Back

Vishu Bheda

AI did the magic • 1y

Indians can use PhonePe UPI payments in Sri Lanka. It has been officially launched in the country. PhonePe collaborates with LankaPay.

Replies (4)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

UPI based payment gateway for developers. I want to enable UPI payments on my website. Which solution can I use? Paytm, Razorpay, Phonepe required documents proving you are a registered business. But I'm a dev, don't have any registered business. Loo

See Moregray man

I'm just a normal gu... • 9m

Fintech unicorn PhonePe has launched an upgraded version of its smart speaker, aimed at boosting digital payments for offline merchants across the country. The latest Made In India device retains all the key features of its predecessor and comes wit

See More

Gyananjaya Behera

Helping an Idea to S... • 1y

UPI Transactions Jump 5% MoM In May To 1,404 Cr Monthly Growth: UPI transactions rose 5% month-on-month in May to 14.04 billion, with transaction volume increasing 4.1% to INR 20.45 lakh crore. Yearly Growth: Year-on-year, transaction count surged

See More

Vinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

Case Study: PhonePe – India's UPI Leader Founded in 2015, PhonePe dominates India's digital payments landscape. Stats: Users: 350M+ registered Market Share: 40%+ of UPI transactions Business Model: Transactions, financial services, advertising. R

See More

Account Deleted

Hey I am on Medial • 12m

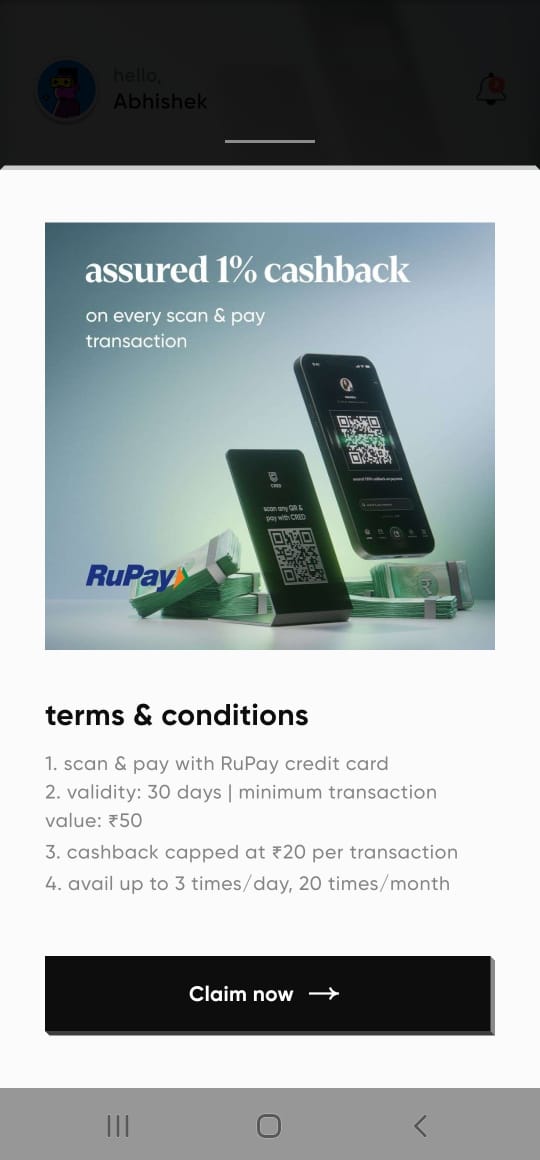

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)