Back

More like this

Recommendations from Medial

SARASHI ASSOCIATION

Hey I am on Medial • 1y

Sarashi Association Need help for startup and grow.....My aim is to provide loans to common poor business people at very low interest rates, and much lower than normal banks and finance company like half interest loans, small medical expenses loans

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

Aryan Sukhdewe

Looking to work in ... • 1y

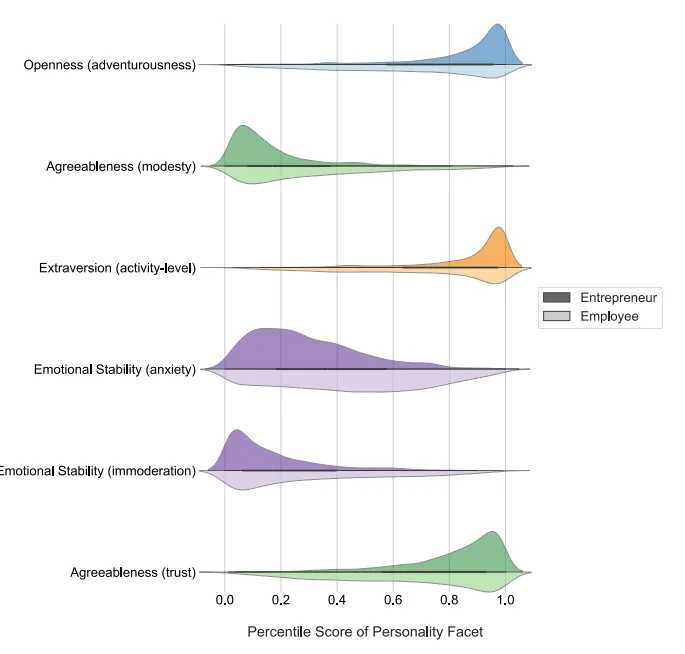

Compared with people at low trust organisations to people at high trust organisations report : 74% less stress 106% more energy at work , 50% higher productivity , 13% fewer sick days , 76% more engagement , 29% more satisfaction with their lives a

See MoreOMPRAKASH SINGH

Founder of Writo Edu... • 1y

How do some stocks suddenly rise in the stock market? Let’s find out 🤯 Market and Economic Factors 1. Demand and Supply: When the demand for a stock increases and supply decreases, its prices rise. 2. Economic Growth: If a company's business is

See MoreVinay Patel

Hey I am on Medial • 1y

hey everyone I have a firm .actually we are into money lending business but now we want to expand our business so any idea how we can get more capital in less interest rates. we provide 5% monthly fixed returns schemes those who are interested can co

See MoreNextGen Thinking

Think Beyond boundar... • 8m

📢 Looking for Freelancers (Part-Time / Project-Based) I’m a freelancer managing multiple clients, and sometimes I receive more work than I can handle. ✅ I’m building a small team I can share projects with when needed. This is not a regular job, but

See MoreKimiko

Startups | AI | info... • 9m

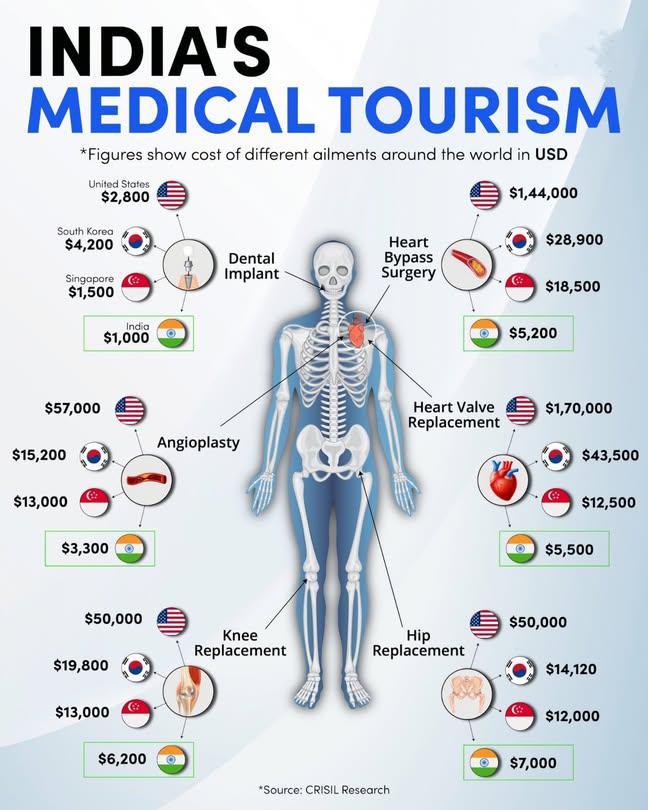

India offers significantly lower medical treatment costs compared to the US, UK, and even some other medical tourism destinations like Thailand and Singapore, often by a large margin. This is due to factors like lower operational costs, economies of

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)