Back

Anonymous 1

Hey I am on Medial • 1y

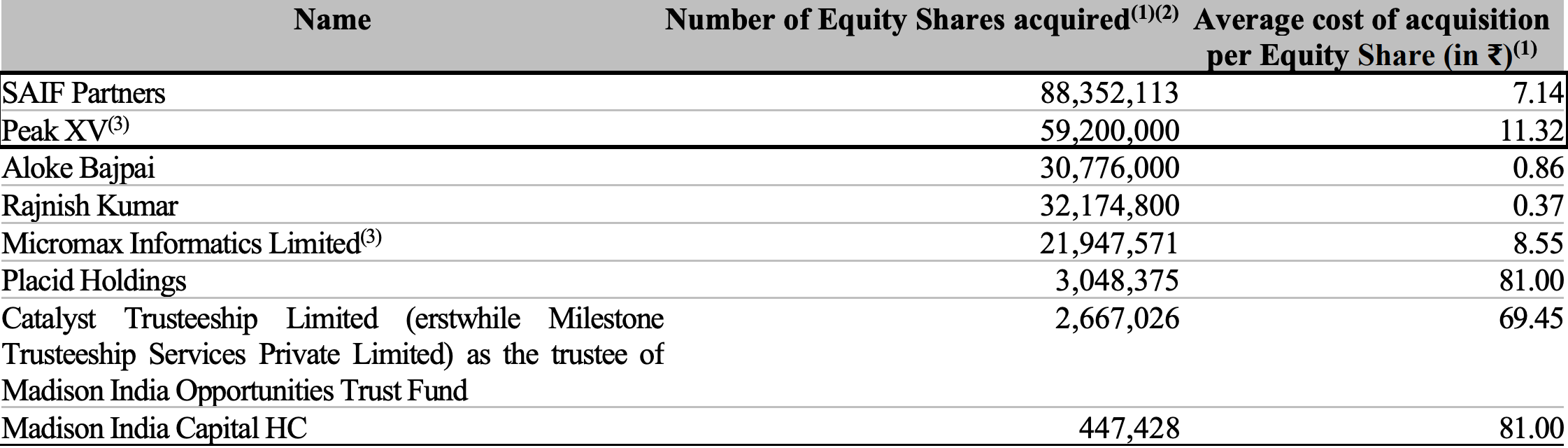

Thanks brother. But what kind of stage do they invest in? Btw sequoia capital has renamed itself to peak XV

Replies (1)

More like this

Recommendations from Medial

Linkrcap Studio

A digital news platf... • 19d

The funding round was led by Peak XV Partners, along with participation from InfoEdge Ventures, Chiratae Ventures, Alteria Capital, Stride Ventured. While Peak XV infused $8 Mn (about INR INR 67 Cr), InfoEdge and Chiratae Ventures invested $2.5 Mn (

See More

Account Deleted

Hey I am on Medial • 1y

Today's topic is : Sequoia Capital Venture Capital Firm🚀📈🤑 I. Introduction : • Sequoia Capital was founded by Donald Valentine in 1972 and current partner is My favourite Roelof Botha ♥️. • Sequoia Capital created new fund called 'Peak XV Pa

See More

Account Deleted

Hey I am on Medial • 2y

Top 10 Venture Capital Firms : 1.SoftBank Vision Fund 2: $151B 2.Sequoia Capital Global Growth Fund: $138.5B 3.Tiger Global Management :$126B 4.Blackstone Growth (BX): $110B 5.Insight Partners: $92B 6.TCV: $87B 7.General Atlantic: $83B 8.Thoma Bravo

See More

The next billionaire

Unfiltered and real ... • 1y

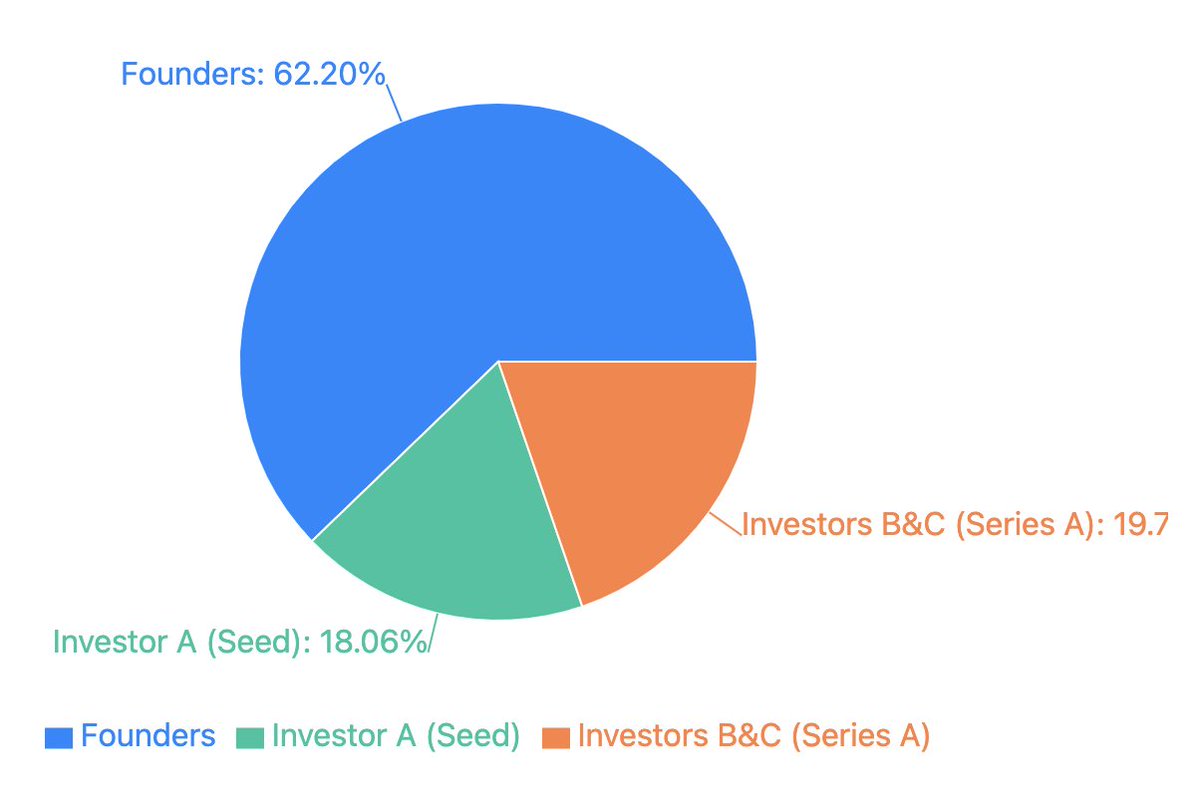

quick math on minimalist outcome: - raised $2M seed from peak (assuming 20 - 25% dilution) - raised $15M series a from peak + unilever ventures at a $76M val. - in talks to be acquired by HUL for $350M - founders to make $217M - seed investors get $6

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)