Back

More like this

Recommendations from Medial

OMPRAKASH SINGH

Founder of Writo Edu... • 1y

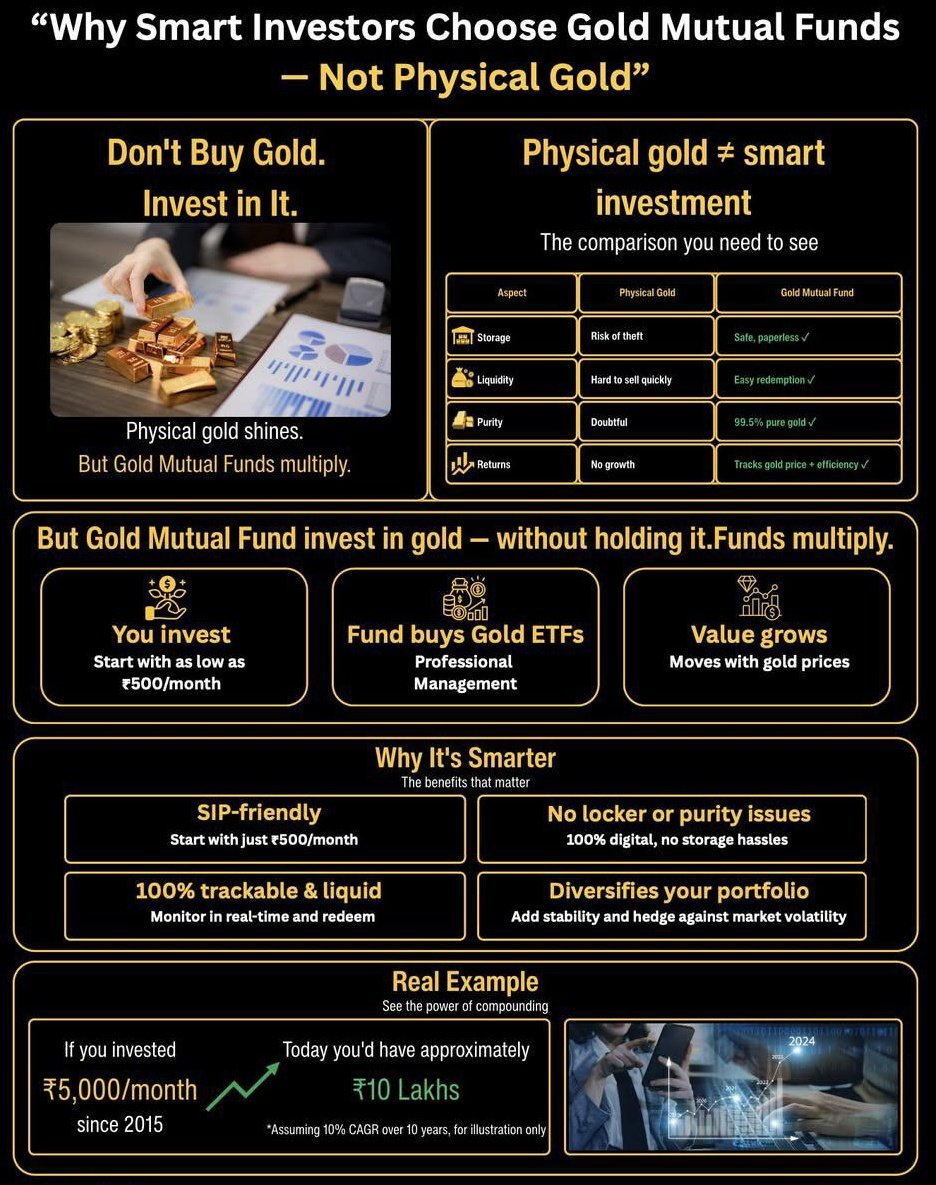

Ways to Multiply Money 🤯 Investments: 1. Investing in the Stock Market: You can multiply your money by investing in the stock market, but it involves risks. 2. Mutual Funds: By investing in mutual funds, you can diversify your money into differen

See MoreKiran aiwale

The business solutio... • 9m

Bajaj Allianz Life insurance Term insurance 1. *Affordable premiums*: Lower premiums compared to whole life insurance. 2. *High coverage*: Provides a high death benefit to ensure financial security for loved ones. 3. *Flexibility*: Choose term le

See MorePVSN RAJU

Start Small Dream Bi... • 1y

We have worked out a solution where non-income earners like children,students,housewives will be able to invest in instruments like Mutual funds,Digital Gold etc.without opening a joint account at the bank with the income earner. This product is to t

See MoreShanu Chhetri

CS student | Tech En... • 9m

🔍 10-Year Stock Returns: A Decade of Change Over the past 10 years, companies like NVIDIA have delivered massive returns (+17,950%), while others like BlackBerry have seen major declines (-64%). This comparison shows how innovation, strategy, and m

See More

VIJAY PANJWANI

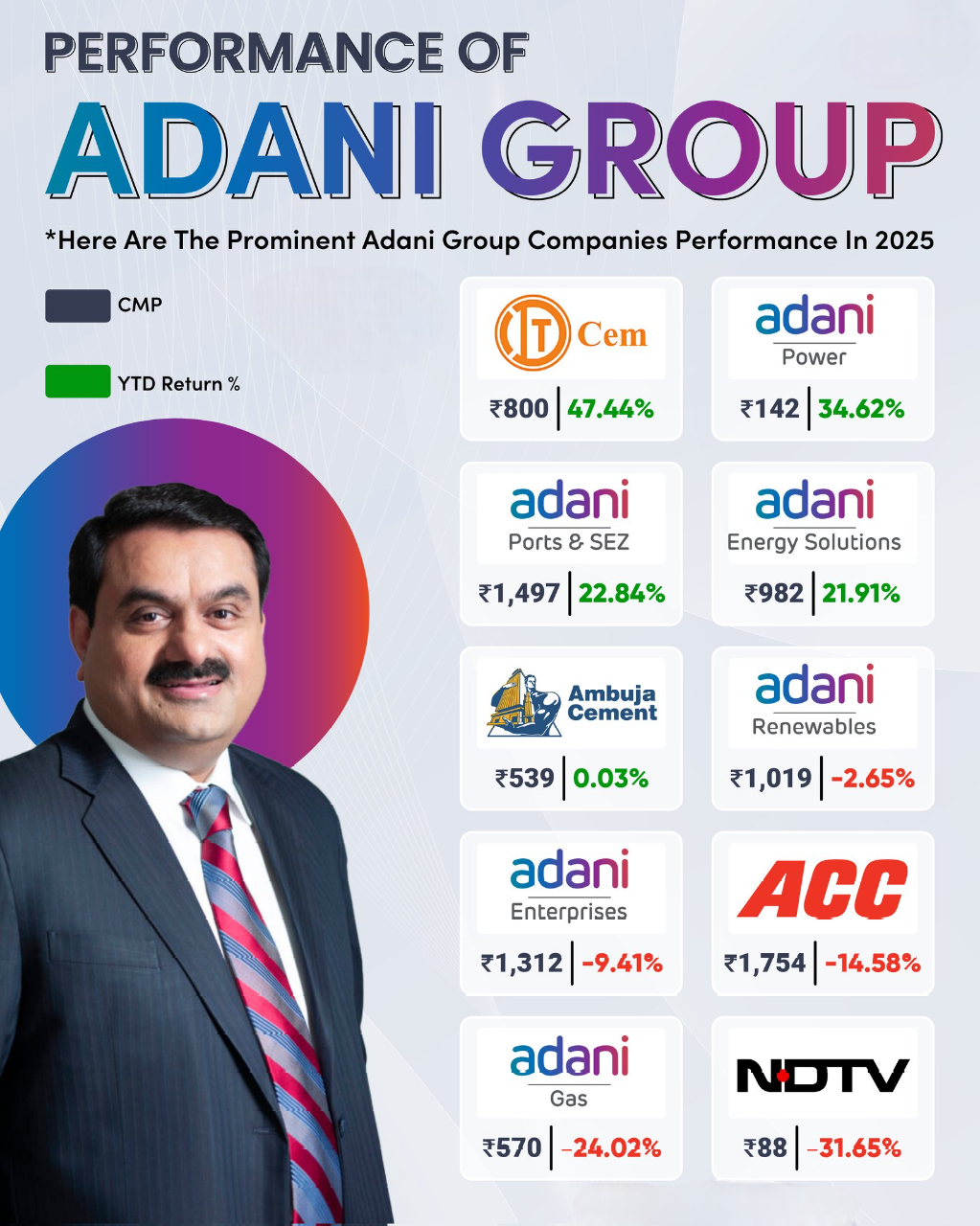

Learning is a key to... • 2m

Performance of Adani Group – 2025 Snapshot From power & ports to cement and renewables, the Adani Group shows a mixed but insightful performance this year. Some stocks delivered strong YTD gains 📈 while others faced pressure 📉 reminding us why d

See More

Suman solopreneur

Exploring peace of m... • 1y

Naval Ravikant on Freedom and Wealth: 1. Take More Risks: If you're sincere and keep trying, failure isn't a huge concern. 2. Own Equity: Ownership, not income, is the source of wealth. 3. Make Use of Leverage: Expand your work via code, media, or b

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)