Back

Krishna Bhargav

Keep things Simple • 1y

RBI is really strict when it comes to regulation..they take action even for the smallest of mismatch in balance sheet.. it is their strictness which has made our economy strong today and we're able to control inflation, maintain gdp growth and lead to a sound fintech infrastructure.

Replies (1)

More like this

Recommendations from Medial

Manish Soni

Can Immediately Join... • 5m

SBI balance sheet is bigger than GDP of 175 countries... SBI is Mature SBI is Patience SBI got that 6 pack balance sheet flex SBI is thehrav SBI aapke Marne k baad bhi sala chalta hi jayega chalta hi jayega... SBI is Husband Material not your t

See More

Rohan Saha

Founder - Burn Inves... • 1y

why the RBI isn't taking any action against P2P platforms for accepting lenders' money on their own balance sheets. According to RBI guidelines, P2P platforms cannot accept money on their own balance sheet or provide rapid liquidity to any lender, ye

See MoreAtharva Deshmukh

Daily Learnings... • 1y

Have studied about Monetary Policy in short and it's effect. The monetary policy is a tool through which the Reserve Bank of India (RBI) controls the money supply by controlling the interest rates. RBI is India’s central bank. While setting the int

See MoreAtharva Deshmukh

Daily Learnings... • 1y

About Rates in the market... To strike a balance in market, the RBI has to consider all economic factors and carefully set the key rates. Any imbalance in these rates can lead to economic chaos: 1)Repo Rate:-The rate at which RBI lends money to oth

See MoreAkshat kumar Jain

Front end developmen... • 1y

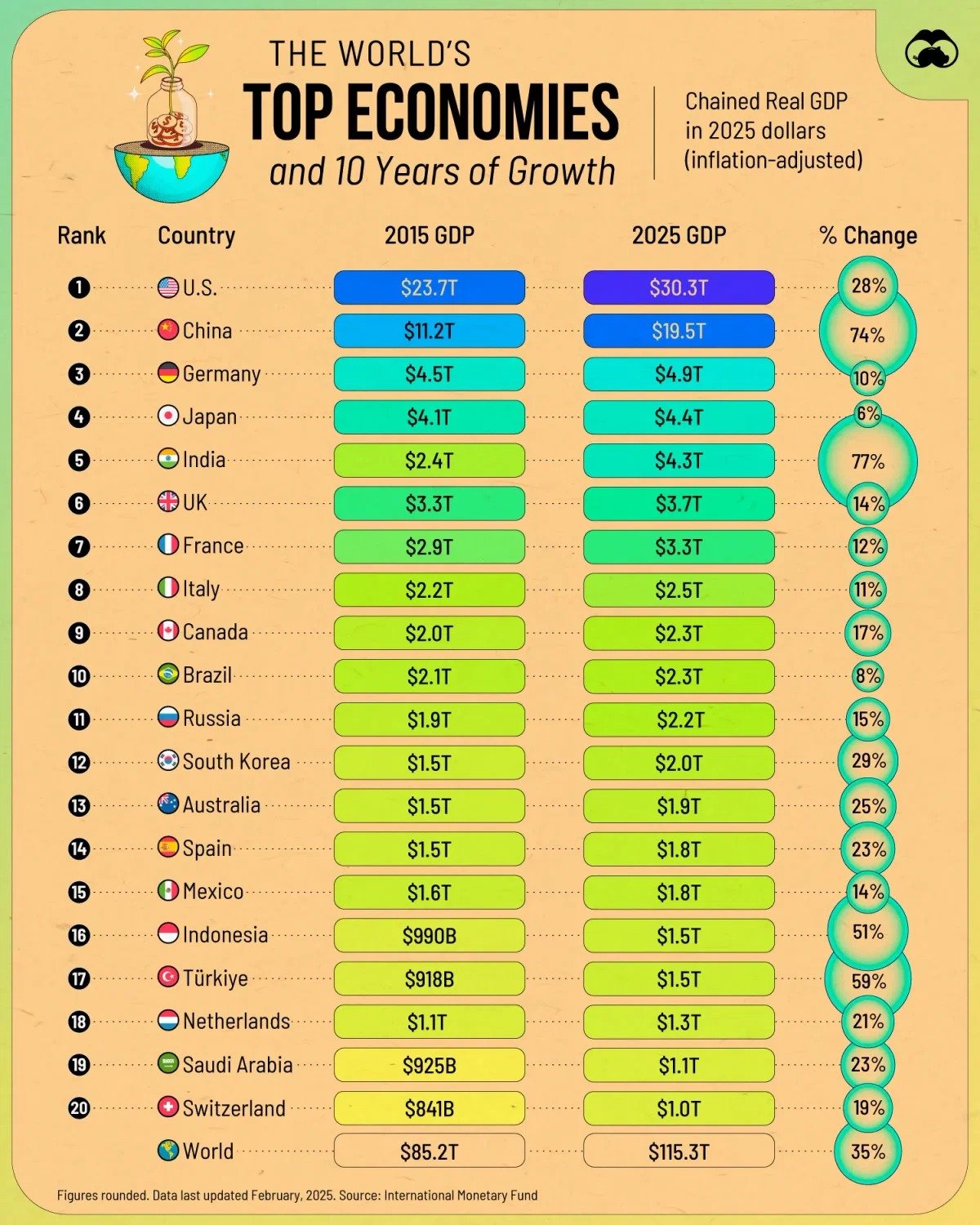

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreTushar Aher Patil

Trying to do better • 5m

RBI unlikely to rush into rate cuts despite US Federal Reserve easing, say experts. The US Federal Reserve recently cut its benchmark interest rate by 25 basis points (bps) to the 4-4.25 percent range. This was the first reduction since December. Thi

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)