Back

Replies (1)

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

"How to Build ₹5 Crore in 20 Years: Top Mutual Fund Schemes to Consider" How to Build ₹5 Crore in 15-20 Years: Best Mutual Fund Investment Strategy If you aim to accumulate ₹5 crore in 15-20 years, it’s crucial to choose the right mutual fund schem

See MoreRohan Saha

Founder - Burn Inves... • 10m

Flipkart's Super Money app introduced the Super Card a few months back. It's a pretty handy option basically, you can get a credit card by just creating a fixed deposit (FD), no need for a strong credit history. So if you're looking to build your cre

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

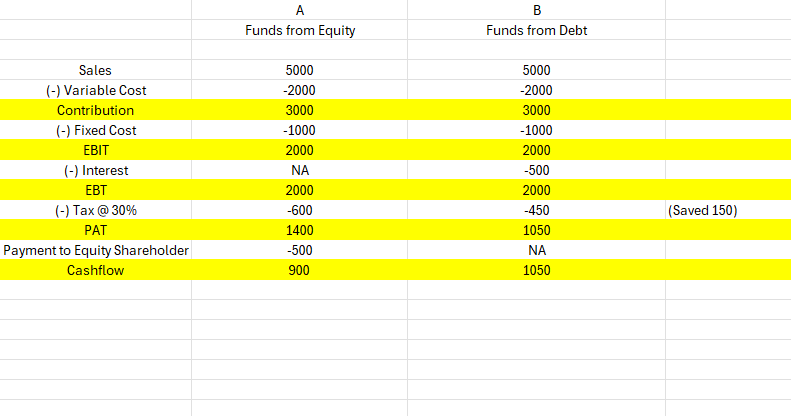

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Jayant Mundhra

•

Dexter Capital Advisors • 11m

It seems, after 10 long years, Mukesh Ambani has a plan for Jio Payments Bank 🙏🙏 Let me explain all that has happened so far, right from the start, and why I say something is brewing! .. You see, Reliance received the license to run a payments b

See More

Ravi Handa

Early Retiree | Fina... • 1y

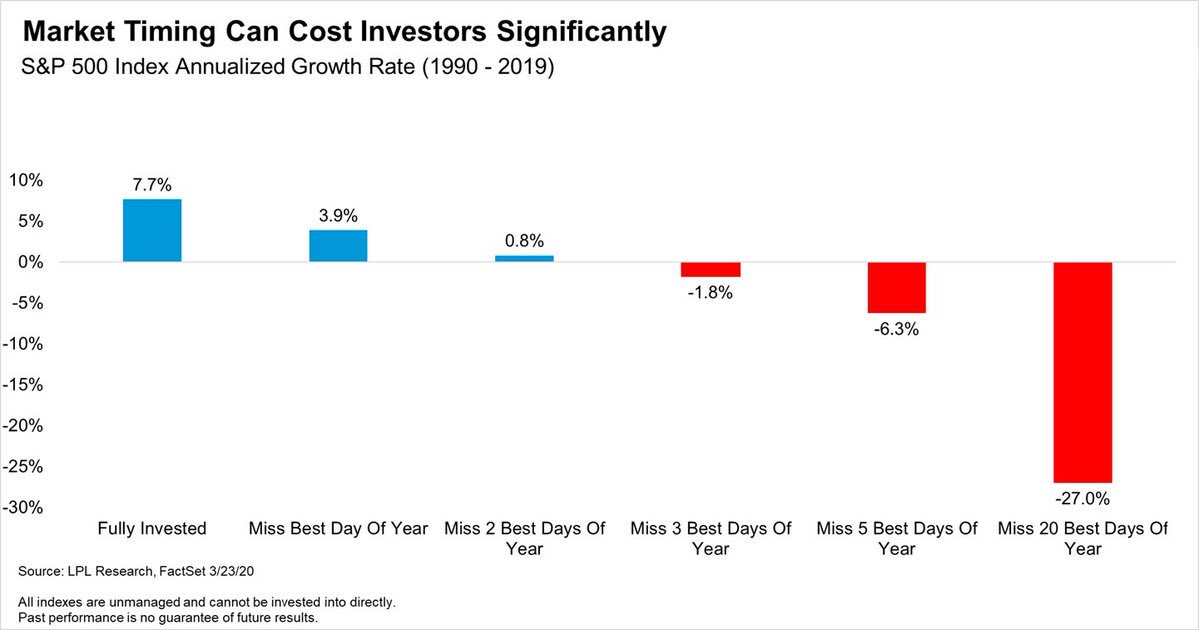

Time in the market is more important than timing the market. We have all heard that. We have all seen charts like the one given below. However, I do have a problem with blanket statements like that. If you are an early retiree like me or someon

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)