Back

Anonymous 1

Hey I am on Medial • 1y

VCs aren’t supposed to be “accountable” Thought i don’t know why tf. Founder hi gaali khate hain. Sadly.

More like this

Recommendations from Medial

Dr Saurav singh

Doctor by profession... • 1y

1kg paneer laya 480Rs ka Dost gaali de rahe hai utne me to 2.5kg chicken 🍗 aa jata 2-3 din tak aaram se bana ke khate maja bhi aata Aur sach me chicken itna sasta ho gaya hai kya yrr Veg se achha to chicken hi khaye fir protein hi protein To fu

See MoreRahul Tomer

Founder & CEO TomerT... • 6m

It’s horrible to see how little civic sense we practice, whether in India or abroad. Littering, spitting, breaking traffic rules, ignoring queues, being loud, these aren’t small issues, they reflect how we treat our society. Progress isn’t just new r

See MoreRushikesh vetal

Building another goo... • 11m

💥 Kunal Shah – The Rebel Who Built CRED 💥 Dropped out of MBA. Never coded. Never followed rules. Yet built FreeCharge (sold to Snapdeal for $400M) and then CRED (valued at $6B+). While everyone thought loyalty programs were dead, he created CRED—

See MoreSomeone you will know

Founder, Builder, Ob... • 7m

🚀 Post 1: “Startups don’t die from lack of funding — they die from lack of alignment.” Most first-time founders think fundraising is all about creating a sleek pitch deck and blasting it out to 50+ VCs. But here’s the truth: 🧠💣 That deck? It’s ju

See MoreShubham Shrivastava

Let's make the chang... • 4m

Honestly, I find this a bit annoying. Whenever I post something like, “I’m working on project X”, suddenly 10–12 agencies message me saying things like, “Hi Shubham, I can help you with this. What’s your budget?” Bro, it’s my project I don’t need tha

See MoreAccount Deleted

Hey I am on Medial • 9m

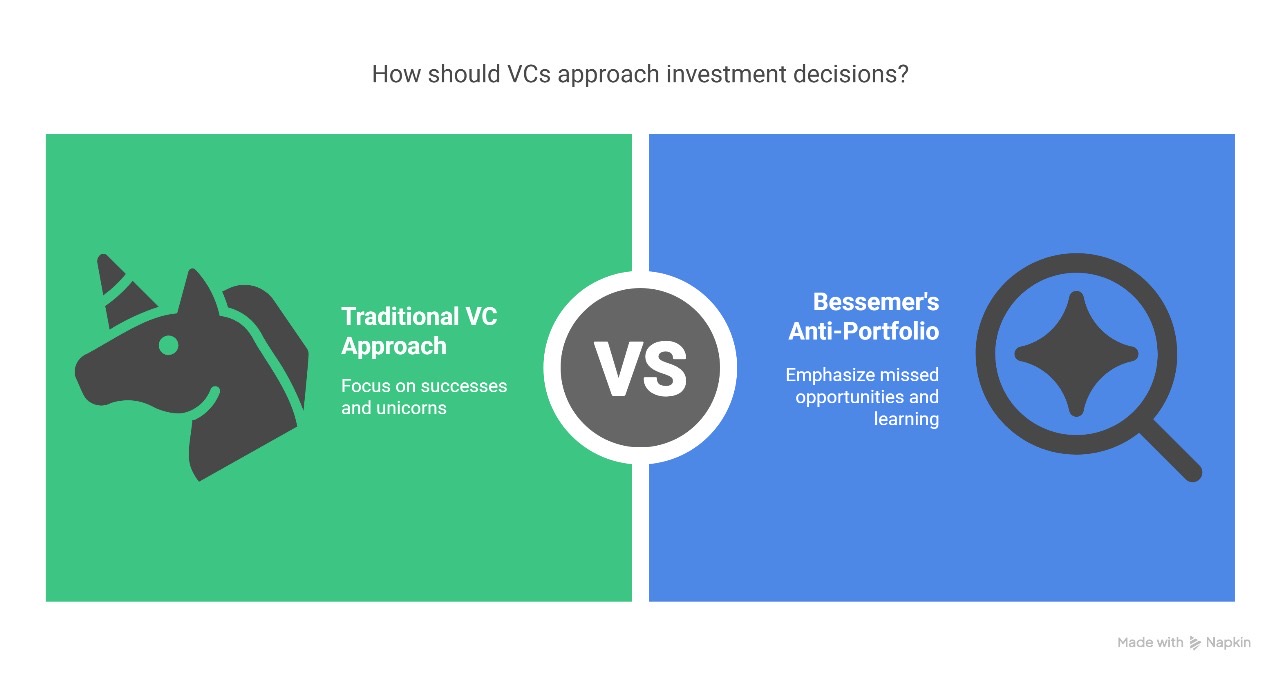

Of course you would have looked back and thought, “Damn.. I should’ve bet on that”? That’s what Bessemer Venture Partners turned into a whole tradition- they call it the Anti-Portfolio. While most VCs flex about the unicorns they backed, Bessemer o

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)