Back

Chosen one

Investor • 1y

Is it possible to launch a brokerage firm and outperform zerodha and groww with sufficient funding? If yes, why will traders shift platform from zerodha to us?

Replies (1)

More like this

Recommendations from Medial

Abhishek jyotiba

Here to change somet... • 1y

'Will take you to court if I lose any single penny': Angry trader slams Kamath's Zerodha after glitch India's second-largest brokerage firm, Zerodha, once again faced a technical glitch. On Monday, multiple users took to X to report technical issues

See More

Deepasnhu Chail

Mastering the Game o... • 1y

#11 Zerodha Nithin Kamath launched Zerodha, a discount brokerage firm, in 2010 with just ₹3 lakhs. He and his team worked relentlessly, at times even taking calls at 3 AM to provide customer support. They also created educational content like trad

See More

Account Deleted

Hey I am on Medial • 1y

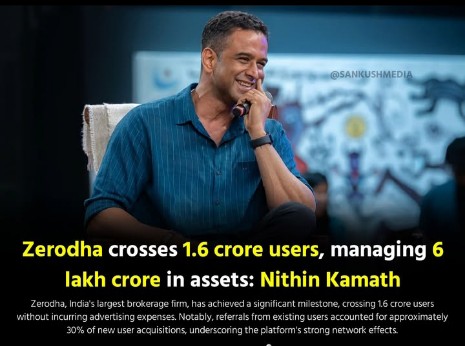

Zerodha, India's largest brokerage firm, has achieved a significant milestone, crossing 1.6 crore users without incurring advertising expenses. Notably, referrals from existing users accounted for approximately 30% of new user acquisitions, undersc

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)