Back

Anonymous 5

Hey I am on Medial • 2y

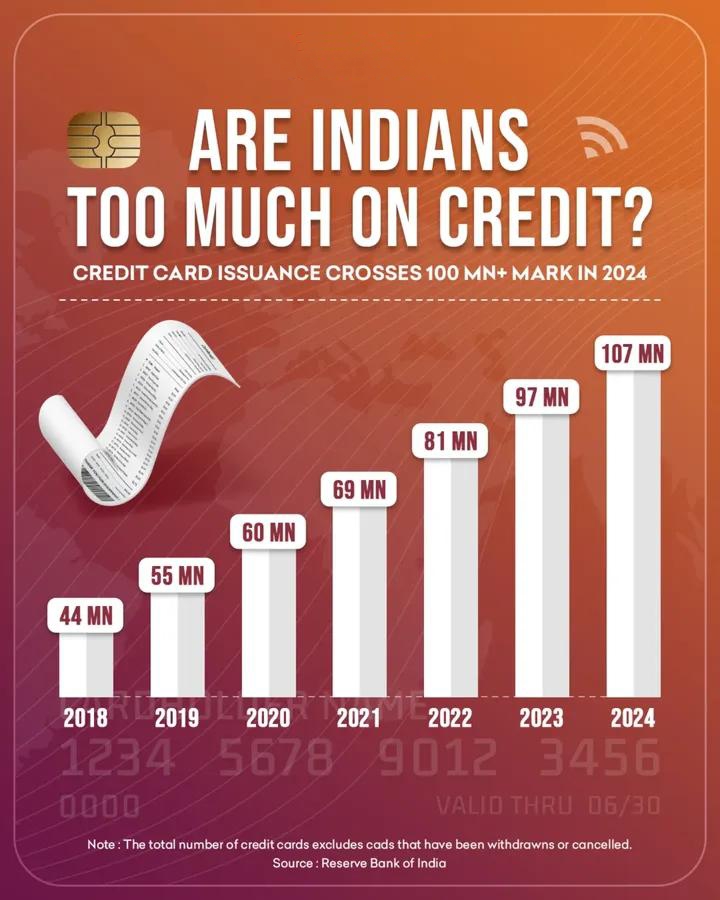

Credit card and BNPL apps were the greatest mistakes of my life. You only realise how bad they are once you are deep in debt.

More like this

Recommendations from Medial

AjayEdupuganti

I like software and ... • 1y

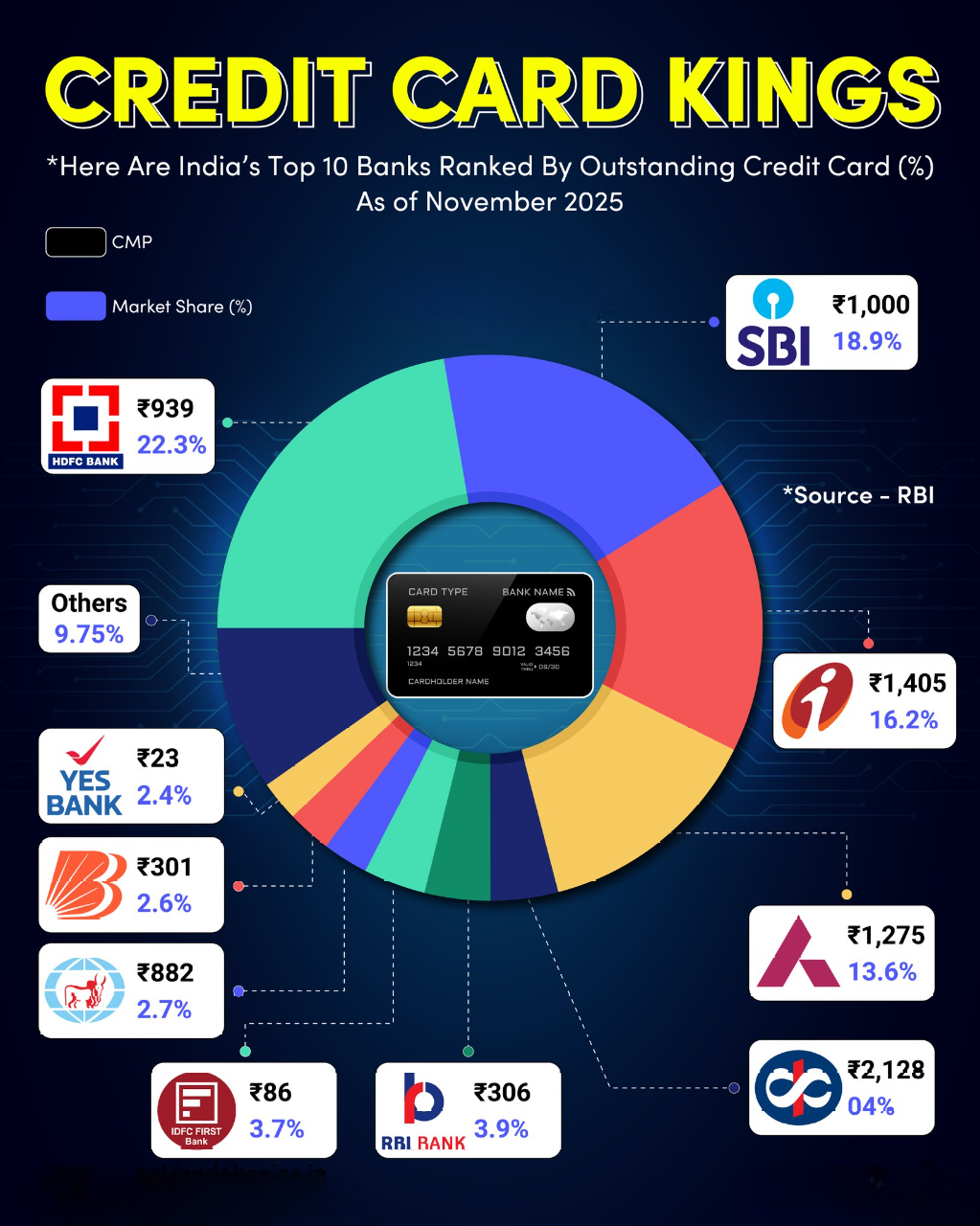

Do you use a RuPay credit card with UPI? How often does your credit card bill exceed your expectations? Are you spending more because of your credit card? I just want to understand whether this could become another potential debt trap for Indians

See MoreAccount Deleted

Hey I am on Medial • 1y

Today's Topic : Buy Now Pay Later Services Do You think BNPL Service will big ? E.g : Simpl,Lazypay etc. •Buy Now, Pay Later (BNPL) services are popular for splitting purchases into smaller, interest-free installments. •BNPL services are targeting

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)