Back

Anonymous 2

Hey I am on Medial • 2y

Didn‘t fidelty cut their valuation by 50%? Guess the late stage investors are going to lose a lot of money 🤡😂

More like this

Recommendations from Medial

Shaswat Raj

Think. Feel. Build. ... • 8m

I’ve been building a SaaS product and learning a lot about startups and marketing along the way. Now I’m at the stage where I’m thinking about a few key things: How do you get your first 10–50 users? When is the right time to start talking to VCs?

See MoreAccount Deleted

Hey I am on Medial • 1y

Indian Startups Raise $1.76 Billion in January 2025 The Indian startup ecosystem kicked off 2025 on a high note, securing $1.76 billion across 128 deals—the highest in six months. Growth and late-stage startups led the way, while early-stage investm

See More

Ahmad Raza Siddiqui

CEO & Founder at Aaz... • 8m

💼 Start Investing ₹50 Lakhs to ₹10 Crores with Aazakart Own the Future of India’s Digital Bazaar Aazakart – India’s Largest Zero-Inventory Marketplace – is inviting growth-stage investors to participate in our next big leap. > Be more than an inv

See More

Divakar J

Creating things that... • 11m

Hi everyone! I guess I should have done this earlier, but it's never too late! *About Me:* Name: Divakar J Age: 18 Good at: DESIGN (any type), sports, music, reading *Experience:* I'm currently working with gaming YouTubers, creating graphic desig

See More

Anonymous

•

Darshan Dental College and Hospital • 9m

I have been going through a lot lately, got laid off from first college intern as a dev -> switching to a product management role -> have been working for almost 2 years now? A lowkey job of 7lpa, still not able to justify dad’s hefty investment on m

See MoreAyush Jamwal

Founder of 0Unveiled... • 4m

A lot of people think early-stage startups fail because of bad ideas. But honestly, most fail because they lose momentum. We almost did too. Between rebuilding our MVP, running feedback loops, and debugging servers at 3 AM, there were moments it fe

See More

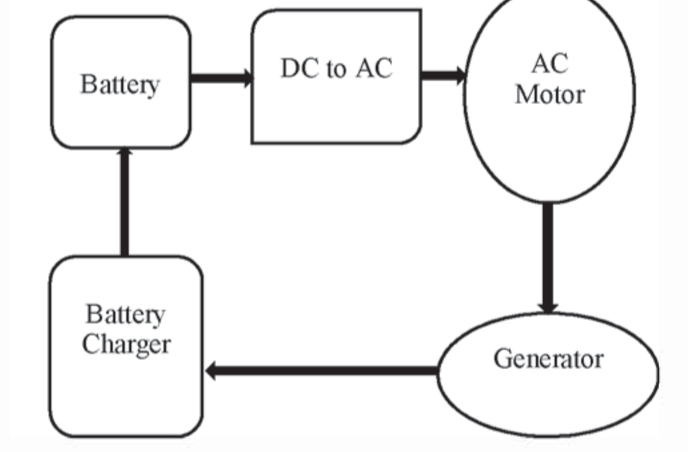

Karmveer Dhayal Dudu

Hey I am on Medial • 1y

If someone helps me, I can make the whole world aware of something that people cannot even imagine. Yes, I am telling the truth. After doing a lot of research on the fuel-less electric generator, I realized that what I researched can actually work sm

See More

Vigneshwar Kondhapuram

Open to connect • 1y

I think the business to start 2024 is ContentCreation. Because it is a chain of things, if you build a good community than automatically you can do lot more things, like affiliate marketing, promoting good stuff which will help your audience. And if

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)