Back

Anonymous 2

•

upGrad • 1y

Companies realised that most effective way to get investors exit is through IPO only. If plan of investors is to exit by private transfer, they will prefer outside location. If their plan is to exit by IPO then India is greatest country considering amount of audience that is crazy to apply in IPO. In this case you don't have to convince some big investor to give you a cheque. You can get penny from so many small investors.

Replies (2)

More like this

Recommendations from Medial

Sanjay Kadali

•

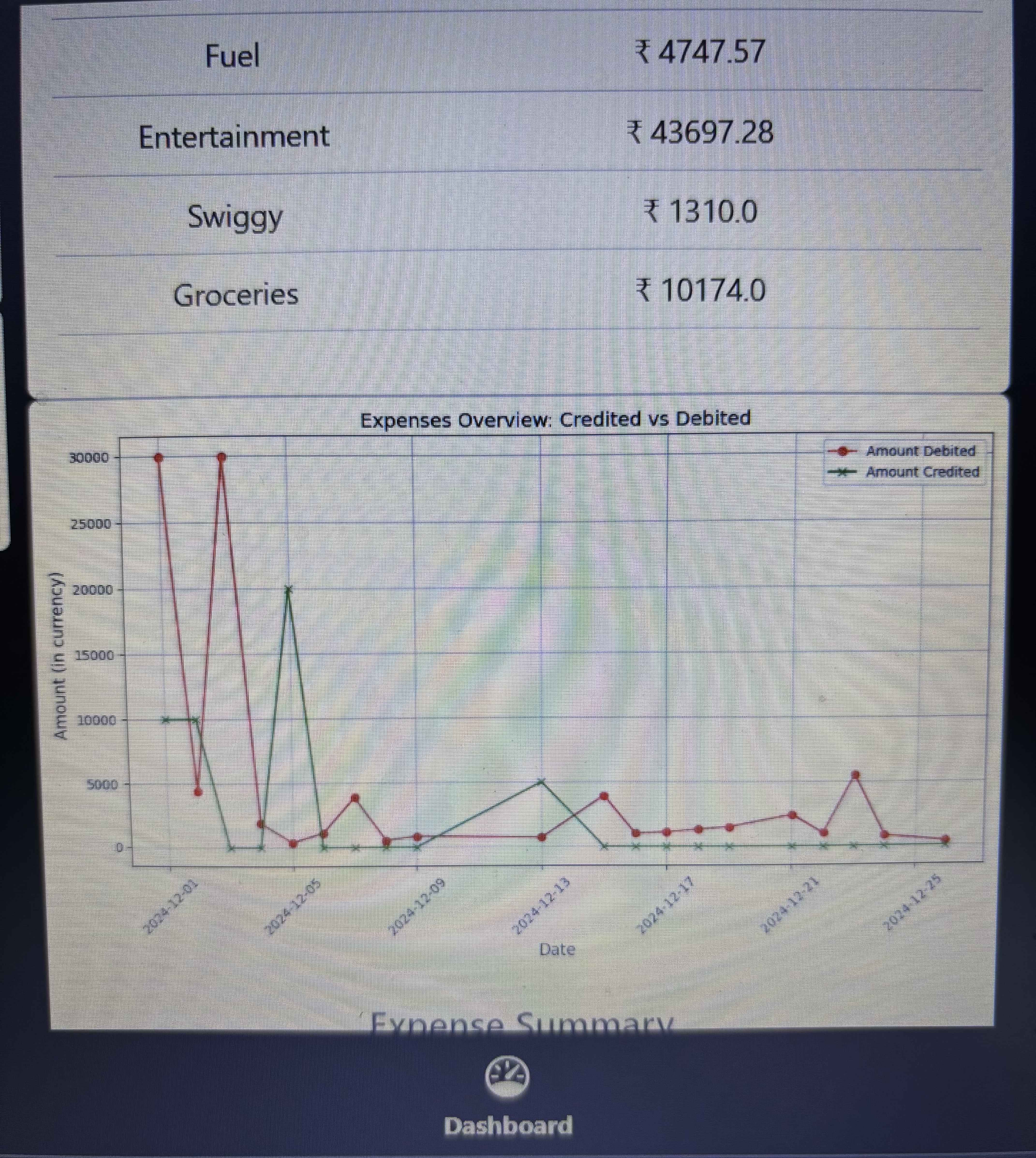

Health Catalyst • 1y

Phewh! I so realised, Im spending too much on my entertainment.... Finally, I can rely on my app to help me understand my spend patterns! Try Penny Wise - https://penny-wise.app If you want to be a smart and controlled spender! Like, share and upV

See More

Amit Kumar

Make it work, make i... • 1y

How does startup founders convince Investors to invest in their company. I mean if ill ask my dad to invest 10k he won't invest a penny😂. Man how do they crack the code of getting funded. If anyone know any tips i would like to know maybe in future

See MoreAtharva Deshmukh

Daily Learnings... • 1y

The IPO market is also called as the Primary Market,and it's extremely important to understand circumstances leading to IPO,as it attracts many new first time stock investors. Why do companies go PUBLIC? The main reason for a company to go public i

See MoreDownload the medial app to read full posts, comements and news.