Back

Pranav Sheth

Together We Can Make... • 1y

But this is Betting and there's no Gaurantee of returns while on the other hand Mutual Funds can give you 15 to 30 percent returns in a year

Replies (1)

More like this

Recommendations from Medial

Shubham Jain

Partner @ Finshark A... • 1y

Financial Planning for One Client Age :- 34 Salary In Hand :- 1.8L Expenses :- 85-95K ( Including EMI ) Advised him to invest in 60K in Mutual Funds and 20K in Gold Funds . Going to increase SIP by 10% Every Year Amount after 15 Year in MF :-

See MoreNiran Nagasai

Hey I am on Medial • 1y

I have 1L capital, I'm looking for good mutual fund to invest after some research me and my friend decided to invest lumsum in "Aditya Birla PSU equity" since it's last year returns were great and this fund performing the best among top 5 PSU equity

See MoreRohan Saha

Founder - Burn Inves... • 8m

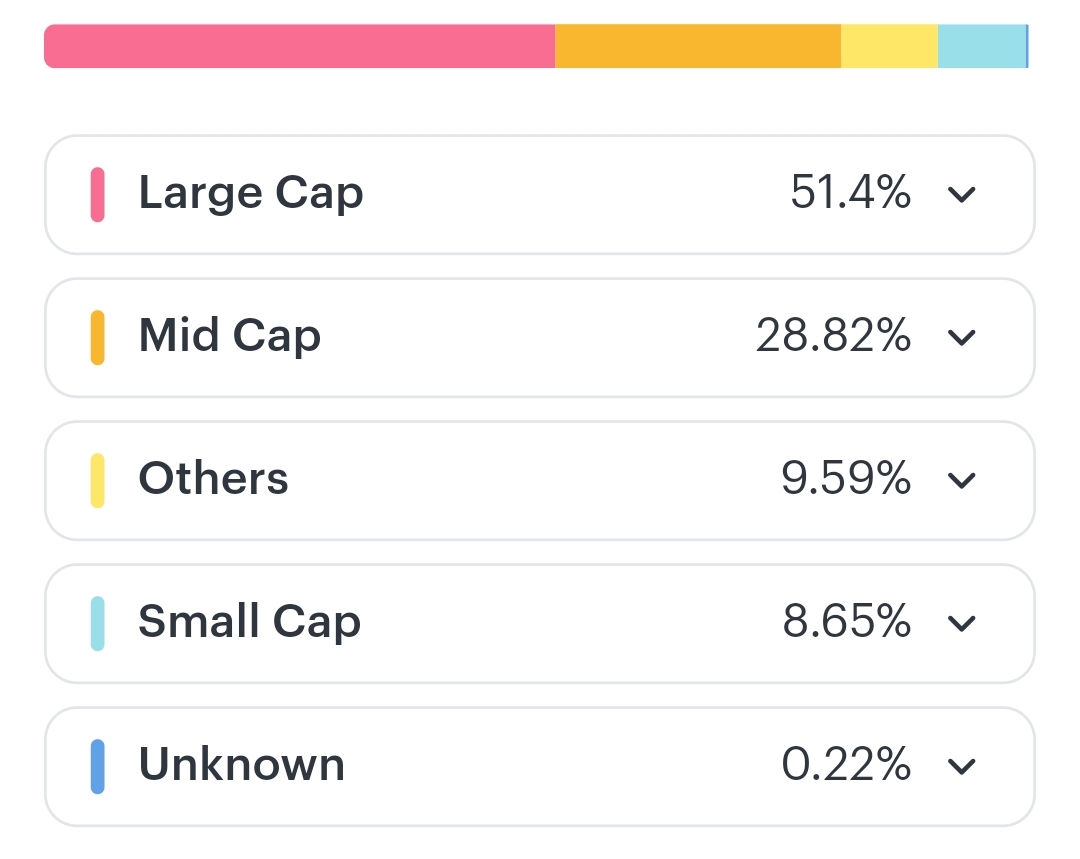

Over 51 percent of my portfolio is in large cap stocks yet I have delivered better returns this year than many mutual funds It makes me wonder what is it that holds fund managers back? Is it the way they manage cash or is there something else going o

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)