Back

CA Sumit Chandwani

The New way of Compl... • 3m

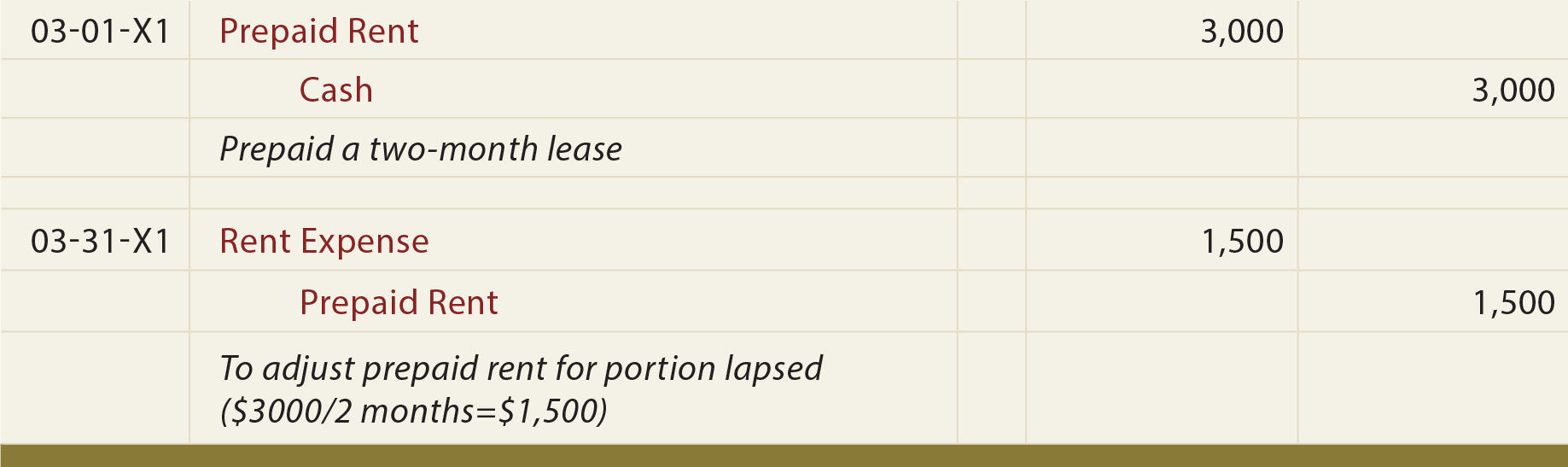

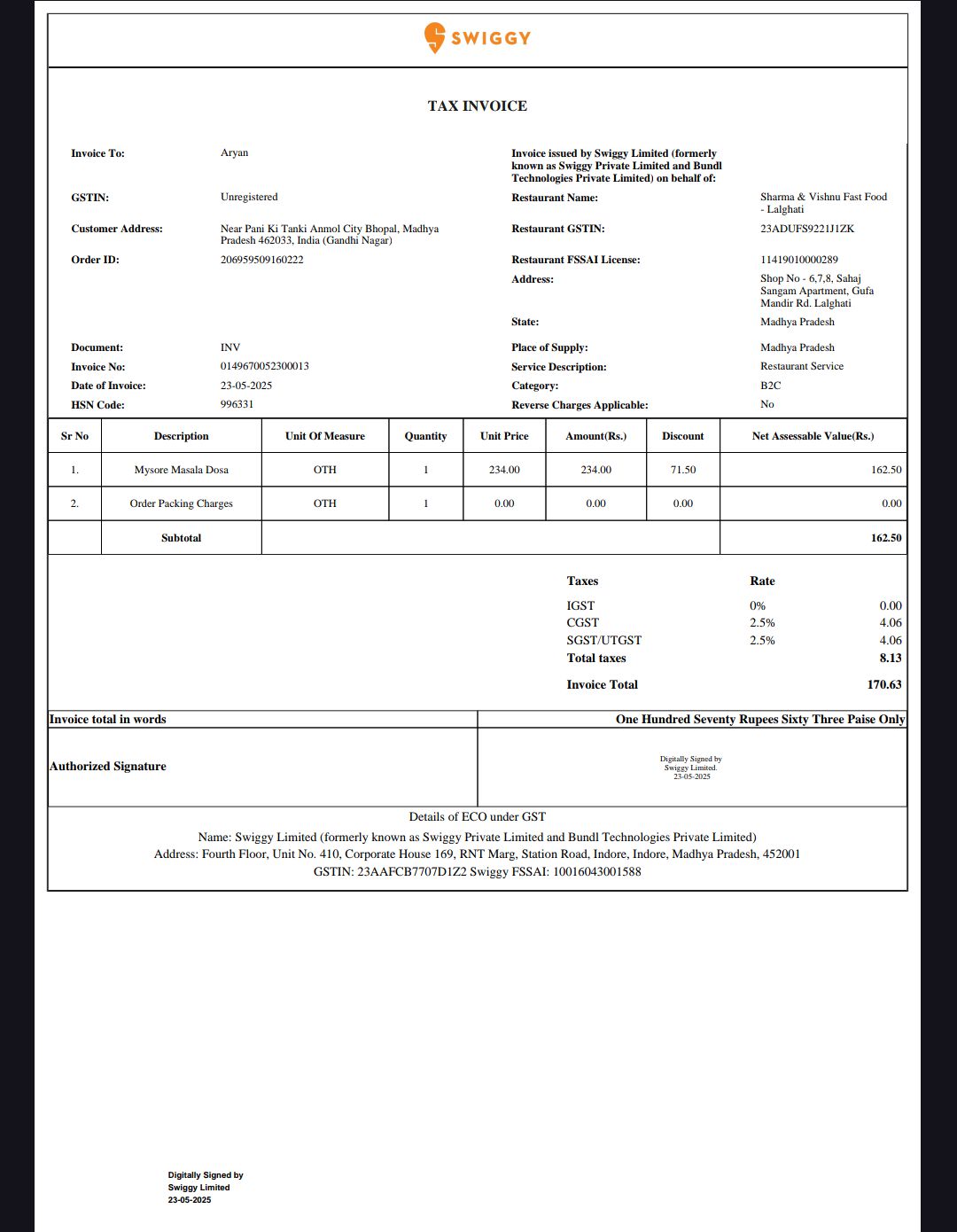

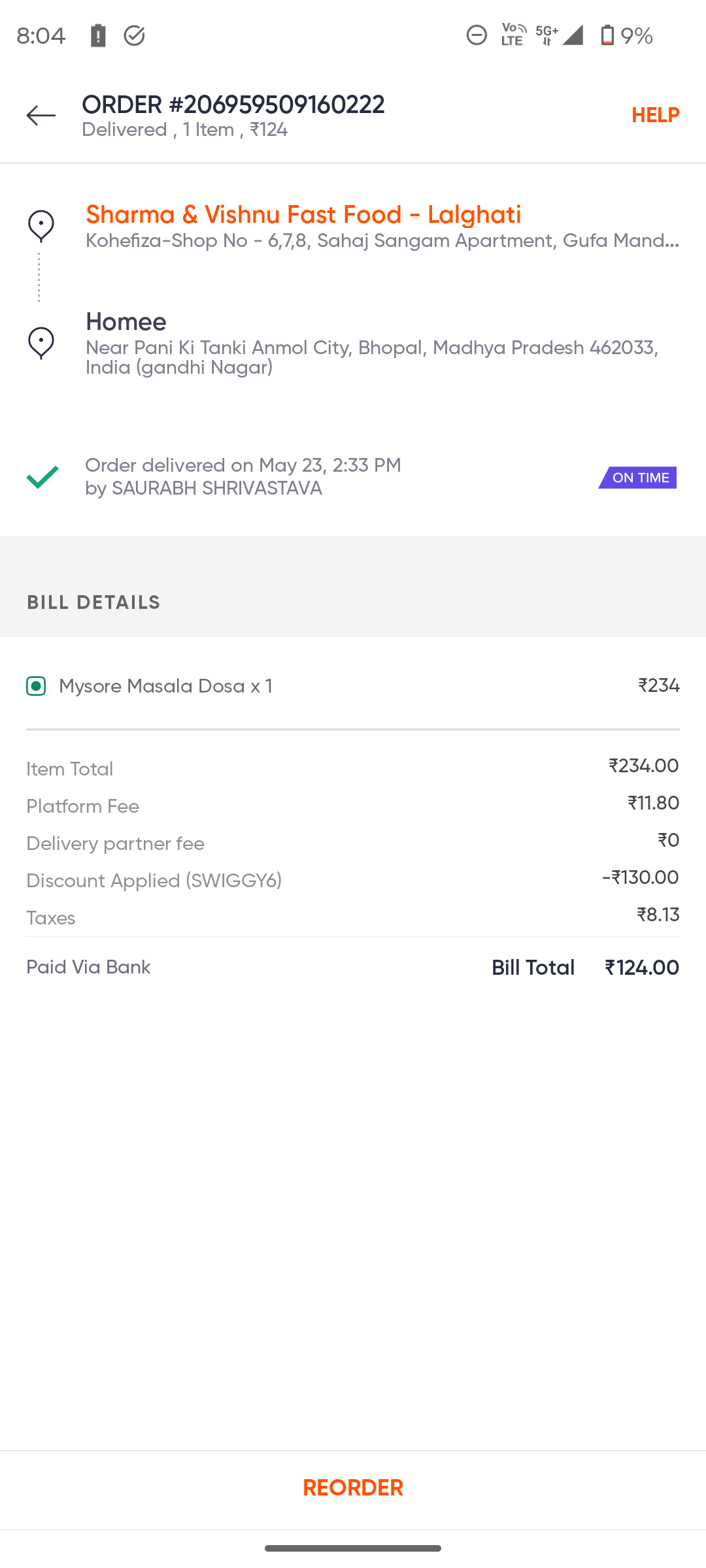

Hi Both, GST can be claimed only on actual Invoicing of Rent expense by the landlord, in case of commercial property, otherwise GST on Reverse charge is to be paid at the time of considering actual rent expenses. Reasoning - GST can be claimed once landlord uploads the details in his GST outward return (GST R1) and it will be done when invoice is issued.

More like this

Recommendations from Medial

CA Kakul Gupta

Chartered Accountant... • 12d

GST Rate Change – Important Clarification The Govt. has clarified that new GST rates will apply on all deliveries made on/after 22nd September. 👉 Even if you have booked your order, issued invoice, or made advance payment pehle, the new rate will

See MoreSunil Huvanna

Building AI Applicat... • 1y

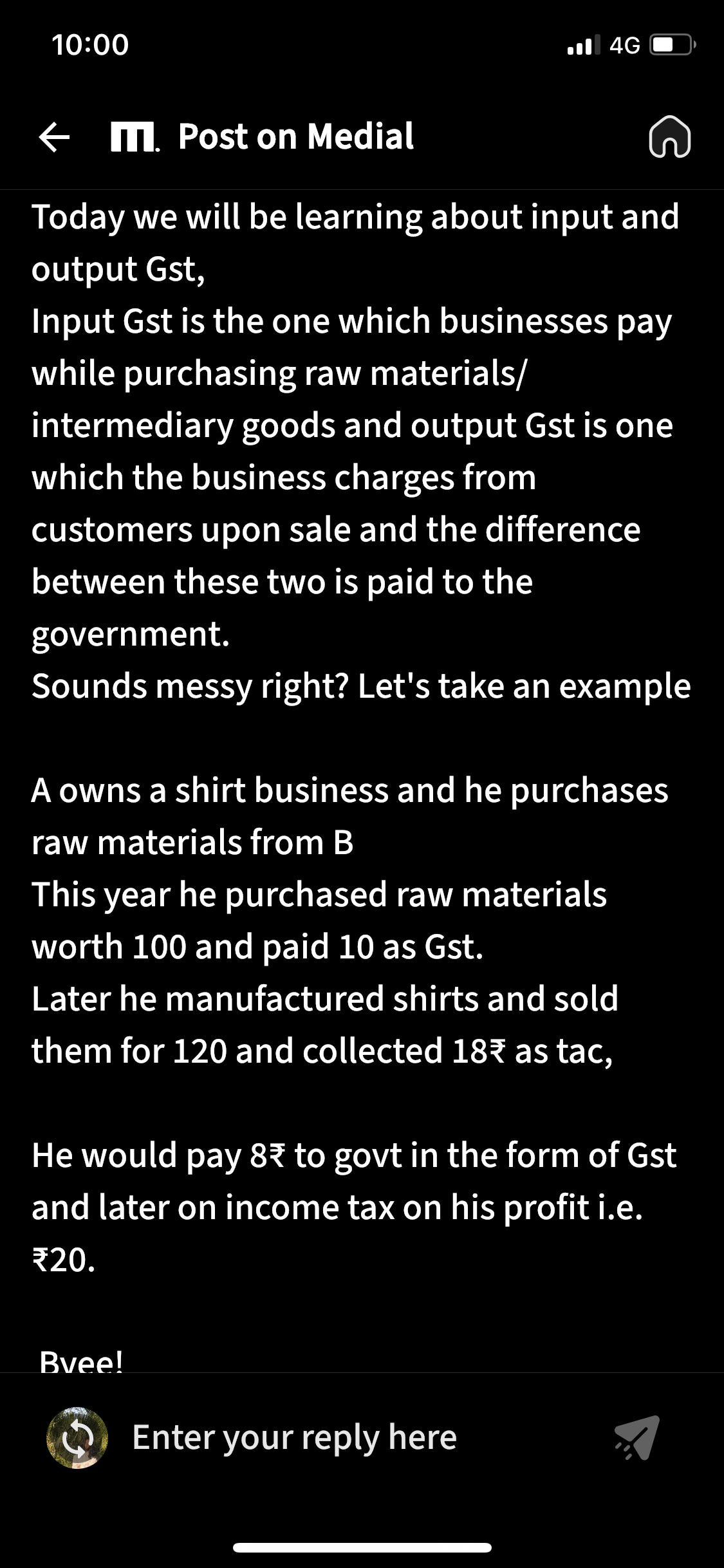

I personally feel that any budding entrepreneur shall never be able to design an end-to-end tech tech product especially if the tech invovles invoicing untill unless one actually gets to know about GST & Invoicing fundamentals! I am making this stat

See More

Manish Lohia

Real Estate | Design • 3m

Sneak Peak into my new Real Estate Listing & Services website launching soon. We will be launching with the following services in Phase 1 and gradually release more features and services : - Property Listings - Real Estate Legal Services - Tenant

See More

AASHIRWAD DEVELOPER GROUP

The business should ... • 10m

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Download the medial app to read full posts, comements and news.