Back

Anonymous 3

Hey I am on Medial • 1y

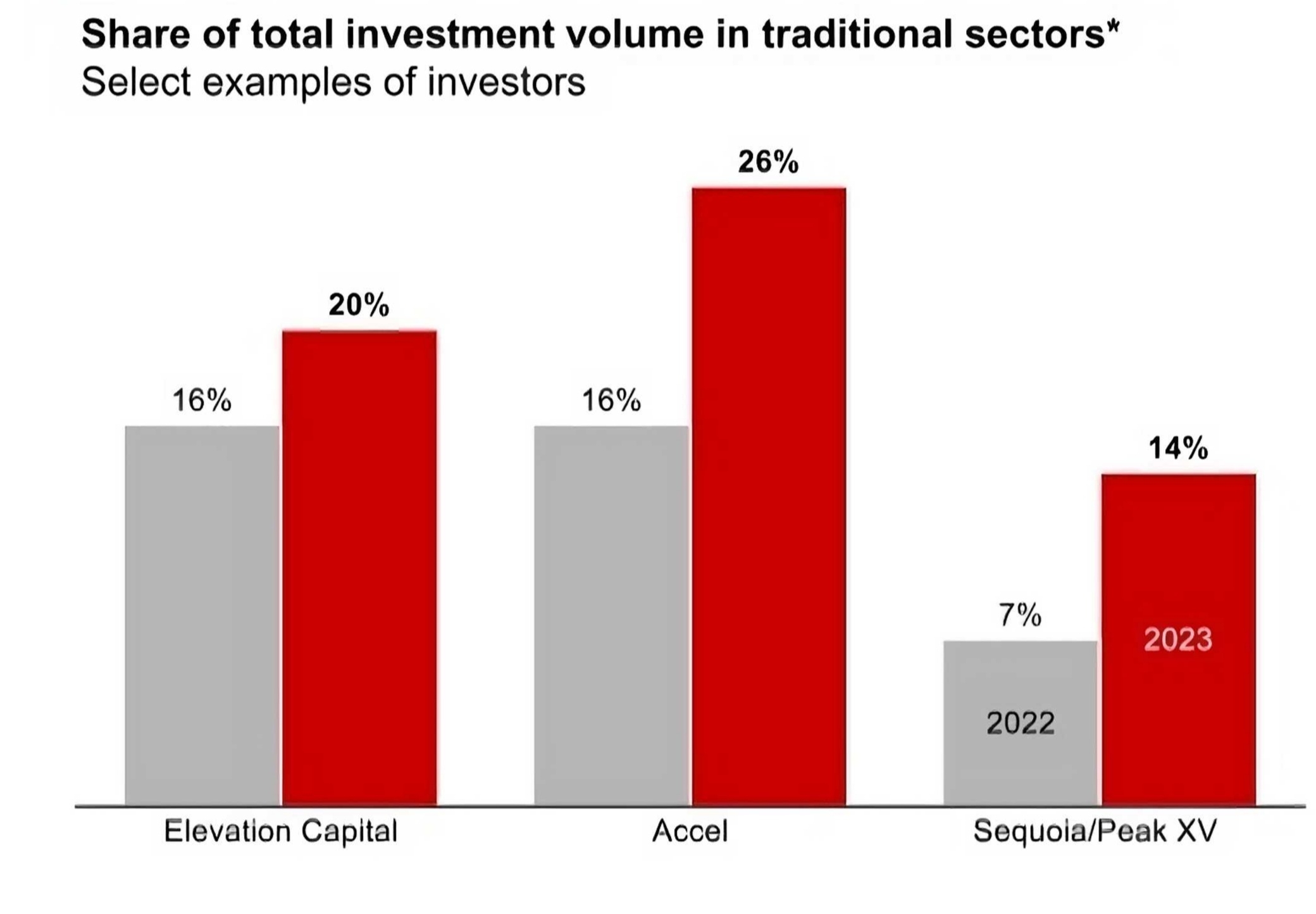

Decline in deal volume has been driven by a significant reduction in mega-rounds and a shift towards smaller ticket rounds. This has led to a democratization of investment, with private equity (PE) and growth equity firms doubling their share in deployment to pull even with leading VC firms. Crossover funds have trimmed funding activity and reduced deal volume by approximately 90%, while family offices have continued to provide crucial early-stage capital. Domestic VCs have become significantly more salient, driving more than 90% of the raises and launching several thematic funds focused on emergent themes. This has led to a shift towards traditional sectors that you have mentioned.

Replies (2)

More like this

Recommendations from Medial

Venture Linkup

Where Businesses Con... • 10m

Between April 7 and 12, Indian startups collectively secured $195.1 million across 20 funding deals, reflecting a 35% increase from the $144.4 million raised by 22 startups the previous week. While fintech emerged as the top-funded sector, it was ec

See MoreGautam Das

If I play, i play to... • 1y

L&T Faces ₹70,000 Cr Setback Amid CEO’s 90-Hour Workweek Controversy! Larsen & Toubro (L&T) has suffered a major blow as the Defence Ministry rejected its bid to build six submarines, citing non-compliance. This decision cost the company a massive ₹

See MoreAccount Deleted

Hey I am on Medial • 1y

• Today's Topic Is : Stages Of Funding Rounds • Before discussing the funding rounds, let's understand why funding is necessary : • Funding is necessary to start any company or to build MVP or Testing the Products. •Types of Funding Rounds: 1.

See MoreDownload the medial app to read full posts, comements and news.