Back

Havish Gupta

Figuring Out • 2y

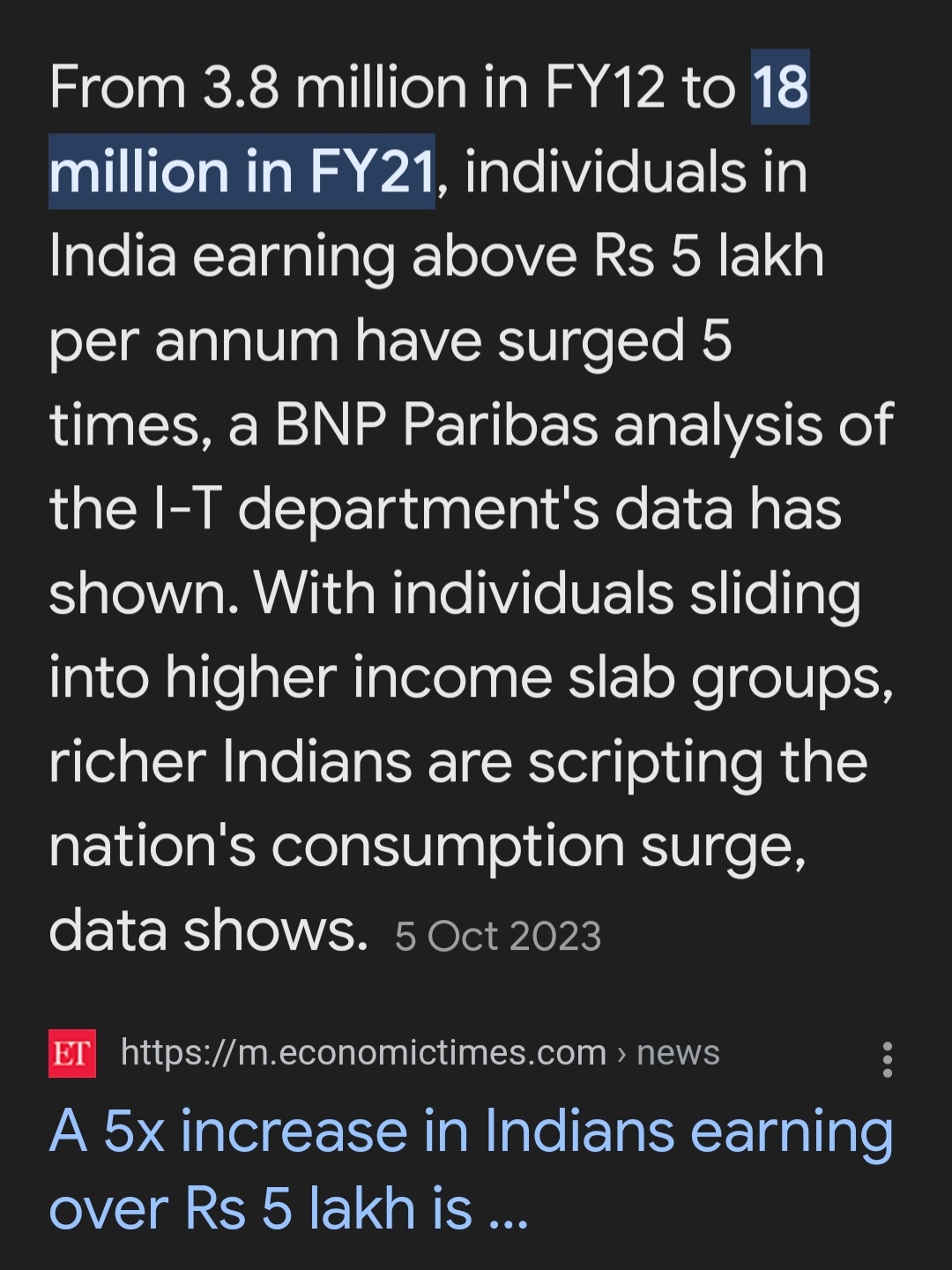

By the way, current no tax limit has increased to 7 lakhs.

1 Reply

2

Replies (1)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

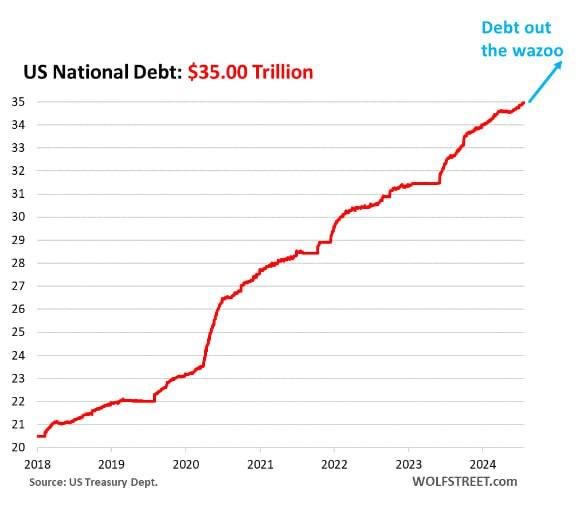

We Have a Breakthrough - The U.S. National Debt Has Surpassed $35 Trillion. 📉 Since January 2020, the U.S. economy has grown by 31%, while the debt has increased by 50%. The borrowing rate exceeds the real economic growth, and the U.S. is clearly l

See More

2 Replies

1

6

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)