Back

PVSN RAJU

Start Small Dream Bi... • 1y

We have worked out a solution where non-income earners like children,students,housewives will be able to invest in instruments like Mutual funds,Digital Gold etc.without opening a joint account at the bank with the income earner. This product is to teach financial literacy to young Indians and inculcate the habit of saving & investing. My question to you all is this a much needed product in the market. All your suggestions and thoughts on the product are welcome.

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 10m

Many traders and investors often overlook fixed income instruments, but having a portion of the portfolio in debt is essential for stability. Buying bonds in India is very easy, yet people do not give much consideration to bonds or debt mutual funds.

Siddharth K Nair

Thatmoonemojiguy 🌝 • 7m

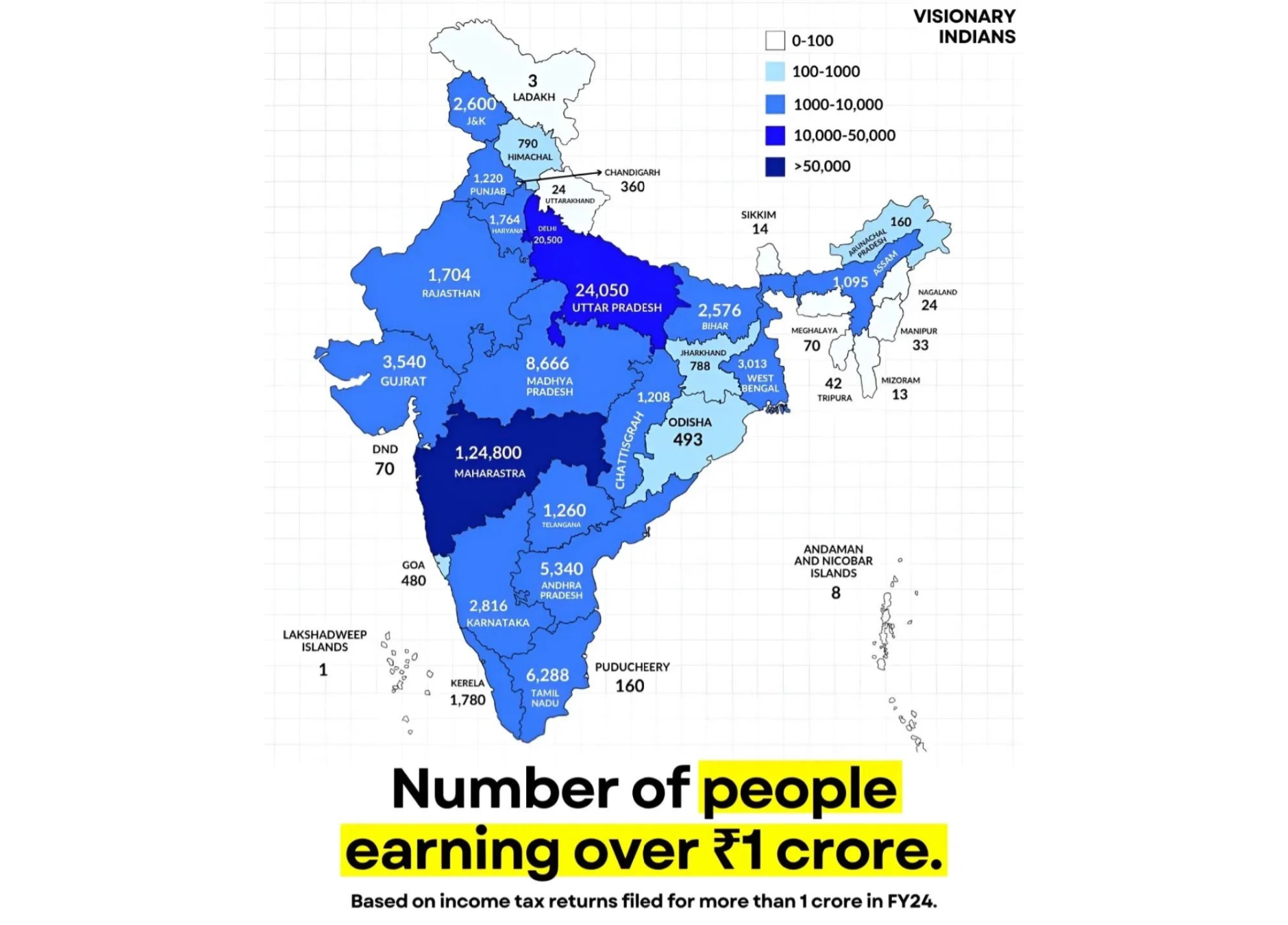

How Many Indians Actually Earn Over ₹1 Crore a Year? The Number Might Shock You. 💬 With a population of over 140 crore, you'd expect lakhs of crore plus earners in India. But the real number is surprisingly low. What does this say about income ineq

See More

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

Decline in India's Household Savings Net household savings in India declined to a 47-year low of 5.1% of gross domestic product in FY23, compared to 7.2% in the previous year. The finance ministry attributes this to changing consumer preferences for

See More

Dindayal sinha

Am promoter not prom... • 11m

Problem statement: Studies show that over 250 million children worldwide lack basic literacy skills, and only 10% of students in low-income countries complete secondary education. The need for innovative, inclusive learning solutions has never bee

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)