Back

MD. SAQIB

Hey I am on Medial • 1y

Just go and watch a man named ankur warikoo. And just start investing this. I am telling you seeing your money grow at an annual rate of 15-20% in a mutual fund will just give you immense pleasue

Replies (1)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 8m

I usually don’t go around recommending podcasts, shows, or books but this one is different. Ankur Warikoo has a series on his YouTube channel called 'Money Matters' and I genuinely think everyone should give it a watch. It’s packed with practical in

See MoreSamCtrlPlusAltMan

•

OpenAI • 1y

🔍 Inside Ankur Warikoo's 2024 Money Machine Ever wondered how a content creator turned entrepreneur really makes money? Let's break down how @warikoo built a ₹16.84 crore empire in 2024 while staying true to his values. The surprising part? His bigg

See More

financialnews

Founder And CEO Of F... • 1y

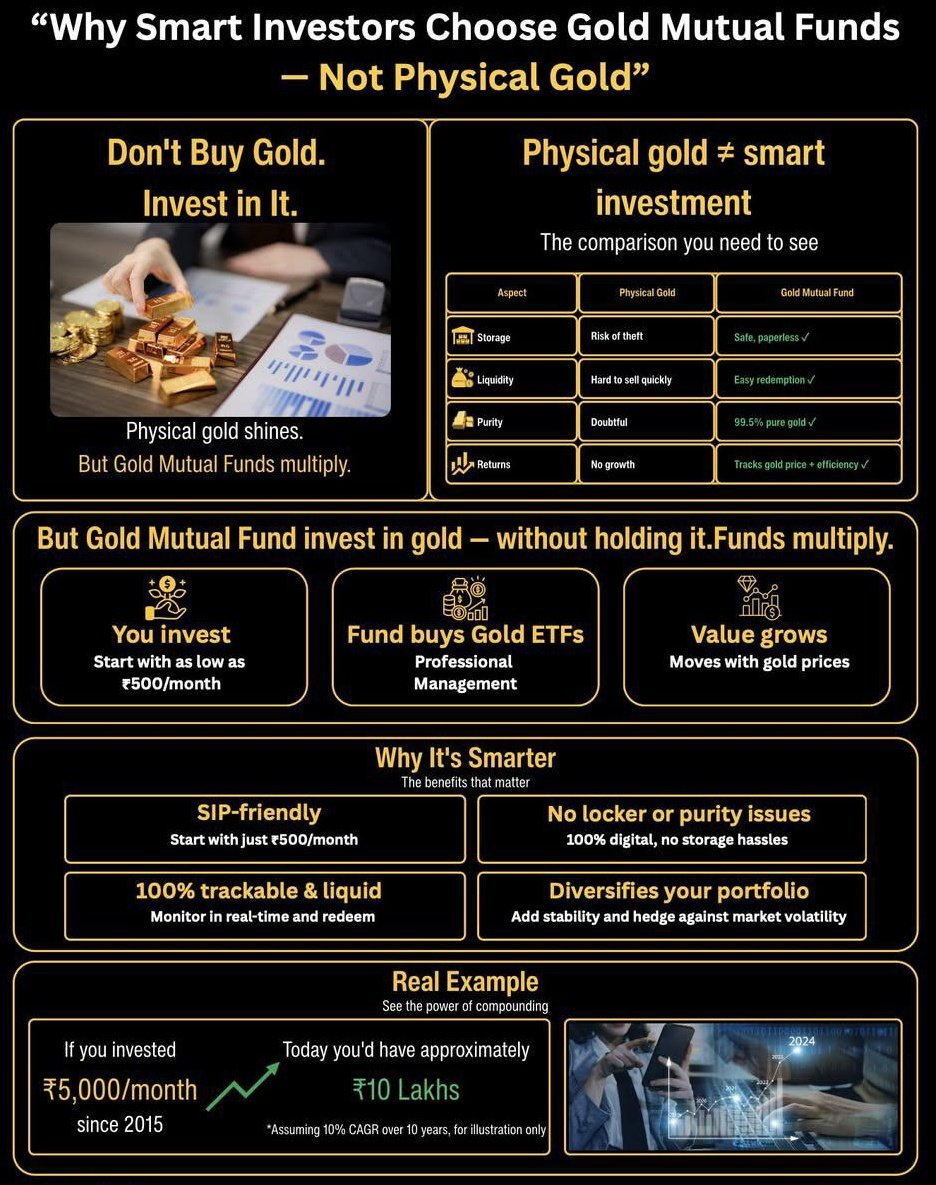

"Mutual Fund SIP Calculator: How Long to Reach 1 Crore with Monthly SIPs of ₹5,000 or ₹10,000?" Investing in mutual funds through a Systematic Investment Plan (SIP) is a smart way for investors to grow their wealth and potentially become a crorepati

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)