Back

Yagnesh Gadhvi

Nothing • 1y

First of all u should bifurcate it whether it is merchant loan or personal loan and the biggest challenge infornt of you is 100percent loan repayment which is still in India impossible as even BharaPE had repayment around 92 to 96 inspite of being an unicorn....and even if it is possible what about your operational costs as u said it is fintech ... The word tech carries lot of costs with itself... Hope u get my point

Replies (1)

More like this

Recommendations from Medial

Praveen Kumar

Start now or Regret ... • 1y

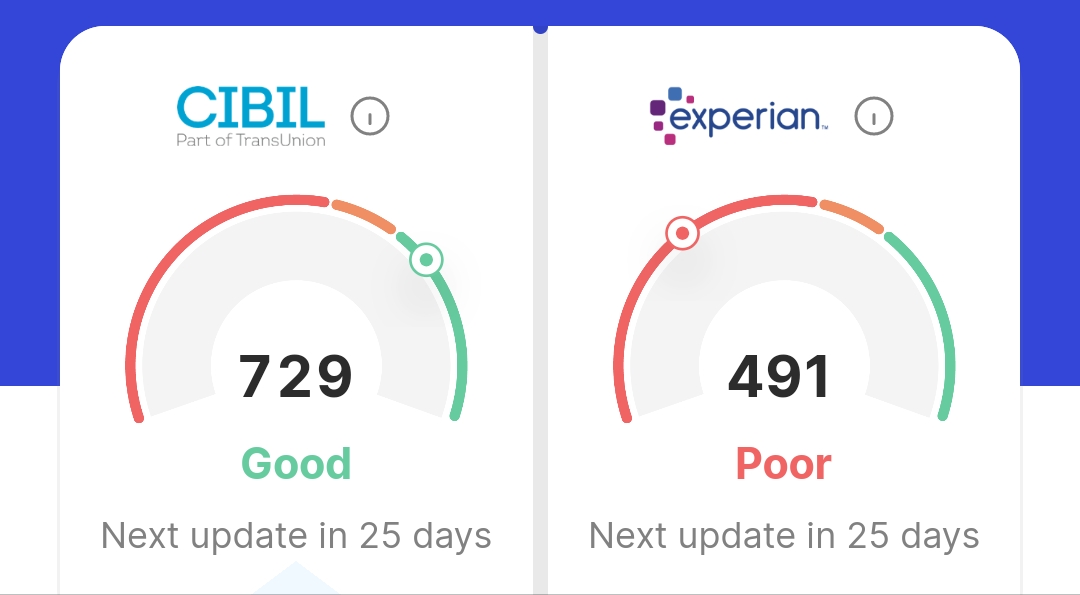

hii , At the age of 19 I have unfortunately taken a loan for my friend in mpocket and the loan was never paid.I have neglected that time because I don't have money .Now I am salaried with 5.2 lpa but I have less credit scores , so no credit card are

See More

Kamar Thakur

Real estate and fina... • 4m

Who has -1 CIBIL means they never took a loan but today they need a loan, then all people can contact us but only for employees or business owners from 1lacs to 5lacs.Those who do not need it, please do not waste your time.Everyone has a need, but no

See More

Rohan Saha

Founder - Burn Inves... • 1y

The fundamental difficulty in the financial industry is managing liquid capital for operating expenditures. A standard overdraft facility costs us 7-8% per year. Taking a loan for your operation is not a wise idea since it has a significant impact

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)