Back

Replies (1)

More like this

Recommendations from Medial

SARASHI ASSOCIATION

Hey I am on Medial • 1y

Sarashi Association Need help for startup and grow.....My aim is to provide loans to common poor business people at very low interest rates, and much lower than normal banks and finance company like half interest loans, small medical expenses loans

See MoreVikas Acharya

Building Reviv | Ent... • 11m

Yenmo Raises ₹9.2 Crore to Expand Instant Loan Services Yenmo, a Bengaluru-based startup, has raised ₹9.2 crore in funding, led by Y Combinator with support from Pioneer Fund, Zaka VC, and other investors. What Does Yenmo Do? Yenmo offers instant lo

See More

Kimiko

Startups | AI | info... • 9m

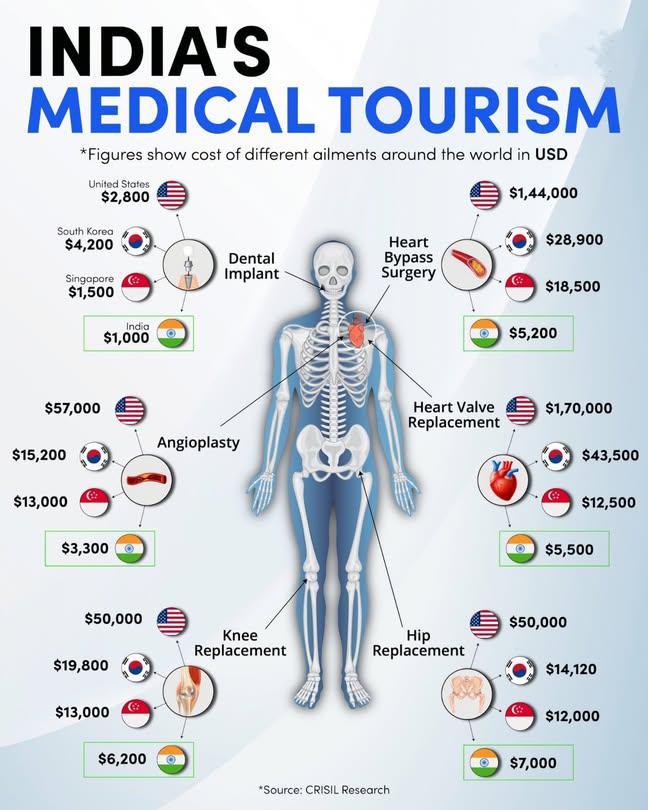

India offers significantly lower medical treatment costs compared to the US, UK, and even some other medical tourism destinations like Thailand and Singapore, often by a large margin. This is due to factors like lower operational costs, economies of

See More

Bharat Yadav

Betterment, Harmony ... • 1y

Key Financial Considerations for Medical Professionals 1 . Debt Management: Strategize student loan repayment, credit cards, and personal loans. 2. Retirement Planning: Maximize tax-advantaged accounts (401(k), IRA). 3. Investments: Diversify portfol

See MoreGyananjaya Behera

Helping an Idea to S... • 1y

Volt Money Partners PhonePe To Offer Loans Against MFs - Partnership Announcement: Volt Money has partnered with PhonePe to offer loans against mutual funds through the PhonePe app, with loan sizes ranging from INR 25,000 to INR 5 Cr. - Integration

See More

Rajeev Ranjan Jha

Empowering Businesse... • 1y

Immediate Hiring: MBBS Doctor Location: Sitapur, Uttar Pradesh Salary: ₹50,000 to ₹1,00,000 per month Benefits: Accommodation provided Job Description: We are seeking a qualified and dedicated MBBS Doctor to join our medical team in Sitapur. The id

See More

Vikram Kumar

Founder at Stockware • 1y

Navi Finserv Ordered to Cease Loan Disbursement by RBI 🚨 In a recent development, Navi Finserv, the NBFC arm of Sachin Bansal’s Navi Technologies, has been ordered by the Reserve Bank of India to cease and desist from sanctioning and disbursing loa

See MoreAssv Finance

Hey I am on Medial • 6m

Crores of hardworking Indians in villages and small towns are denied credit when they need it most — for emergencies, essentials, or opportunities. Banks are slow. Moneylenders are cruel. ASSV Finance is solving this problem with compassion and techn

See MoreAbdul Razzaq

Eager to Learn and U... • 1y

I've conducted research on pursuing a master's degree in AI abroad, but I'm confused about what to do next. This is the information I have gathered. Can you help me make a decision and share your opinion? Pursuing a Master's in AI Abroad Ireland: A

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)