Back

Soumya Ranjan Dash

Hit & Trial • 1y

Startup is never a new concept, business have been building from ages. Main issue with VCs: 1. Very less founder who become VC(most important point) 2. Current VC try to templatise existing startup to that of US market. 3. VC don't understand the market, and stick copying what other are doing. Yes, you're right, it will take time for VC to grow, untill more founders start investing.

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 4m

Quick breakdown for VC analysts: Family offices vs. institutional VCs — what each brings, how their mandates, time horizons, decision-making, and involvement shape startup strategy. Learn when patient capital, values-aligned investing, and flexible d

See MoreThe Vc Girl

Not a Vc Yet, just O... • 7m

16 VC Terms I’m Learning to Become Sniper . Not a VC (yet), but I’m obsessed with how they think. TAM – Size of the $$ opportunity CAC – Cost to get a user LTV – Money a user brings over time Runway – Months till cash runs out Burn Rate – Monthly

See Morebrijesh Patel

Founder | Venture Pa... • 3m

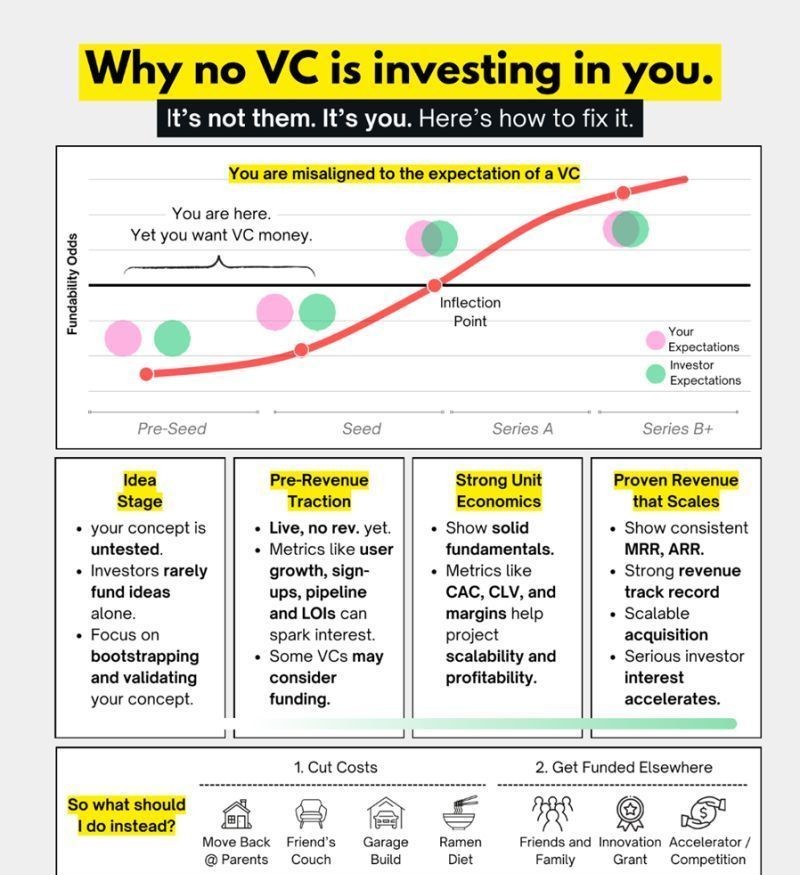

🚫 Why No VC Is Investing in You (Yet) Let’s be honest — it’s rarely the VC. It’s the mismatch between where your startup is and what VCs expect. This visual explains it perfectly 👇 Most founders think they’re “ready for funding.” But their expec

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)