Back

Dinesh H

Let's work together • 2m

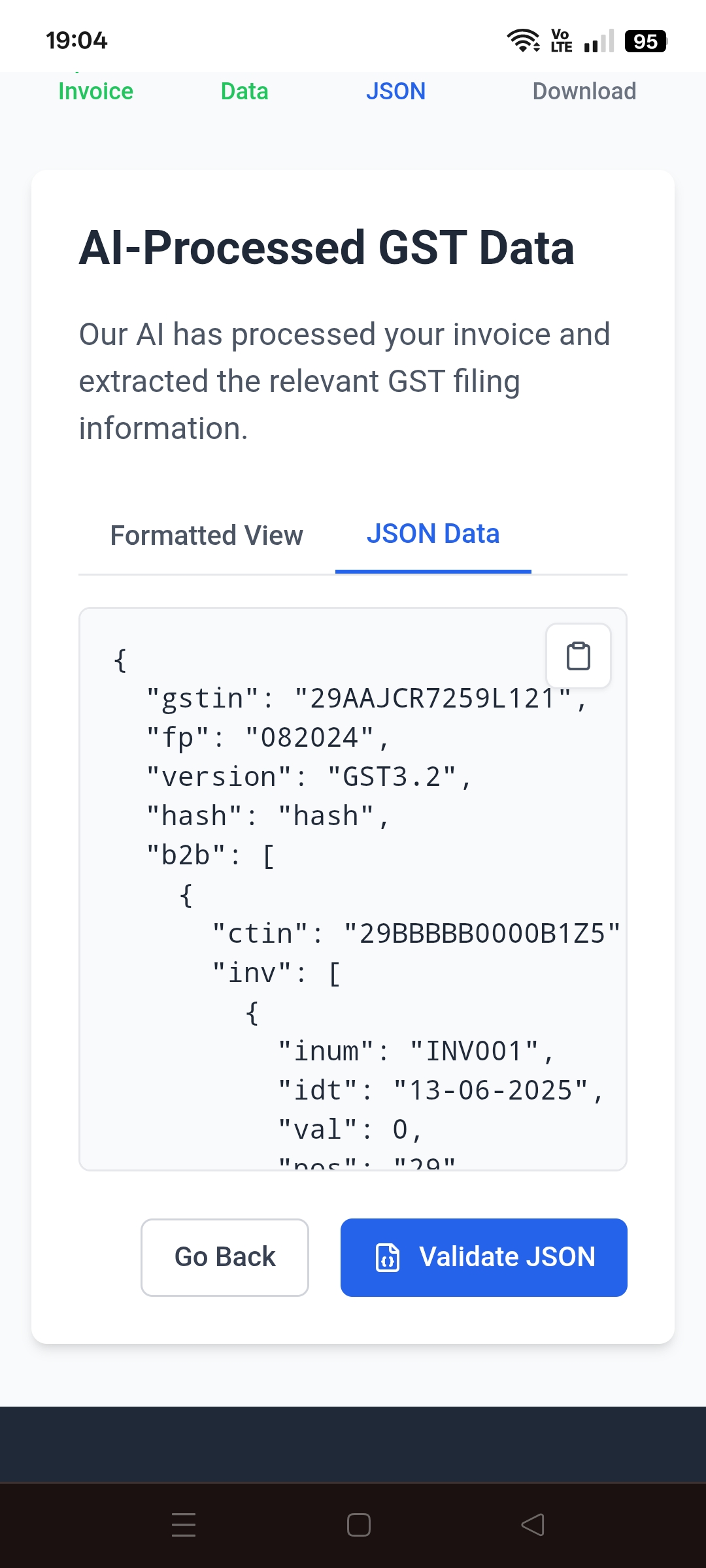

Filing GST is confusing, especially for freelancers and small business owners in India. Most tools are complex or expensive — making tax filing stressful instead of simple. 🚀 Just built my MVP! A tool that helps Indian freelancers file GSTR-1 easily. 1. Upload your invoice images or enter basic invoice data. 2. It extracts details using AI and converts them to GST-ready JSON. 3. You can directly use the file for GST portal uploads. ✅ What it solves: 1. No need to manually enter invoices into the GST portal. 2. Avoids errors by generating the correct JSON format. 3. Saves time and removes the fear of filing mistakes. 💬 Looking for feedback! Would love your thoughts on how it feels, what to improve, or anything you'd want to see added. try it -https://candid-cascaron-632b71.netlify.app/ Even if you don’t file GST — your outsider view would still help! 🙌

More like this

Recommendations from Medial

Mesride Tech

Software hamara, bus... • 1y

Must have softwares for startups : 1. CRM : Manage your relationship with customers 2. Accounting : have a check on in & out financials 3. Invoice : to make invoices fast 4. GST billing : to manage GST 5. HR Management: to manage your human resource

See MoreAFFORDABLE TREND

The business should ... • 8m

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

CA Chandan Shahi

Startups | Tax | Acc... • 5m

Here are 10 important accounting tasks to complete before 31-03-2025 to ensure a smooth financial year-end closing and compliance: ✅ 1. Reconcile All Bank Accounts Ensure that bank statements match the books of accounts. Resolve any discrepancies b

See MoreSaurabh Mishra

Building a tech gian... • 2m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreDownload the medial app to read full posts, comements and news.