Back

Chirag

•

&OTHERS • 9m

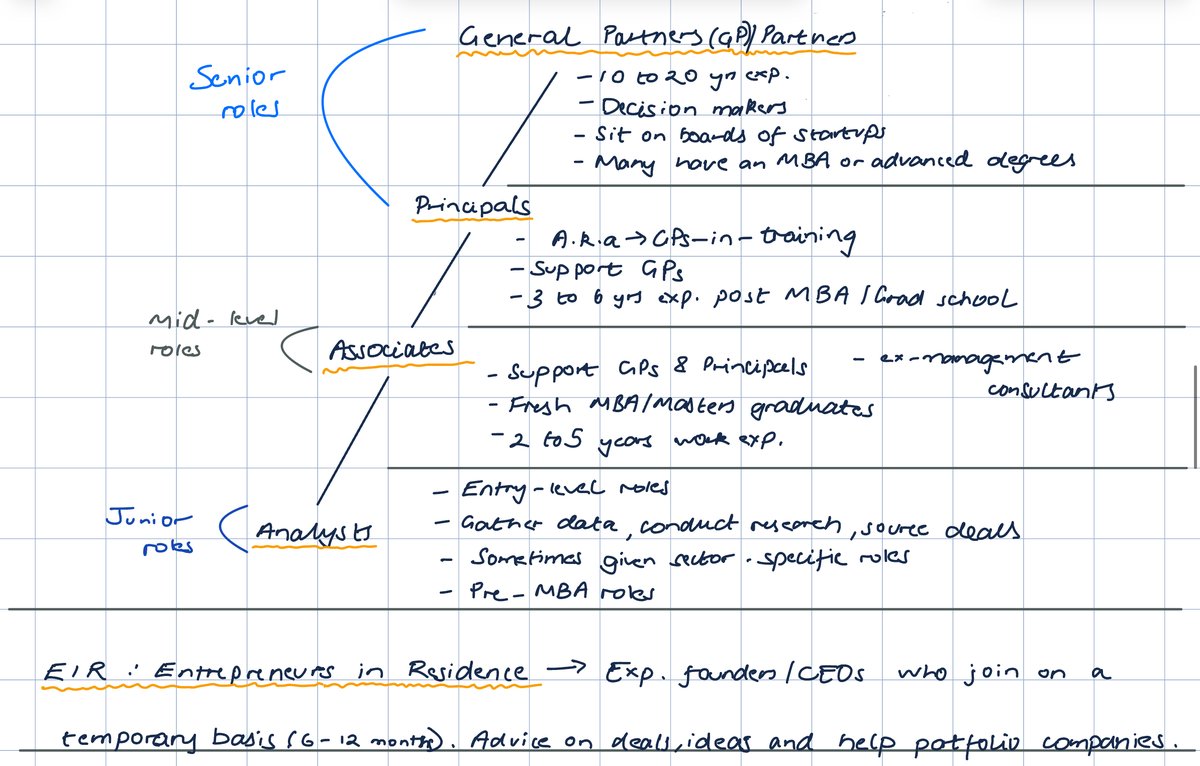

“Another one leaves Peak XV.” But this time… it’s not just another. Two key team members — Suraj Agarwalla (VP, Growth) and Vedant Trivedi (Surge) — have now exited the firm. This marks the fifth high-profile exit in less than a year — following Shailesh Lakhani, Abheek Anand, Piyush Gupta, and Anandamoy Roychowdhary. What’s really going on inside India’s most powerful VC firm? Is this just natural reshuffling after the Sequoia → Peak XV split? Or are young investors rethinking their career paths altogether? Across the board, mid-level VCs are either turning founders, launching solo funds, or joining startups to drive impact from the ground up. And in a market where fundraising is slow and scrutiny is high — even Peak XV had to cut its growth fund by $465M last year — maybe it’s not just founders who are pivoting. Is the VC dream losing its shine? Or are we witnessing the next evolution of Indian venture capital? Is this the new normal? Or a sign of deeper shifts to come?

More like this

Recommendations from Medial

Linkrcap Studio

A digital news platf... • 19d

The funding round was led by Peak XV Partners, along with participation from InfoEdge Ventures, Chiratae Ventures, Alteria Capital, Stride Ventured. While Peak XV infused $8 Mn (about INR INR 67 Cr), InfoEdge and Chiratae Ventures invested $2.5 Mn (

See More

Linkrcap Studio

A digital news platf... • 3d

Indian startup funding stood at $200.2 Mn across 31 deals, up 42% from the preceding week. Between February 16 and 20, 16 startups collectively raised $118.3 Mn a sharp 69% drop from the $200.2 Mn secured across 31 deals in the preceding week. Peak

See More

The next billionaire

Unfiltered and real ... • 1y

Worst VCs in India Who are some of the worst VCs in India? Here's my list: Vaibhav Domkundwar: has NEVER responded to any email I sent to him Prime Ventures: Same as above and also think they are God's gift to entrepreneurship (despite a meh portfo

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)