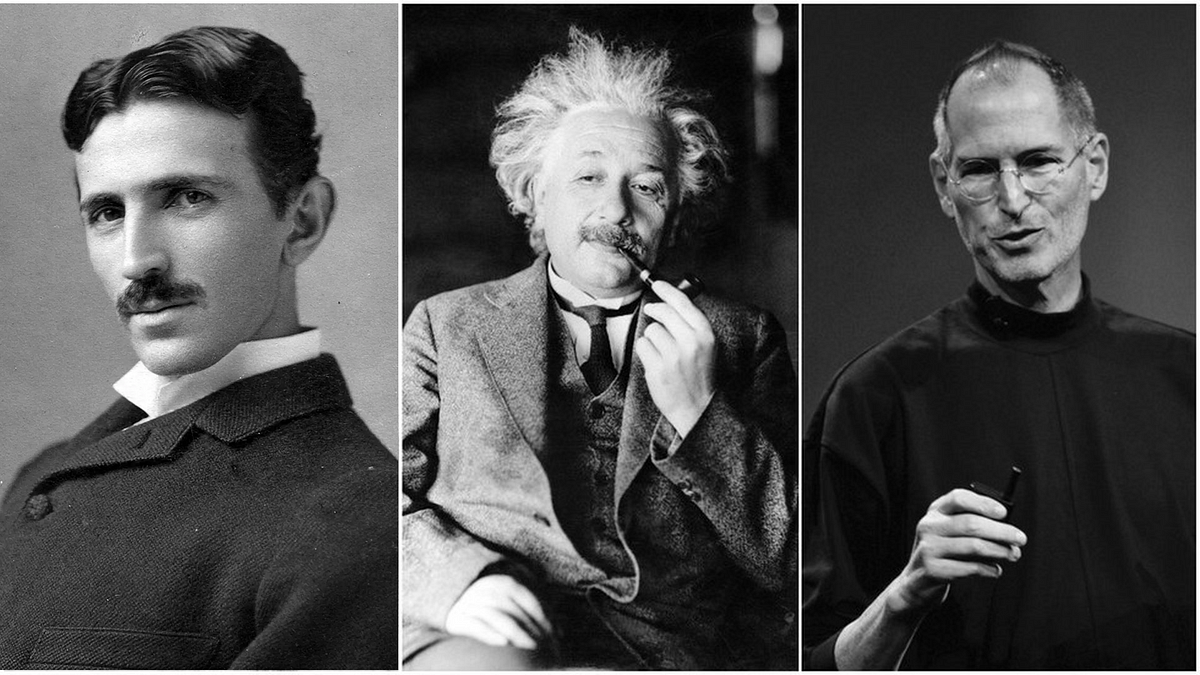

The best people are often a mix of seemingly different things. Nikola Tesla was a genius scientist but also loved poetry. Albert Einstein was passionate about physics and played the violin. Steve Jobs blended technology with his love for design. Leon

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

Ever wondered what happens before a startup secures funding? Let's deconstruct it Valuation is key in funding rounds – is it art or science? For early-stage startups, it's a mix. Common Valuation Methods: DCF: Future cash flows discounted to present

See More

financialnews

Founder And CEO Of F... • 1y

“Nifty Smallcap Stocks: 50% Trading 20-42% Below 52-Week Highs – Investor Strategies” “Dalal Street Small-Cap Stocks: Investor Interest Wanes Amid Weak Earnings, Geopolitical Tensions, and Profit-Taking” Investor interest in small-cap stocks on Dala

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)