Back

Anonymous 1

Hey I am on Medial • 2y

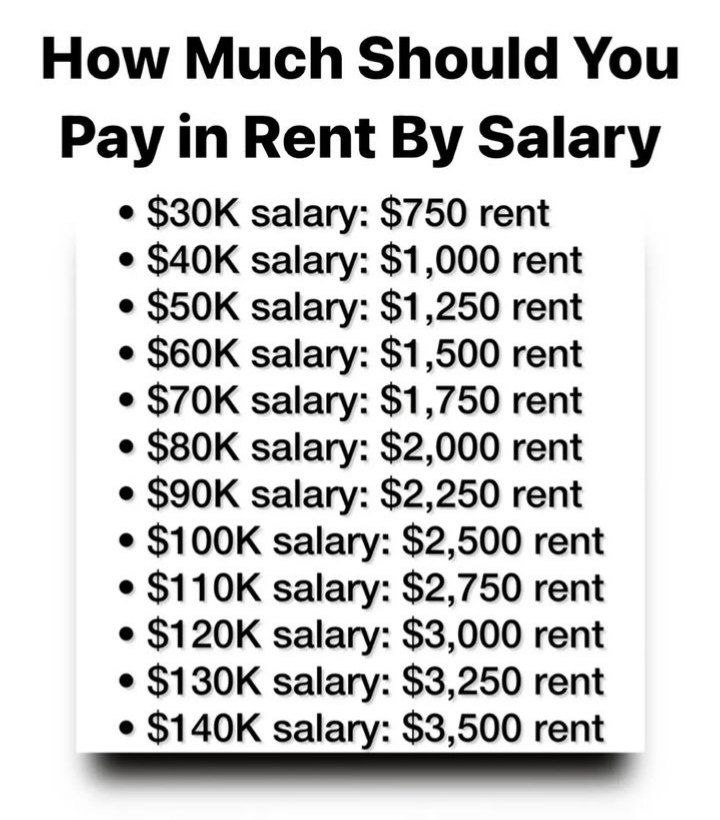

I think you should first focus on bringing your expenses down to atleast be able to save 20% of your salary. Where to invest becomes irrelevant if your savings is meager.

More like this

Recommendations from Medial

theresa jeevan

Your Curly Haird mal... • 1y

🚨 Tax Saving Alert: Only 2 Months Left! 🚨 Hi there! 👋 Here’s a quick guide to help you maximize your savings: 🔹 80C - Save up to ₹1.5L PPF, ELSS (higher returns), NSC, LIC, Tax-Saving FDs (5 yrs). 🔹 80D - Health is Wealth Save ₹25K (self/fami

See More

Shriharsha Konda

•

Start.io - A Mobile Marketing and Audience Platform • 8m

If you are a freelancer, or are just curious what it holds on the taxation front, Section 44ADA can mean huge tax savings. Here is a detailed breakdown - https://shriharsha.com/salary-to-contract-44ada/ Also bonus - a tool to compare your potentia

See More

Shouryjeet Gupta

Buildung Udyog | Sha... • 1y

₹25 LPA salary in Delhi : You doing better than many ₹25 LPA salary in Bengaluru : You are doing average ₹25 LPA salary in Mumbai : You are poor *** If you are thinking of changing cities due to a job, remember to measure your salary against ‘co

See MoreKumar Pranjal

Founder, Domainly • 1y

Avriti has partnered with Domainly to provide our freelancers with affordable hosting solutions & help them save on their costs. This will also help customers by allowing them to have up to 40% savings on Domainly's Shared Hosting Plans. After Avriti

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)