Back

Vinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

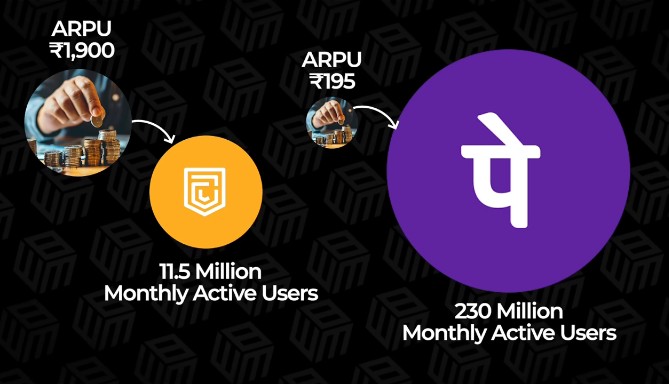

Net loss of INR 2,795.3 crore for the financial year 2022-23 (FY23), PhonePe Is service provider, they can’t monetise on digital transactions, instead they make money From ads, insurance,Loan, Etc and they are working on many more things to Monetise! Moreover due to its success govt is also thinking to provide some subsidies and loan reliefs in order to continue the Digital payments !

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 12m

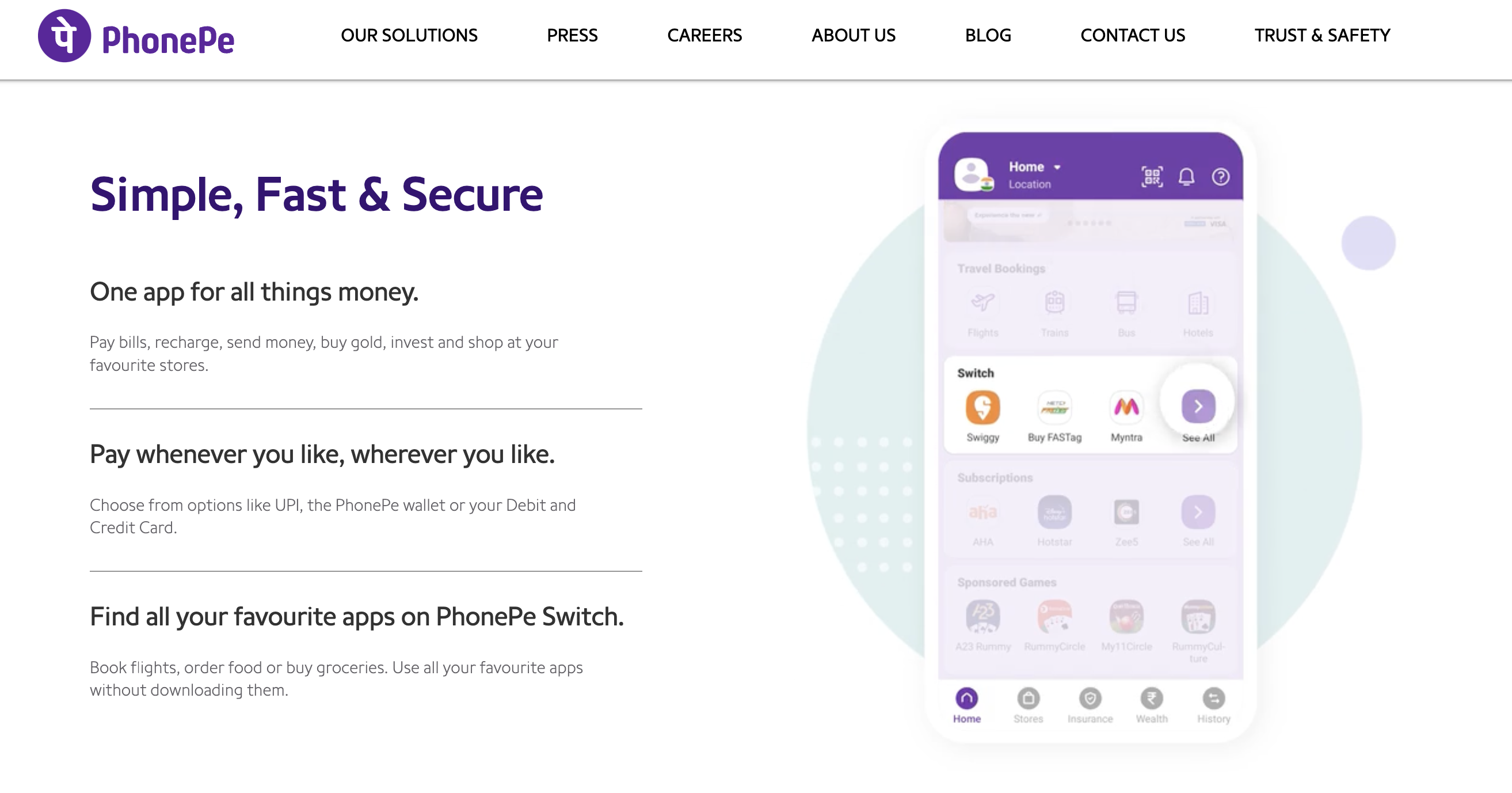

Walmart owned UPI payment giant PhonePe to enter Indian share market soon! Currently very basic proccess of IPO (Initial public offering) works are going on from PhonePe side. When PhonePe gets complete approval from SEBI, They share their complete

See More

Gyananjaya Behera

Helping an Idea to S... • 1y

Volt Money Partners PhonePe To Offer Loans Against MFs - Partnership Announcement: Volt Money has partnered with PhonePe to offer loans against mutual funds through the PhonePe app, with loan sizes ranging from INR 25,000 to INR 5 Cr. - Integration

See More

Kamar Thakur

Real estate and fina... • 4m

Who has -1 CIBIL means they never took a loan but today they need a loan, then all people can contact us but only for employees or business owners from 1lacs to 5lacs.Those who do not need it, please do not waste your time.Everyone has a need, but no

See More

Account Deleted

Hey I am on Medial • 9m

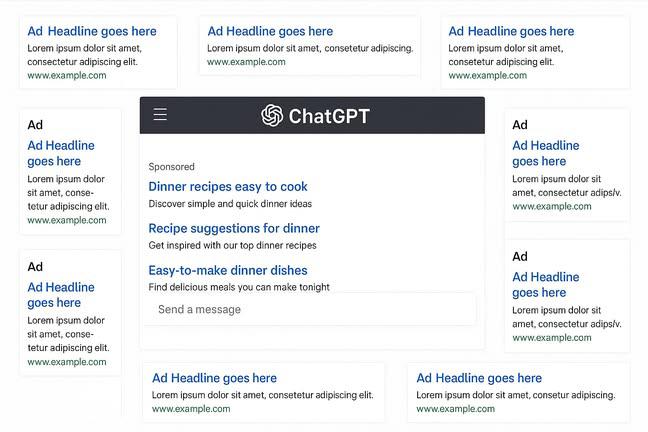

I saw someone on LinkedIn say "I always go to ChatGPT for questions now, it's not as cluttered as Google search results". One thing people forget is that - ChatGPT eventually will likely have TONNES of ads all over the results soon. It's still in t

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)