Back

Abhinav Amarapuram

Life's an adventure,... • 1y

Using investor or VC money to gain market share can be sustainable for long-term growth if the investments are strategically utilized to build a strong foundation for sustainable revenue and customer retention.

Replies (1)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 6m

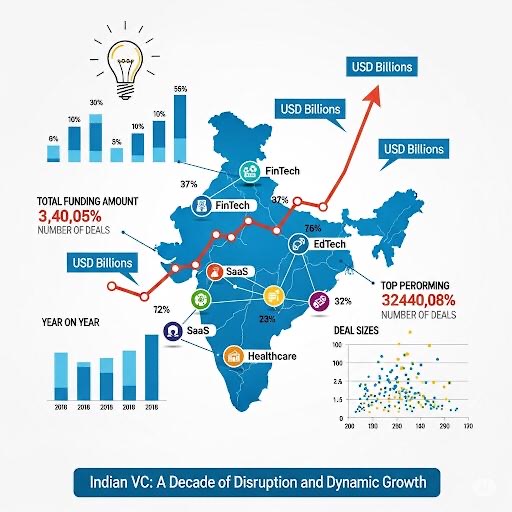

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

Siddharth K Nair

Thatmoonemojiguy 🌝 • 10m

Understanding Product-Market Fit Product-market fit (PMF) happens when your product meets a strong market demand. It’s when customers not only buy but also love and recommend your product. Without PMF, even great marketing won’t lead to sustainable

See More

Vatan Pandey

Founder & CEO @Zyber... • 10m

🚀 Business Growth or Just Valuation? Many startups chase high valuations but forget the core of business—profitability, sustainability, and real customer value. 🔴 Reality Check: ❌ Valuation without solid revenue ❌ Scaling too fast, weak foundatio

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Beyond the Buzzwords: India’s Revenue-Making Startups & the VC Lens India’s startup scene isn’t just about hype—it’s about real, revenue-generating ventures ready to scale. Founders who’ve proven product-market fit and built solid revenue engines no

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Beyond the Buzzwords: India’s Revenue-Making Startups & the VC Lens India’s startup scene isn’t just about hype—it’s about real, revenue-generating ventures ready to scale. Founders who’ve proven product-market fit and built solid revenue engines no

See More

Download the medial app to read full posts, comements and news.