Back

Anonymous

Hey I am on Medial • 2y

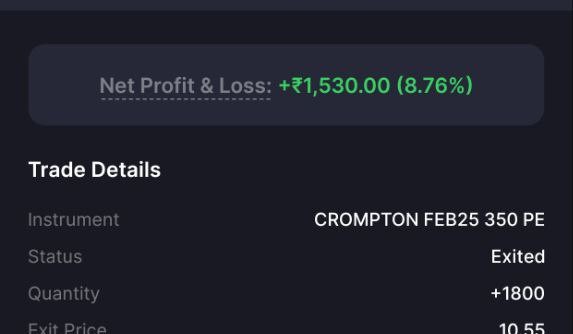

Yep, Algorithms used for automatic price adjustments in stock markets employ various strategies, including market-making algorithms, liquidity provision algorithms, and arbitrage algorithms. These algorithms analyze market data and execute trades based on predefined rules and objectives. The trade book, in this context, refers to a record of all trades executed by a brokerage firm, providing details such as trade price, volume, and time of execution.

More like this

Recommendations from Medial

Brayden Lucas

Hey I am on Medial • 3m

Top Benefits of Crypto Arbitrage Bot Development in Crypto Arbitrage Trading Crypto Arbitrage Trading Bot development enables traders to maximize profits through automated strategies. A Crypto Arbitrage Bot continuously monitors price differences ac

See More

Harrison Richard

Hey I am on Medial • 3m

Maximize Profits Bitdeal’s Cross-Chain and Multi-Exchange Arbitrage Bot Development! Automate your trades, capture real-time price gaps, and boost profits effortlessly across multiple blockchains. With Bitdeal’s expert solutions, you get secure, AI-

See More

Preet Preet

Trading Motivation E... • 10m

What is Algorithmic Trading? Algorithmic trading refers to the use of computer algorithms to automate the process of trading. By leveraging pre-set criteria and strategies, algorithmic trading can execute trades at high speeds and with greater preci

See More

Jaswanth Jegan

Founder-Hexpertify.c... • 1y

“How Zerodha disrupted stock broking industry ” Disruption Diaries #1 Zerodha was founded by two brothers Nithin and Nikhil Kamath in 2010.Nikhil began his career as a trader at a young age,he faced high brokerage fees,complex processes,outdated tr

See More

Preet Preet

Trading Motivation E... • 11m

Algorithmic trading, often referred to as algo trading, involves the use of computer programs to execute trades automatically based on pre-defined criteria such as time, price, and volume. This approach leverages the speed and computational power of

See More

Harsh Singh

"Harnessing Data Sci... • 11m

StockWise: Unlocking Seasonal Stock Trends with Data Science StockWise is a data-driven stock market research startup focused on identifying seasonal stocks—stocks that consistently exhibit 20-30% price movements in specific months over a decade or

See Morefinancialnews

Founder And CEO Of F... • 1y

This Penny Stock "Standard Capital Markets' Share Surges Post Fundraising Completion; Penny Stock Still Under ₹2" "Standard Capital Markets Ltd Gains 4-5% in Early Trade on Thursday After Completing Fundraising; Stock Remains Under ₹2" Penny Stock

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)