Back

K

Ph • 1y

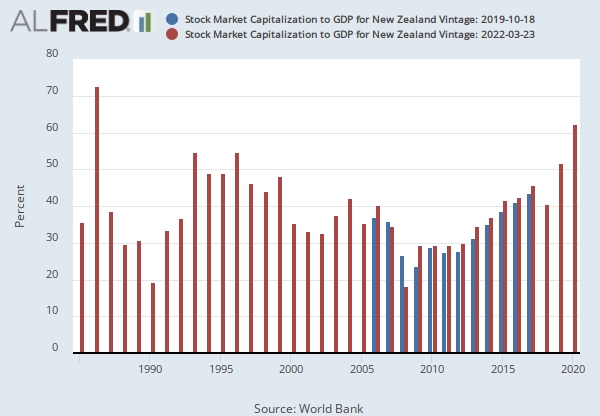

India's market capitalisation crossed $5 trillion, tripling in a decade. Domestic ownership increased as foreign institutional ownership fell. GDP is expected to reach $5 tn in 3 years, $7 tn by 2030.

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 8m

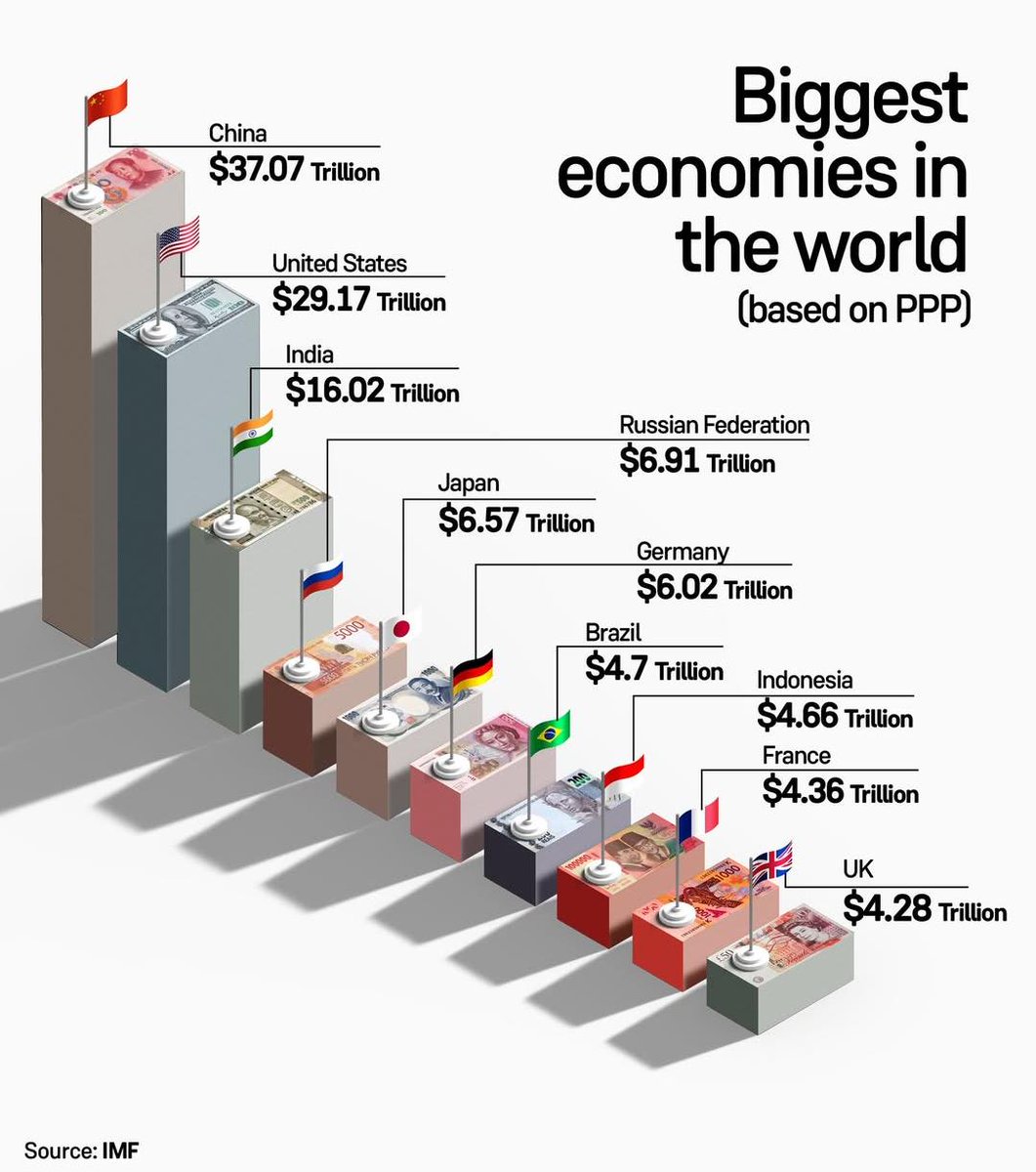

Came across an interesting report from Dalton India – 'The First Decade and The Next Decade'. When Dalton launched their India fund in 2014 → India was the world's 8th largest economy at $2.0 trillion, (part of Morgan Stanley's "fragile five" vulne

See More

Atharva Deshmukh

Daily Learnings... • 1y

Just like the way we go to our local kirana store for daily needs,we go to the stock market to shop for investments.Bombay Stock Exchange and National Stock Exchange are the two exchanges where you can buy or sell a stock via a registered intermediar

See MoreYogesh Kuhade

"I am not a job seek... • 1y

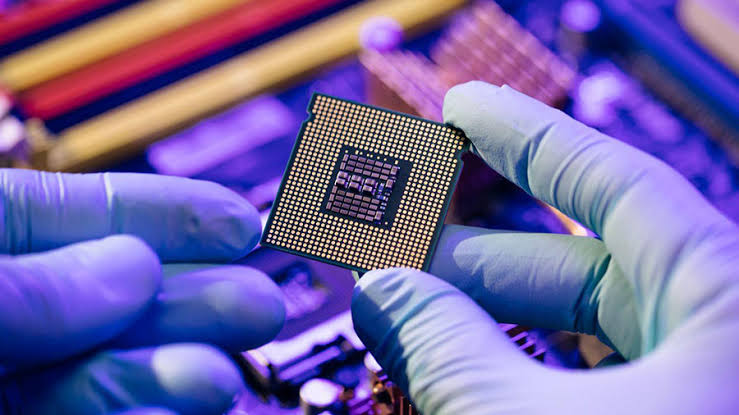

The dizzying, overnight rise of a chatbot by DeepSeek, a little-known Chinese artificial intelligence (AI) lab, has roiled AI-related stocks and wiped out close to a trillion dollars in market capitalisation of such companies. The chips fall (as of

See More

Anonymous

Hey I am on Medial • 1y

🔥 Happy Birthday PM Modi JI 🔥 In 2009, India had only about 200-300 startups. However, after Narendra Modi became the Prime Minister in 2014, the startup ecosystem experienced incredible growth. In just a few years, India saw a surge to 60,000 reg

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)